Continue reading

COMMODITY NEW UPDATE: MCX Silver, Gold, Crude oil, Nickel, Cardamom & Lead

On Feb 27, 2013 what I said about Crude oil?

Click here to read it

I told you,”Now you should to sell it. Short term targets: 4998-4974-4948″

Yesterday crude oil touched our all short term target!

I hope, everybody enjoying!

Now where crude oil will go? Continue move down side or take U-Turn?

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Today, what you are expecting about Gold and Silver. I think, it should be die bit more. Anyway in-detail I will discuss with my subscribers.

Expecting more blood from MCX Nickel. Listen, once Nickel open downward then you can sell it. Intraday Targets: 910-908

Let’s trade safely. Go and Sell Cardamom with Intraday targets: 921-915

Free users for S/L is yesterday high!

Lead is moving downside day by day. Today it’s opening bell is very important. Once open downward then sell it with targets: 121.7-121.1

Remember, 121 level is hurdle of MCX Lead. It can take U-Turn from the hurdle.

Continue reading

COMMODITY NEW UPDATE: MCX Gold, Crude oil and Lead

MCX Gold is looking weak. Intraday traders for opportunity available both side. Let me learn you, how to trade in Gold this time. Keep your eyes on 30140 level, if once open upward and cross my level then buy it with targets: 30181-30253+ and once open downward then sell it with S/L 30097 and Targets will be 30019-29960. Trade without fear…!

Into my last newsletter I told you, crude oil is looking weak and also kissed my all targets. Now you should to sell it. Short term targets: 4998-4974-4948. My last target is hurdle for you!

Small traders for big opportunity are available in MCX Lead. As I say above in Gold, trade both ways. Keep your eyes on Lead opening bell. Once open upward, Go and Buy it without any worry. Targets: 125.5-125.9. Now you are thinking, if it will open downward then what should I do?

For know more about MCX/NCDEX Market, Subscribe to our free newsletter services. Our service is free for all.

Continue reading

MCX New update: Gold, Natural gas, Aluminum and Kapas

Once MCX Gold open downward, then Go and sell it without any question. Targets: 30181-30143-30098

More information about Gold for subscribers.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

One of the best item in MCX is Natural gas. Go and sell it. Targets: 173.6-171.9

Today MCX Aluminum looking crazy. So many times in our past newsletters, I was mentioned to sell aluminum. I am saying this again thing, if once today it will close at 107.9 or below.. then go and sell it…. It will kiss 106.4 in just 2 trading sessions. Yes, exact time with stop loss for subscribers only!

I also said so many times to sell MCX kapas in past newsletters. Today just going to give you alert. Stop selling after 2 trading sessions because it will try to change direction. Intraday traders for last targets: 875-871

Once thing keep in mind, once it’ll close below to our last target then you will see big bloodbath in it.

Continue reading

Commodity MCX & NCDEX Gold, Silver, Crude oil, Natural gas, Zinc, Jeera

You know, world’s fastest growing market is commodity market and in it crazy movers are Gold and Silver. One more thing you should to know, ‘The major monetary metal in history is silver, not gold’. Remember, your TV is lying to you when it says the ‘demand for Gold and silver’ is decreasing. Anyway, stop struggling and start making money with me.

Let me start with Crude oil. First, click here and read our crude oil report now. Okay, now I hope you got it what I want to say you. Go and sell crude oil with targets: 4861-4841-4800. Contract changed that’s why little levels will change. Yes, stop loss and exact levels for subscribers only!

Only subscribers can read the full article. Please log in to read the entire text.

I think, should not say more about MCX Gold after above chart.

First click here and read our past natural gas report with chart. If MCX Natural gas not close below to hurdle 178.5 then it will kiss 190-200-214+.

On this 21st, Natural gas was kissed our first target!

NCDEX Jeera is very crazy item in Angri commodities. Free readers, I am just your well-wisher and want to say you. Today it’s looking downward. More information about Jeera to subscribers only.

SILVER, ZINC & JEERA REPORT IS BELOW. FOR TO SEE It Log IN NOW AND ONLY SUBSCRIBERS CAN READ IT. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Only subscribers can read the full article. Please log in to read the entire text.

We will update soon Lead and Nickel Chart soon.

Continue reading

Indian Gold Demand Picks Up

Indian Gold Demand Picks Up

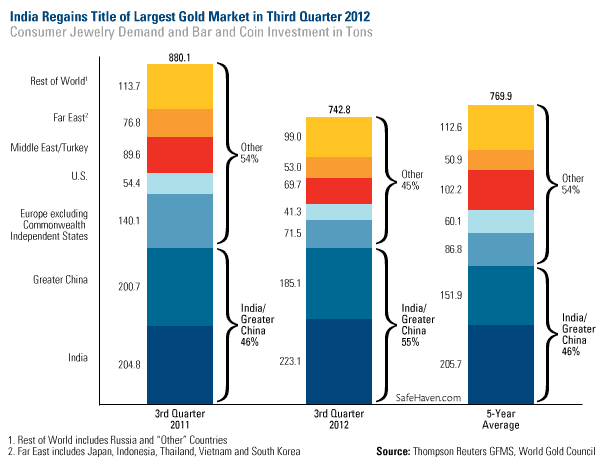

The love for gold has been reignited in India, according to the World Gold Council (WGC) in its Gold Demand Trends for the third quarter of 2012. India regained its title as the strongest performing market, overtaking the greater China area, as the country experienced a bounce-back in demand due to improved sentiment during the festival season.

Compared to the third quarter of last year, Indian gold jewelry demand grew by 7 percent while gold bar and coin demand rose 12 percent. Total consumer demand was 223 tons, compared to 205 tons this time last year. The second largest market was Greater China, which consumed 185 tons in the third quarter of 2012. This was less than the 201 tons consumed in the third quarter of last year.

Together these markets in the east made up 55 percent of the world’s jewelry and investment demand, according to the WGC.

Although India experienced a setback earlier this year when gold shops boycotted a proposed tax on the yellow metal, imports recovered by July “as inventory levels were bolstered (aided by a well-timed dip in the local price) and the market adjusted to the customs duty,” says the WGC.

The third quarter has historically been a strong seasonal time for the Love Trade to come alive in the east. Monsoon rains and the festival season in the fall are generally associated with the buying and giving of gold. Still, for the year, don’t expect the Love Trade in India to be as strong as it was in 2011, as gold demand remains subdued with the ongoing weakness of the rupee.

Lock

Lock