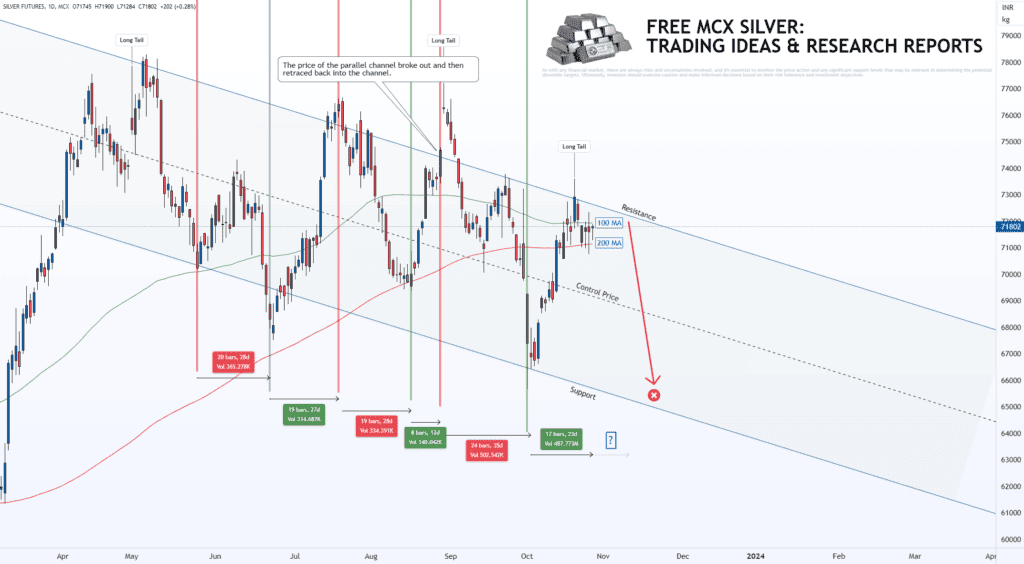

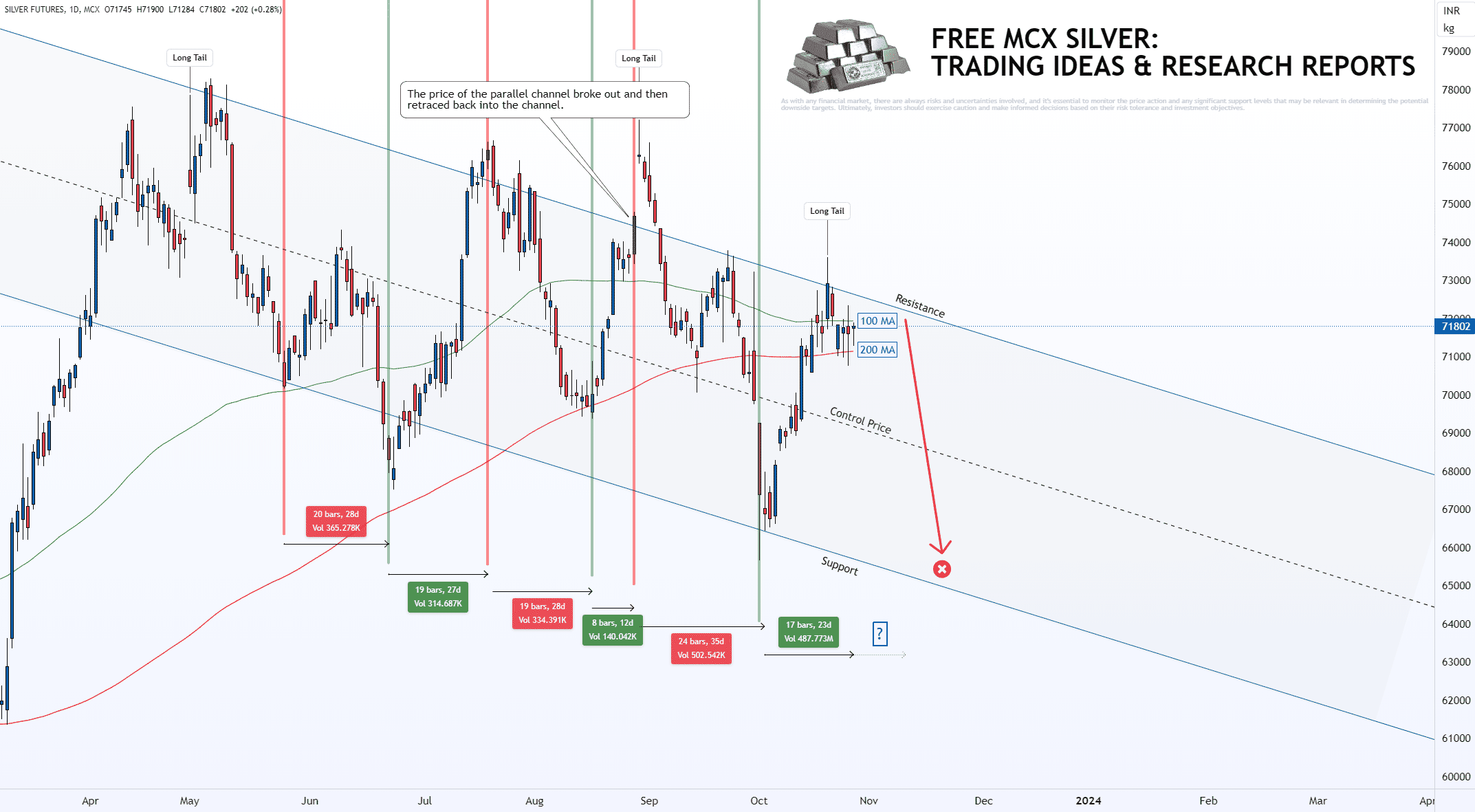

Analyzing Silver’s Market Movements: Navigating Potential Uptrends and Downtrends with Time Cycle and Technical Analysis

From the chart provided, it is evident that the time cycle length for MCX Silver trends tends to average around 20 days. Analyzing this from a time cycle perspective, there is an indication that a downtrend could be on the horizon. However, with the major Indian festival of Diwali approaching on the 12th of November, there is potential for a continued uptrend, potentially lasting for 24-30 bars. Consequently, there is an anticipation of an upward trajectory for silver, with price targets set at 72600, 73000, 73600, and 74000.

Predicting the movement of silver beyond the 74000 mark becomes a complex task, as there are numerous substantial resistance levels situated above this price point.

From a bearish standpoint, a potential downtrend could be triggered upon the breach of the 200-day moving average. If this scenario plays out, we could see silver prices retracting to levels of 70800, 69600, and potentially as low as 68000.

For the astute traders: be aware that a significant long tail on the chart has the potential to swiftly change the current market trend.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Acceptable scenario! Thanks for sharing!

How to subscribe your MCX and NCDEX service? Request you to guide me about the premium plans. Have a great day!

Nalin shah,

Mumbai

Pls share gold and copper