Theta Decoded: Unraveling the Significance of Options Greeks

Gamma: Unveiling the Significance of Options Greeks

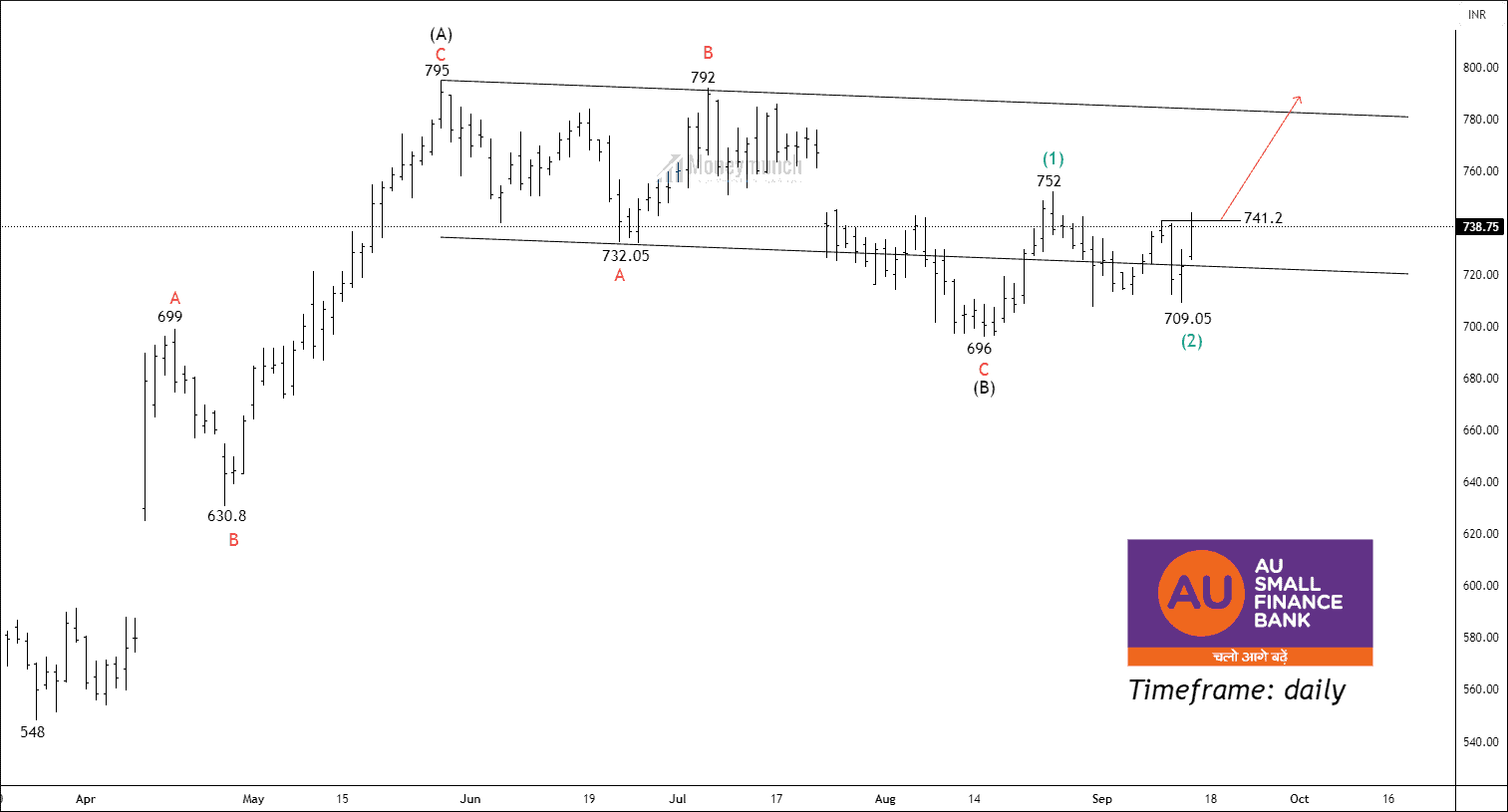

NSE AUBANK – Elliott Wave Forecasting Insights

Delta: Unveiling the Significance of Options Greeks

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Cracking the Code: Option Chains and Option Pricing Tables

