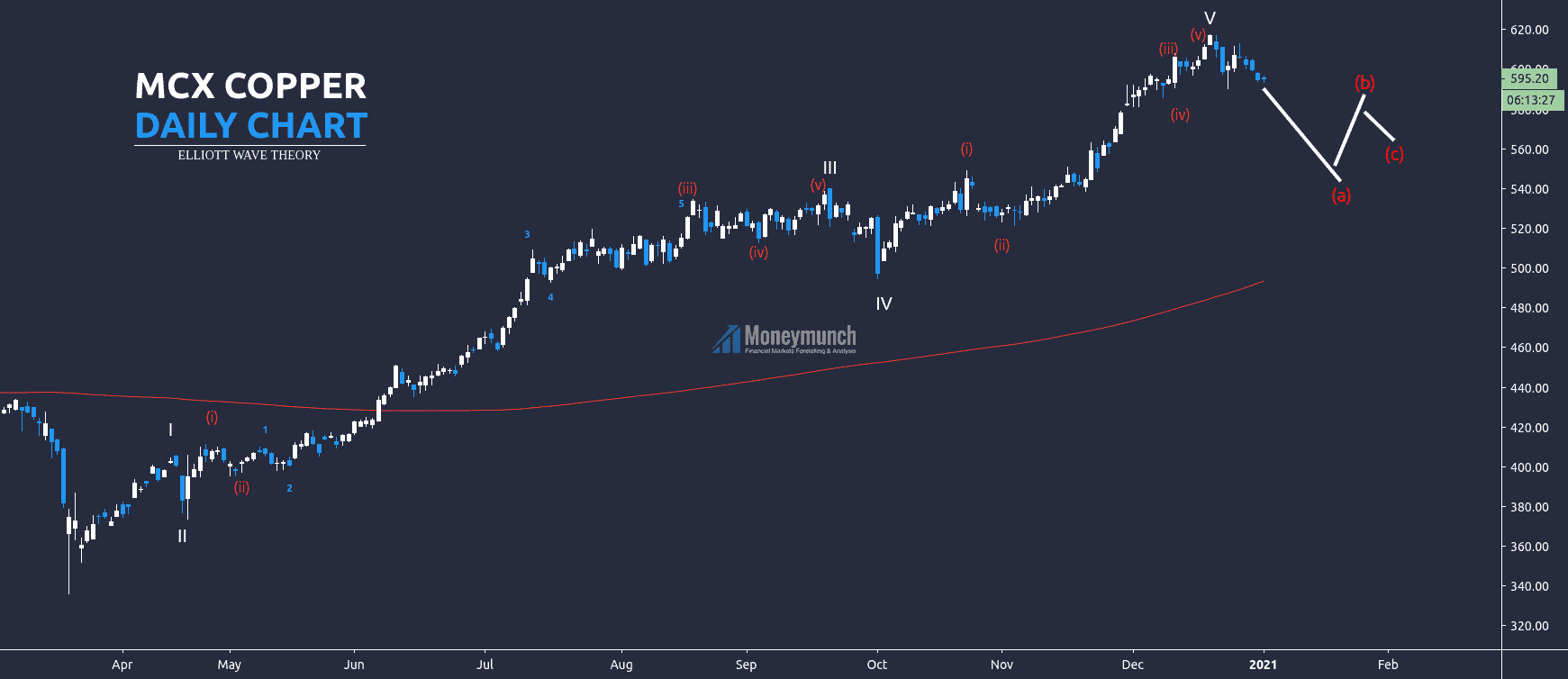

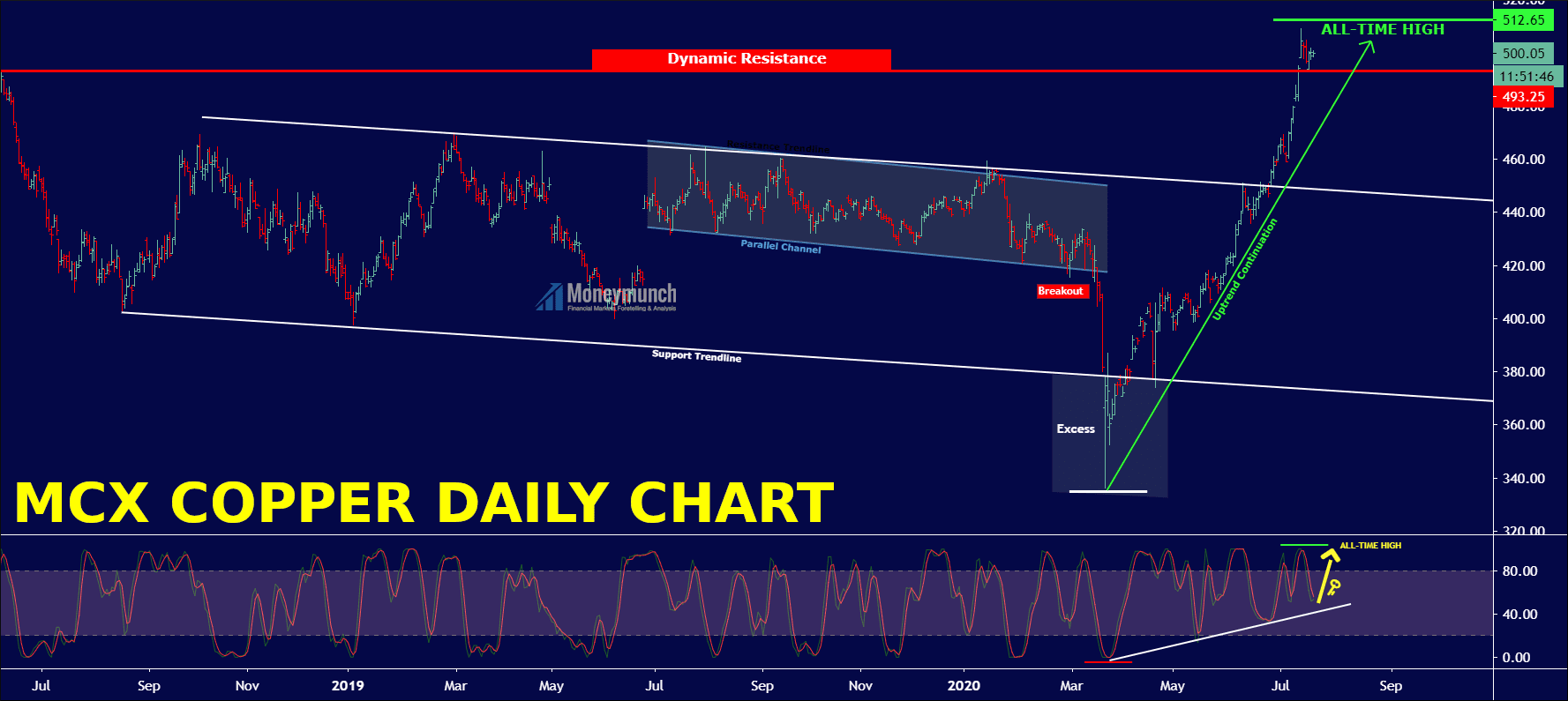

Copper has made the Bullish Elliott wave on the daily timeframe. It’s completed the five-wave cycle, ABC correction is remaining. After the 5th wave, the trend started to make the A, and it’s still making it. MCX copper has to cross 585 – 580 – 560. After that, it will rise for a short period to make the B. And it will fall again to make C. But all over, it’s an uptrend.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock