Continue reading

Gold and Silver: where will go from here and what happened over the last week?

COMEX Gold 5% and Silver 5.52% down on the week and over the last week, you have had an appreciating dollar, so I think that’s weighed on gold price. From the last several years, gold and silver have steadily been moving into stronger hands in its flight from greedy, cavalier and arrogant central bankers who never saw this coming. Why not? They have been habitual drinkers of their own cool-aid. In common situations, when supply is short and demand is strong and growing, the price of such a commodity, good, or service will increase. Just the opposite is happening in the gold and silver markets. For right now, the central bankers are defying the natural law of supply and demand, and it is working. Why is it working? People are not objecting! People are passively taking whatever the NWO/central bankers dish out.

COMEX Gold 5% and Silver 5.52% down on the week and over the last week, you have had an appreciating dollar, so I think that’s weighed on gold price. From the last several years, gold and silver have steadily been moving into stronger hands in its flight from greedy, cavalier and arrogant central bankers who never saw this coming. Why not? They have been habitual drinkers of their own cool-aid. In common situations, when supply is short and demand is strong and growing, the price of such a commodity, good, or service will increase. Just the opposite is happening in the gold and silver markets. For right now, the central bankers are defying the natural law of supply and demand, and it is working. Why is it working? People are not objecting! People are passively taking whatever the NWO/central bankers dish out.

Should you be buying gold and silver at any price? Remember, price is not the issue. Availability is! And we know, central bankers hold all the power cards, and they will play them, at all costs, and the costs will be yours to bear… In all probability, most expectations will be underestimated.

.

Let’s talk about Gold future:

Do you remember May 09, 2013, morning at 9 O’clock I had written article on gold “Kick your all confusions about Gold and where are the Stops? Let me say you“? If you don’t remember then click on article name and read it now because I had written there all keys of Gold direction.

Do you remember May 09, 2013, morning at 9 O’clock I had written article on gold “Kick your all confusions about Gold and where are the Stops? Let me say you“? If you don’t remember then click on article name and read it now because I had written there all keys of Gold direction.

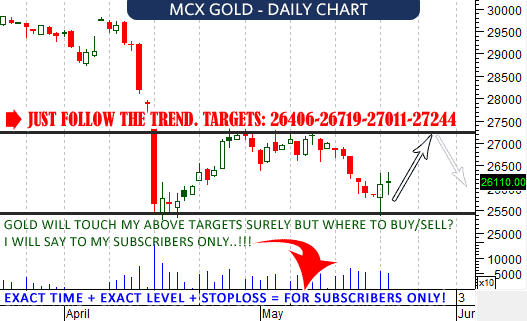

I said, “Once gold close below 26,456 level then targets will over 25,958-25,670.” As I said, Gold kissed my first target and moving to touch the second target too. My subscribers earning money from May 09…

Silver direction:

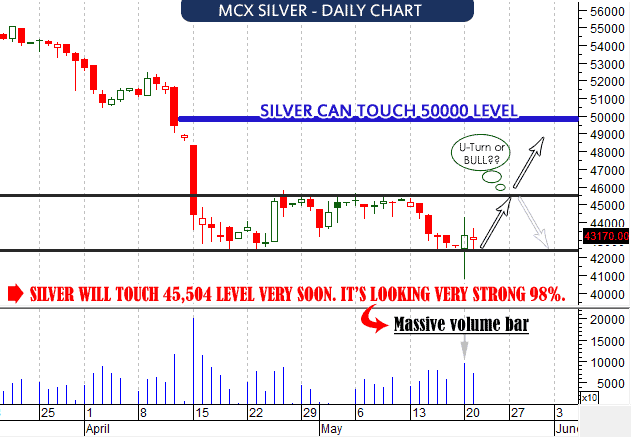

Technically and fundamentally, silver is looking weak. Silver may take U-turn from 42,591 level and it can touch again 43,962 to 45,460 levels. If it does not stop at U-turn level 42,591 then it will touch step by step 41,734 – 40,700 – 39,510 – 38,652 levels soon.

Technically and fundamentally, silver is looking weak. Silver may take U-turn from 42,591 level and it can touch again 43,962 to 45,460 levels. If it does not stop at U-turn level 42,591 then it will touch step by step 41,734 – 40,700 – 39,510 – 38,652 levels soon.

But what is the exact level? Where can I buy or sell?

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Only subscribers can read the full article. Please log in to read the entire text.

Continue reading

Kick your all confusions about Gold and where are the Stops? Let me say you

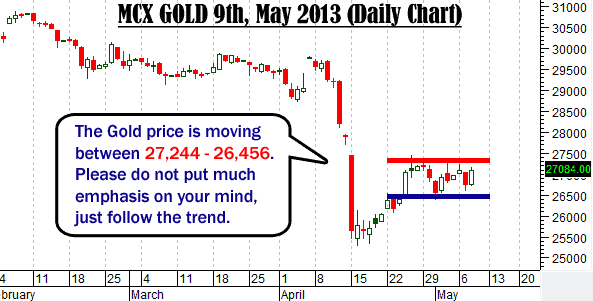

In above chart, I’ve highlighted the trading range with blue and red HSR (horizontal support and resistance) lines. Your one mistake can give you huge loss. Read carefully below levels and make your every trade perfect!