Mastering Options Contract Specifications

Options Symbols and Tickers Demystified

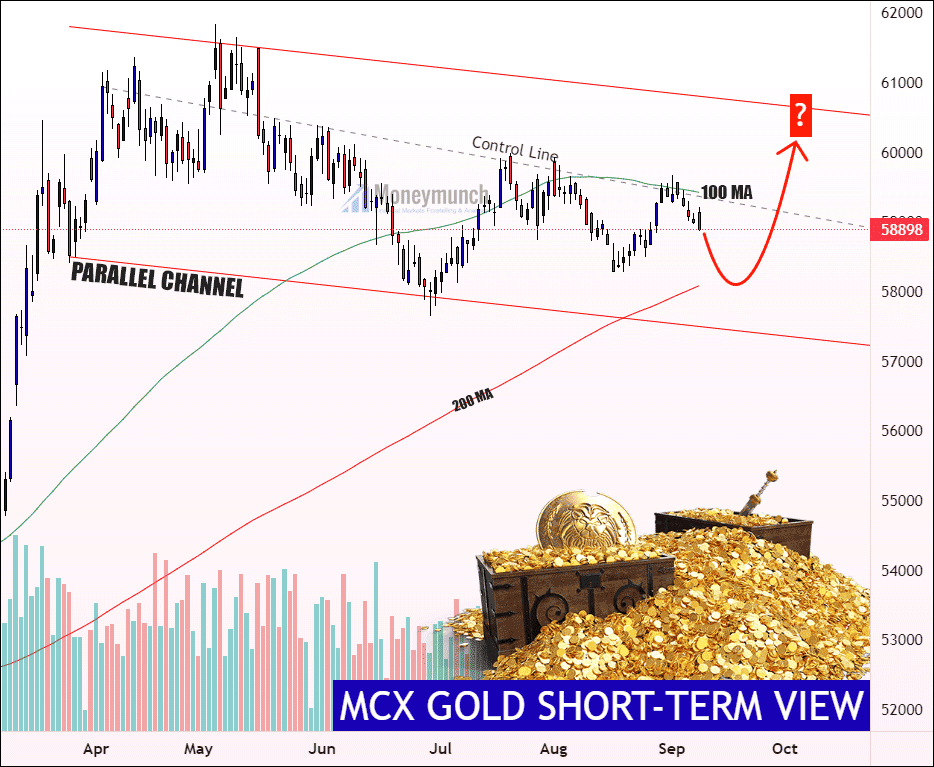

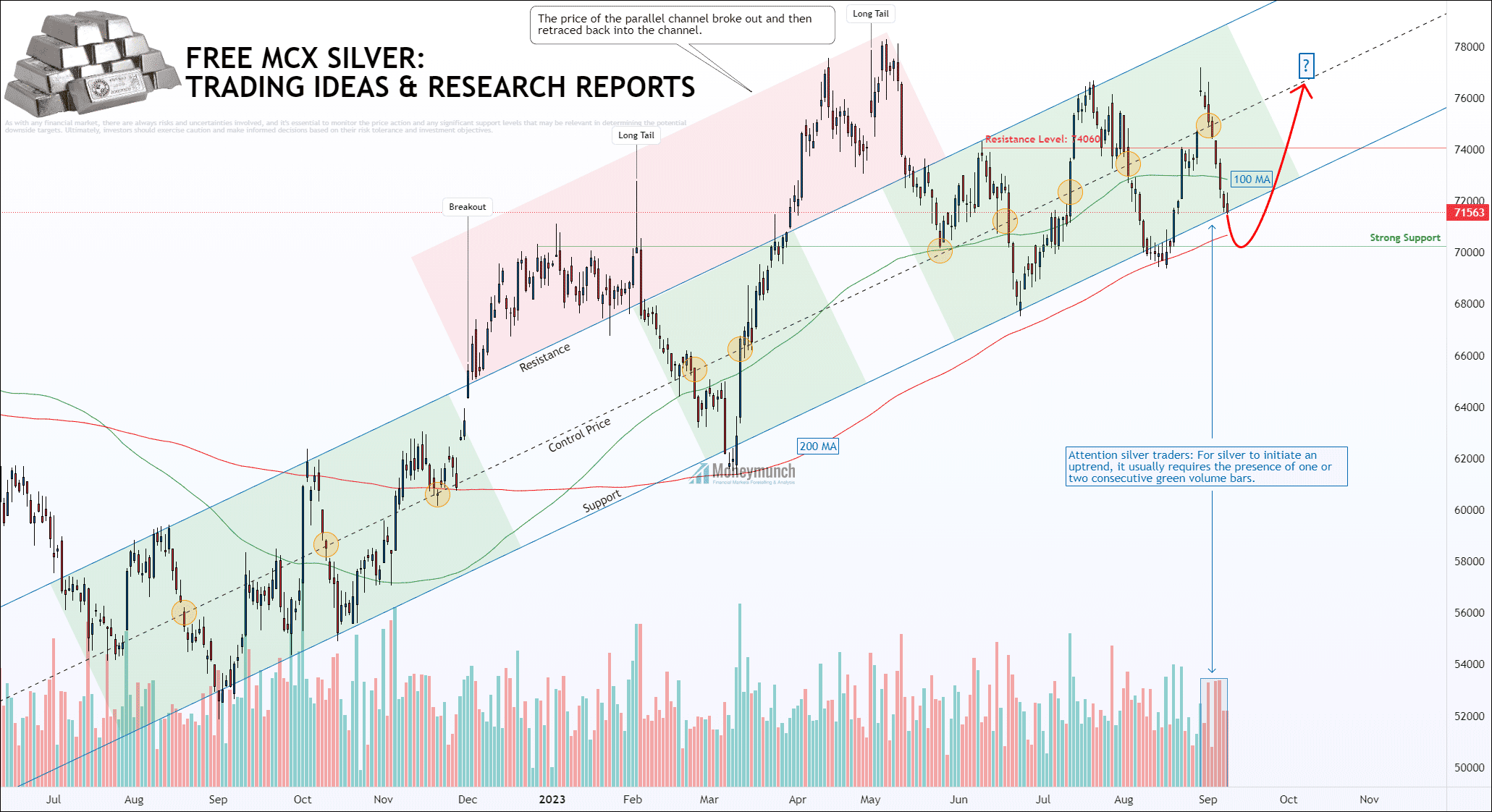

MCX Gold & Silver Technical Analyses: Recent Trends & Upcoming Targets

MCX Gold Technical Analysis: A U-Turn in the Control Channel Signals Potential Targets

