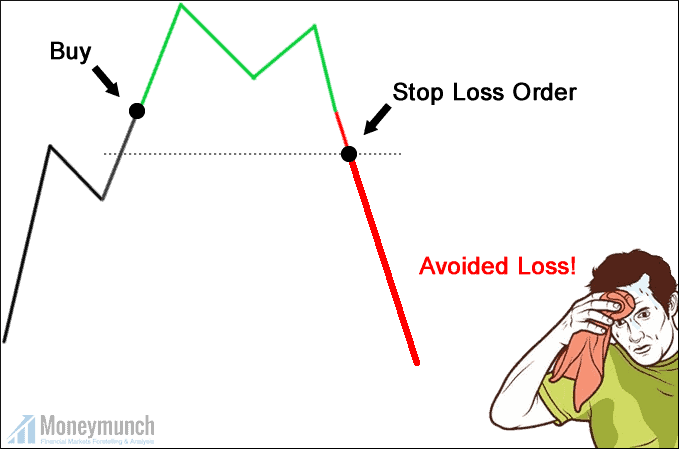

In the world of trading and investing, managing risk is crucial to achieving long-term success. One of the most popular risk management tools used by traders is the stop-loss order. A stop-loss order is an instruction placed with a broker to sell a security when it reaches a specific price. This article will delve into the different types of stop-loss orders and discuss their pros and cons.

Types of Stop-Loss Orders:

Fixed Percentage Stop-Loss: This type of stop-loss order involves setting a predetermined percentage below the purchase price at which the security will be sold. For example, if an investor sets a 5% fixed percentage stop-loss order on a stock purchased at $100, the order will be triggered if the stock price falls to $95.

Volatility Stop-Loss: Volatility stop-loss orders are based on the volatility of a security. They take into account the average daily price range or the security’s historical volatility. These orders dynamically adjust the stop-loss level as market conditions change.

Trailing Stop-Loss: A trailing stop-loss order is set at a percentage or fixed dollar amount below the current market price. As the security’s price rises, the trailing stop-loss order adjusts upward, maintaining a consistent distance from the market price. If the security’s price falls, the stop-loss order remains unchanged.

Pros of Stop-Loss Orders:

Risk Management: The primary advantage of using stop-loss orders is their ability to limit potential losses. By defining a predetermined exit point, traders can protect themselves from substantial declines in the value of their investments. Stop-loss orders provide peace of mind and allow traders to stick to their risk management plans.

Emotion Control: Trading can be an emotional endeavor, and fear and greed often cloud rational decision-making. Stop-loss orders help remove emotions from the equation. Traders can rely on the pre-established exit point instead of making impulsive decisions driven by market fluctuations.

Flexibility: Different types of stop-loss orders offer traders flexibility in their risk management strategies. Fixed percentage stop-loss orders are simple to implement and work well in stable markets. Volatility and trailing stop-loss orders adapt to changing market conditions, allowing traders to account for price volatility and potentially capture more significant profits during bullish trends.

Automation and Convenience: Stop-loss orders provide traders with the convenience of automation. Once the order is placed, it is executed automatically when the predetermined price level is reached, eliminating the need for constant monitoring. This feature is particularly beneficial for active traders who may not have the time or ability to closely monitor the market throughout the day.

Peace of Mind: Knowing that a stop-loss order is in place can provide traders with peace of mind. It allows them to participate in the market without constant worry about unexpected market movements. By setting a stop-loss level, traders can define their maximum acceptable loss, reducing stress and enabling them to focus on other aspects of their trading strategy.

Cons of Stop-Loss Orders:

Market Volatility: In highly volatile markets, stop-loss orders may be triggered prematurely, leading to unnecessary selling. This can result in missed opportunities for the security to rebound and generate profits. It is important to set stop-loss levels that account for the security’s typical price movements and market conditions.

Stop-Loss Hunting: Some traders believe that market participants intentionally target stop-loss orders to trigger price movements and capitalize on the ensuing panic selling. While this practice is illegal and unethical, it is important to be aware of potential market manipulation and set stop-loss levels accordingly.

Whipsaw Movements: Whipsaw movements refer to sudden and rapid price fluctuations that can trigger stop-loss orders and then reverse direction. In volatile markets, these false breakouts can lead to frequent triggering of stop-loss orders, resulting in increased transaction costs and potential losses.

Conclusion:

Stop-loss orders are valuable risk management tools that can help traders protect their investments and maintain discipline in the face of market volatility. By understanding the different types of stop-loss orders and their pros and cons, traders can incorporate them into their trading strategies effectively. It is crucial to set appropriate stop-loss levels based on market conditions, and always remember that stop-loss orders are not foolproof and do not guarantee profits or prevent all losses.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.