Where are the stops?

For MCX traders

Buy stops: 27,244

Sell stops: 26,456

For Comex traders

Buy stops: $1488

Stop sell: $1448

Note: once gold close above 27,244 level then targets will be over 27,608-27,838 and if close below 26,456 then targets will over 25,958-25,670.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Continue reading

Finally Gold & Crude oil looking brighter and Natural gas look like bit downward

You want to know about Gold/Crude oil/Natural gas direction?

Subscribe to our free newsletter services. Our service is free for all.

An intraday trader for great opportunity is available for buy gold today.

Targets: 26613-26750+

Natural gas will move downside today. Yes it future is brighter than others but for today I will say you what to do. Wait for our mail.

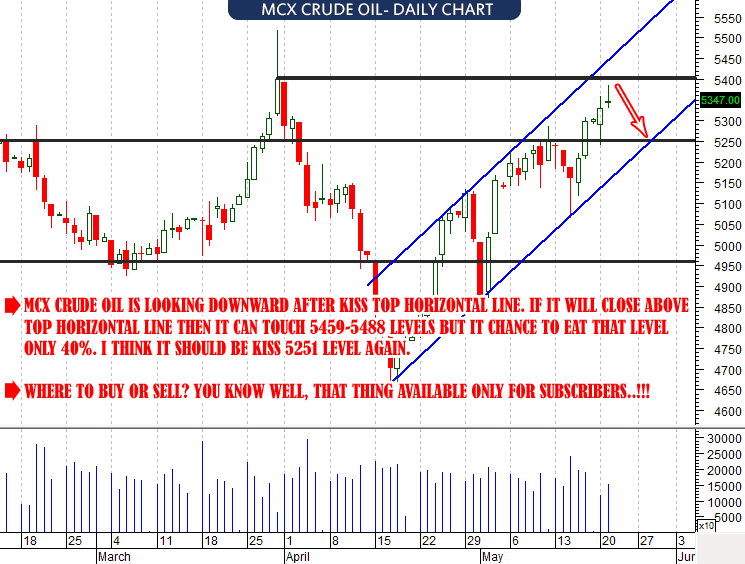

I am looking more upward movement in Crude oil. Just wait and watch.

[/hidepost]

Continue reading

Will Gold and Silver continue to Drop? What to do now that Gold and Silver Prices are Down?

Gold closed Friday at its lowest level since July 2011. In the last two days, gold was off about $79 and silver off about $1.60 at their worst points. Everybody is writing many reasons for gold and silver move but no-one know for sure where the bottom is.

My advice: hold your gold and silver.

Keep in mind, gold will end the year much higher than where we stand today and I trust the precious metals bull market will see gold and silver prices much higher before it is all over. Hang tight!

For long term investors: the gold prices may be more down but there is severe uncertainty in the market and it may be a better option to buy gold now.

I have Gold and Silver hurdle, support & resistance below: [Only Subscriber can see]

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Only subscribers can read the full article. Please log in to read the entire text.

Continue reading

Gold & Silver – Accurate Manipulated?

Charts do not lie. There are a slew of highly respected PMs “gurus” with extensive followings. None we know of have been on target in the past year. Not only are the trends still down, prices made new recent lows, again, within the trading range, but nowhere near the “prices will reach levels you cannot believe” area.

Charts do not lie. There are a slew of highly respected PMs “gurus” with extensive followings. None we know of have been on target in the past year. Not only are the trends still down, prices made new recent lows, again, within the trading range, but nowhere near the “prices will reach levels you cannot believe” area.

Here is another look at the “manipulated charts,” [we do not know of a better source], to see how developing market activity is “developing,” under the circumstances. With “guru” estimates very high, and prices currently relatively low, the charts remain the most reliable barometer, for obviously, they do not lie, whatever may be the lies behind them.

No conclusion drawn about the current trading month for it has just begun, and no one knows how/where it will end. The chart comments need not be repeated, but the labored decline since the last swing high is a message from the market…just not fully played out.

The primary trend remains up, but its current correction keeps price range-bound, net a positive trend sign.

Just, Watch all Chart of Gold and Silver. CliCk on Charts for Bigger…

Only subscribers can read the full article. Please log in to read the entire text.

Continue reading

COMEX

COMEX  Do you remember May 09, 2013, morning at 9 O’clock I had written article on gold “

Do you remember May 09, 2013, morning at 9 O’clock I had written article on gold “ Technically and fundamentally, silver is looking weak. Silver may take U-turn from 42,591 level and it can touch again

Technically and fundamentally, silver is looking weak. Silver may take U-turn from 42,591 level and it can touch again  Lock

Lock