According to the above technical daily chart, MCX Gold futures in the Indian commodity market have recently reversed direction within the control channel. It is reasonable to anticipate potential price levels at 58660, 58360, and 58000 before the commodity resumes its upward trend. Stay tuned for additional updates and insights on the gold market.

Continue reading

Continue readingThe Significance of Market Makers in Options Trading

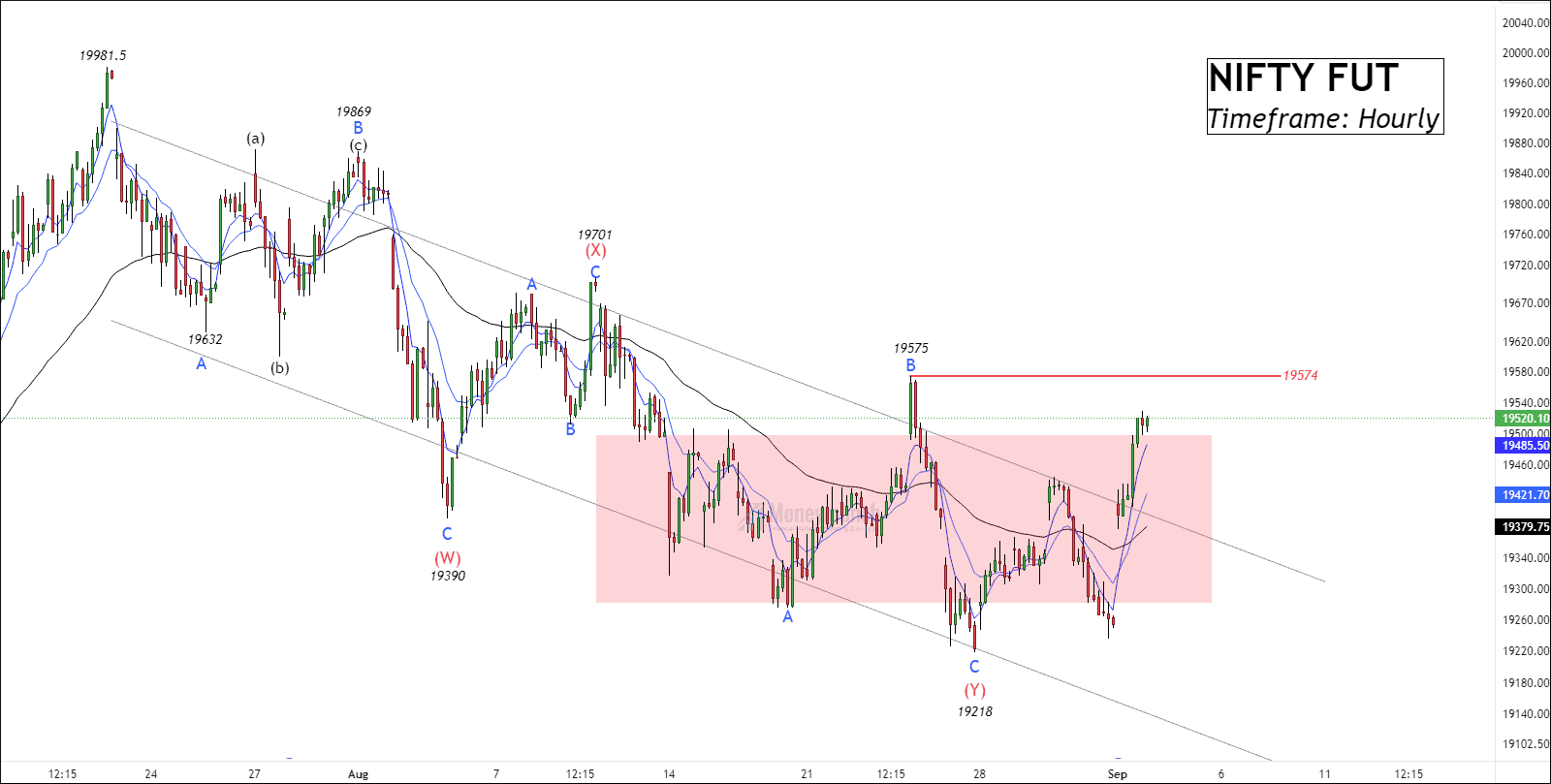

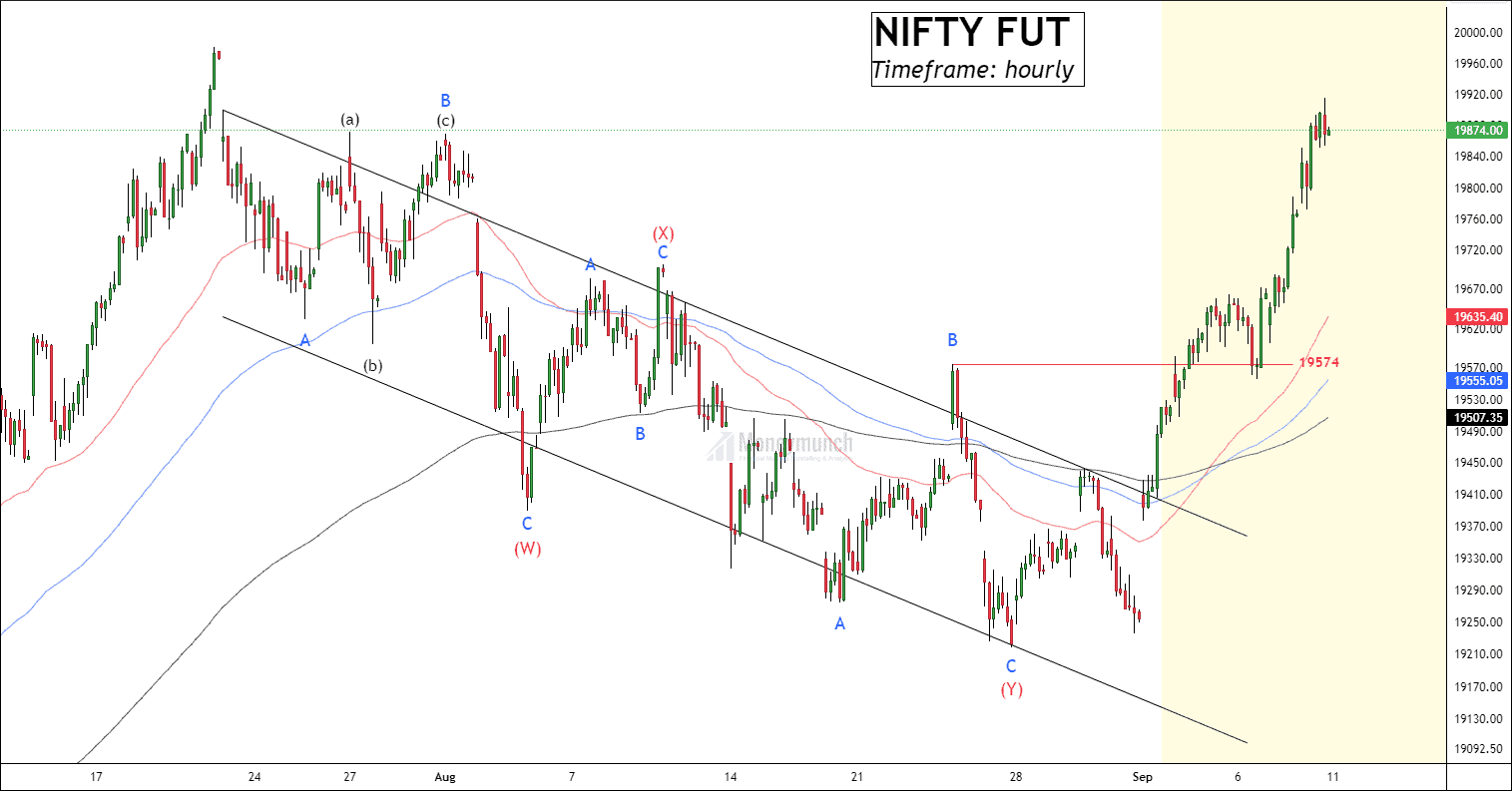

NIFTY FUT – Trading insights & Updates

Did you trade NSE NIFTY trade setup?

Click here: NSE NIFTY – Will Price Confirm Its bull run?

BEFORE

BEFORE

We had written clearly,”If the price breaks wave B, traders can trade for the following targets: 19680 – 19850 – 19940.”

AFTER

AFTER

The Role and Functions of Clearing Corporation

Navigating Options Trading Hours and Market Access

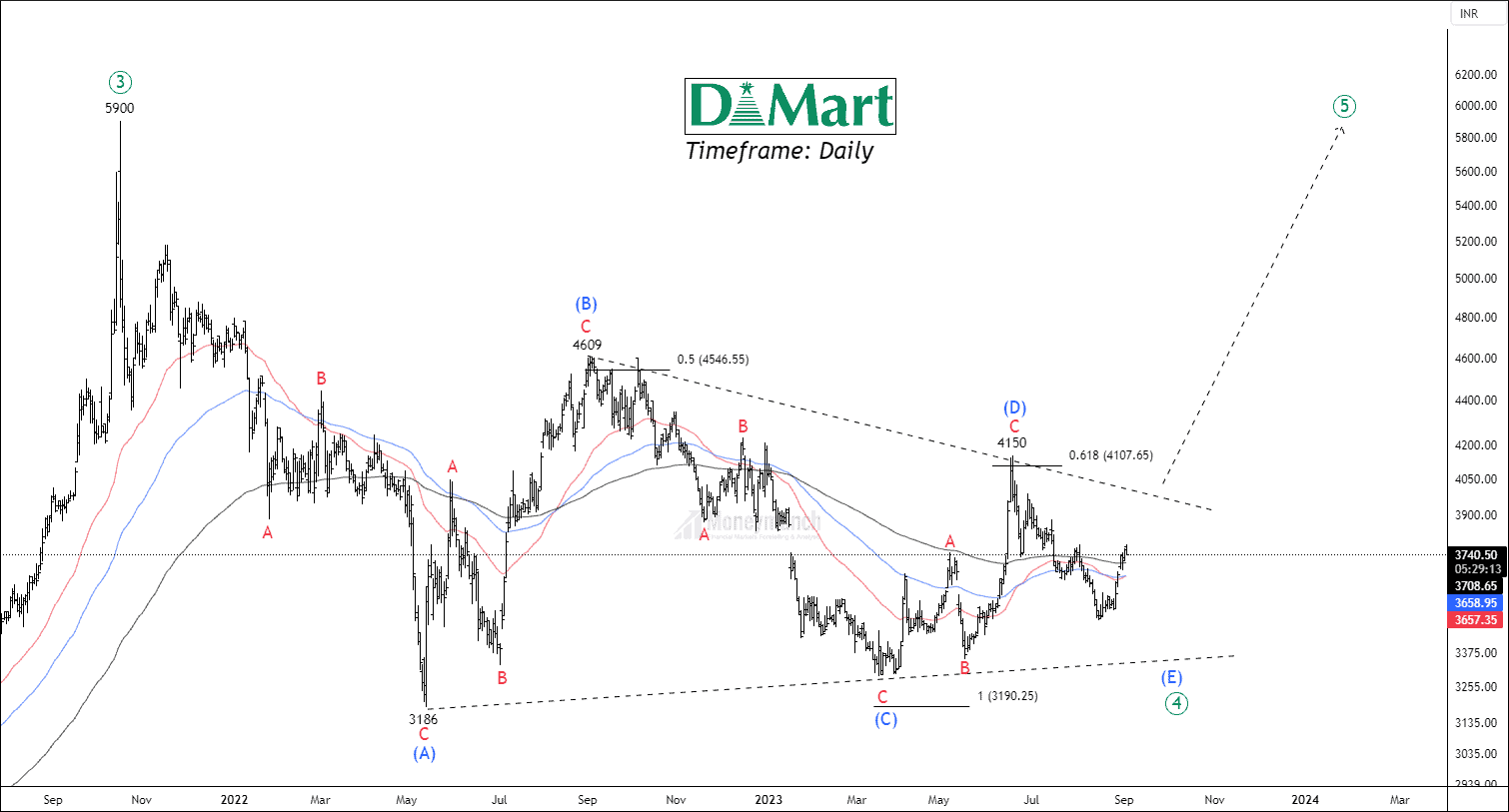

DMART – Will BD Line Breakout Unlock Bulls’ Holy Grail?

NSE NIFTY – Will Price Confirm Its bull run?

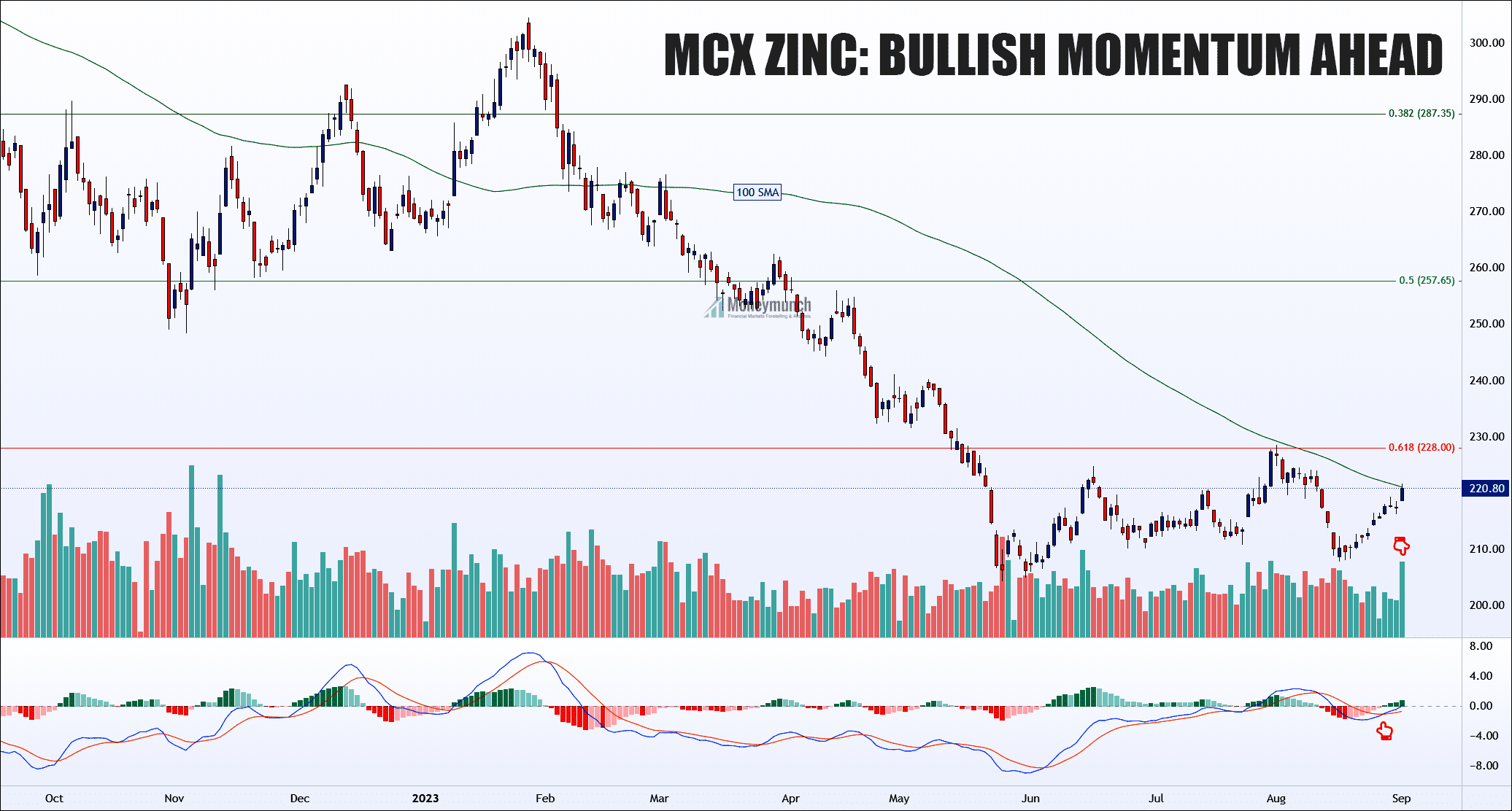

MCX Zinc: Bullish Momentum Ahead

MCX Zinc Signals Potential Bullish Momentum with Clear Target Levels

MCX Zinc is currently right at its 100-day Simple Moving Average (SMA). Additionally, we’ve seen a positive crossover on the Moving Average Convergence Divergence (MACD) indicator.

Closing above the SMA 100 is significant, indicating a potential upward move with two target levels at 224 and 228 in the coming days. This is an appealing opportunity for short-term traders.

It’s important to note that initiating a position when the price is below the SMA 100 is not recommended due to higher risk.

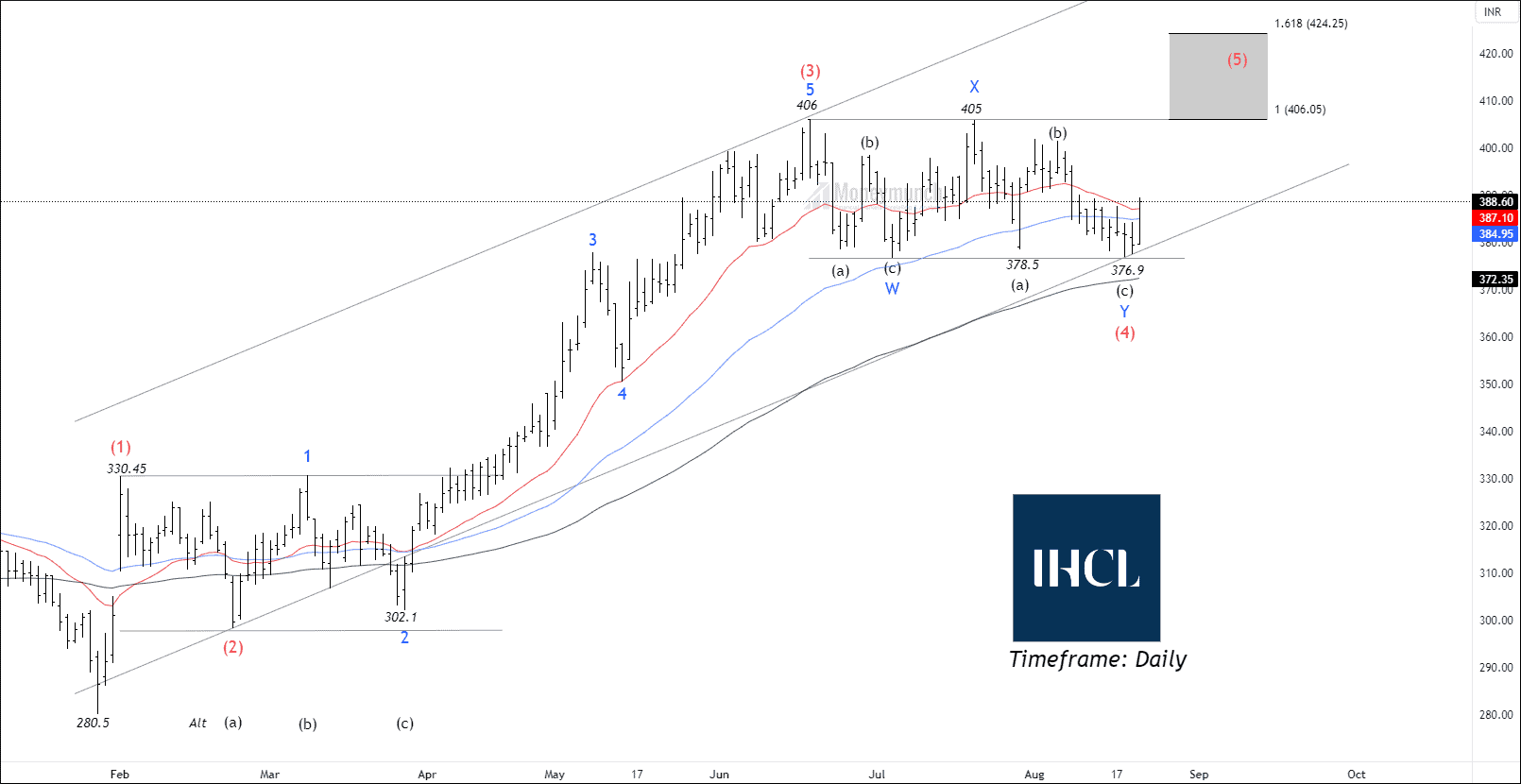

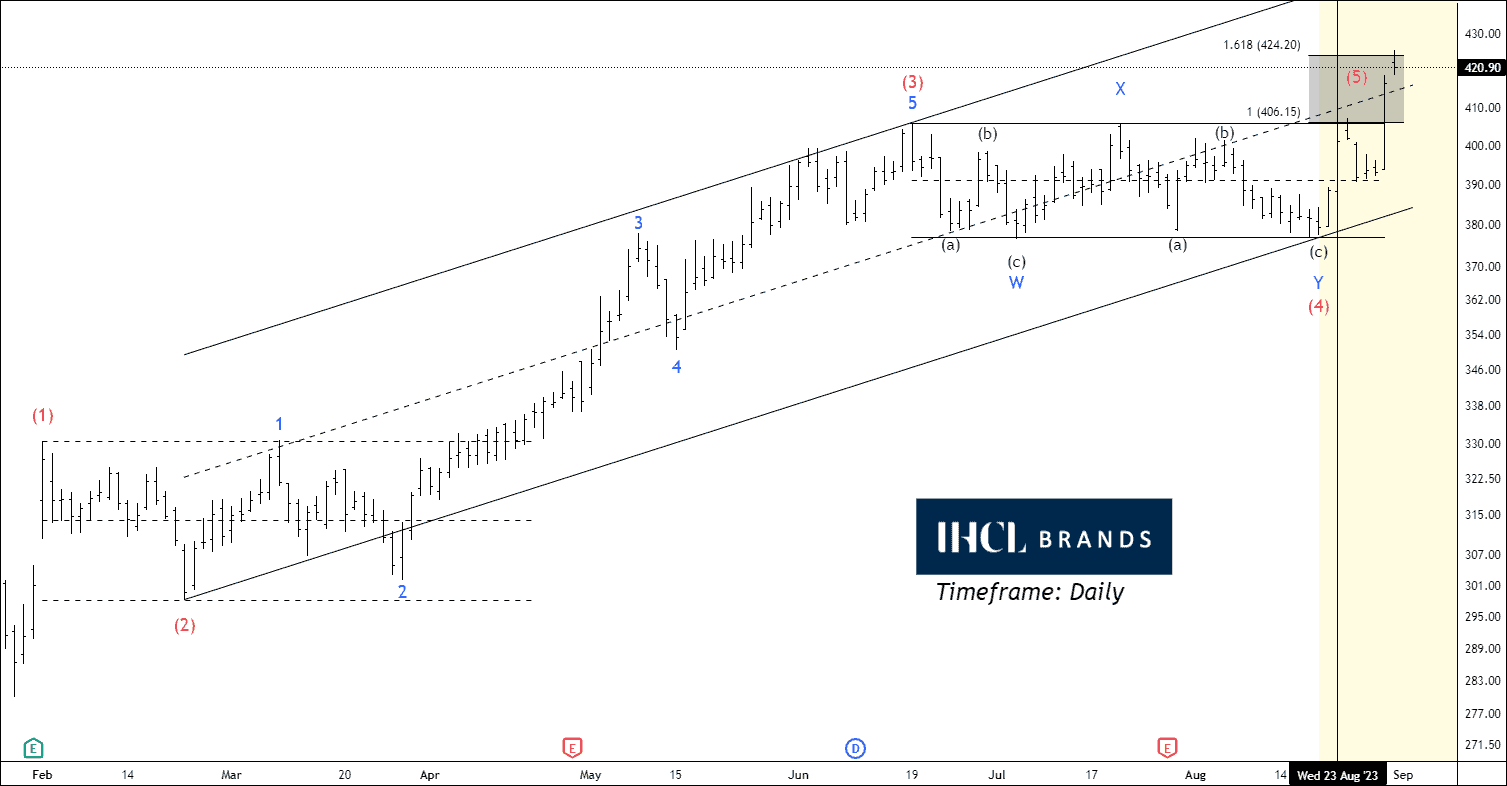

NSE INDHOTEL – Bull Victory

Have you traded NSE INDHOTEL Trade setup?

Visit here: NSE INDHOTEL Is Getting Ready For A Rapid Ascent

BEFORE

BEFORE

We had written clearly, “The retracement of wave 4 corresponds to 38.2% of wave 3. The structure of wave 4 is a double zigzag. Traders can consider the following targets: 402 – 415 – 424.”

AFTER

AFTER

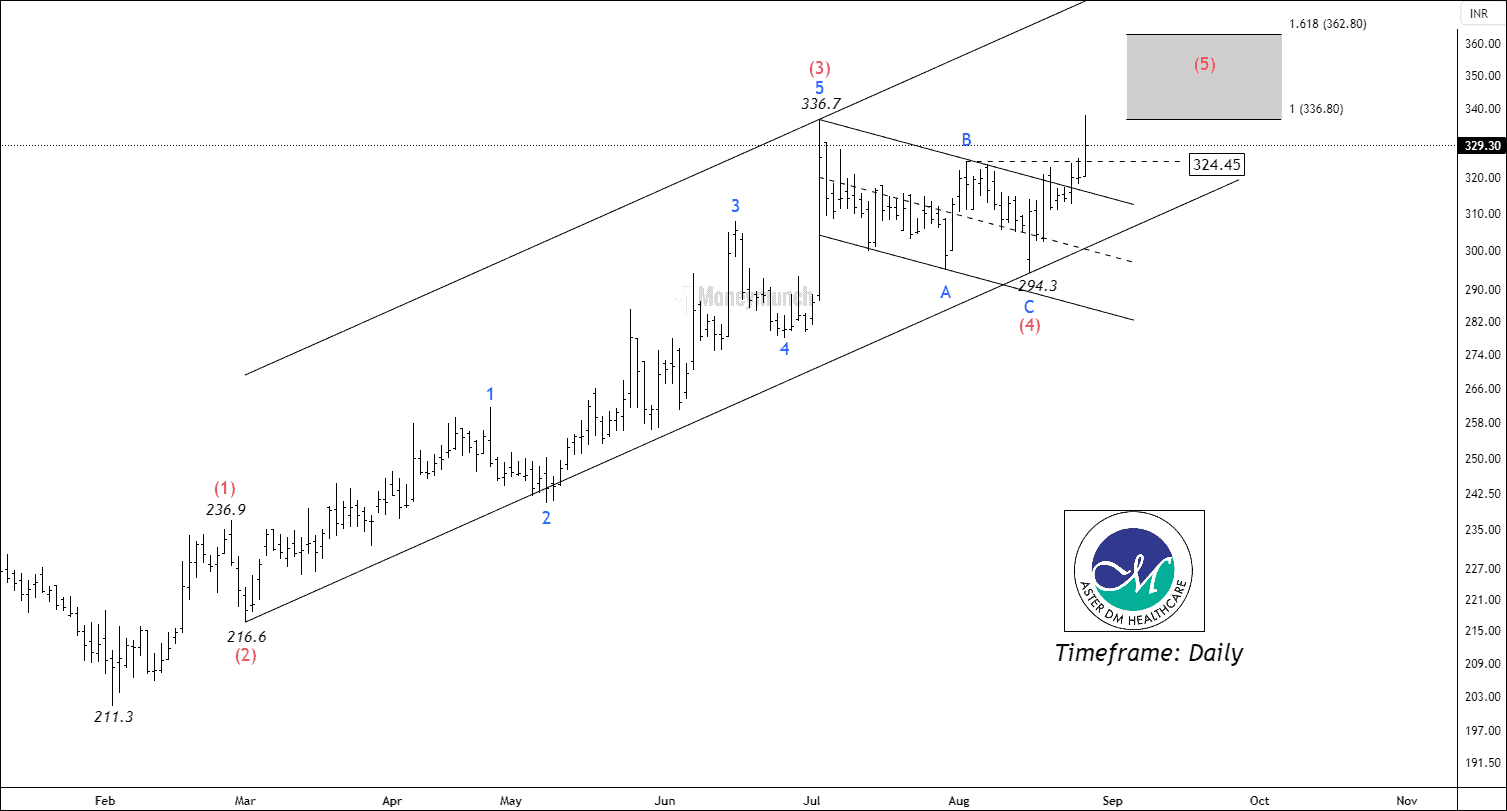

NSE ASTERDM – Elliott Wave Projection

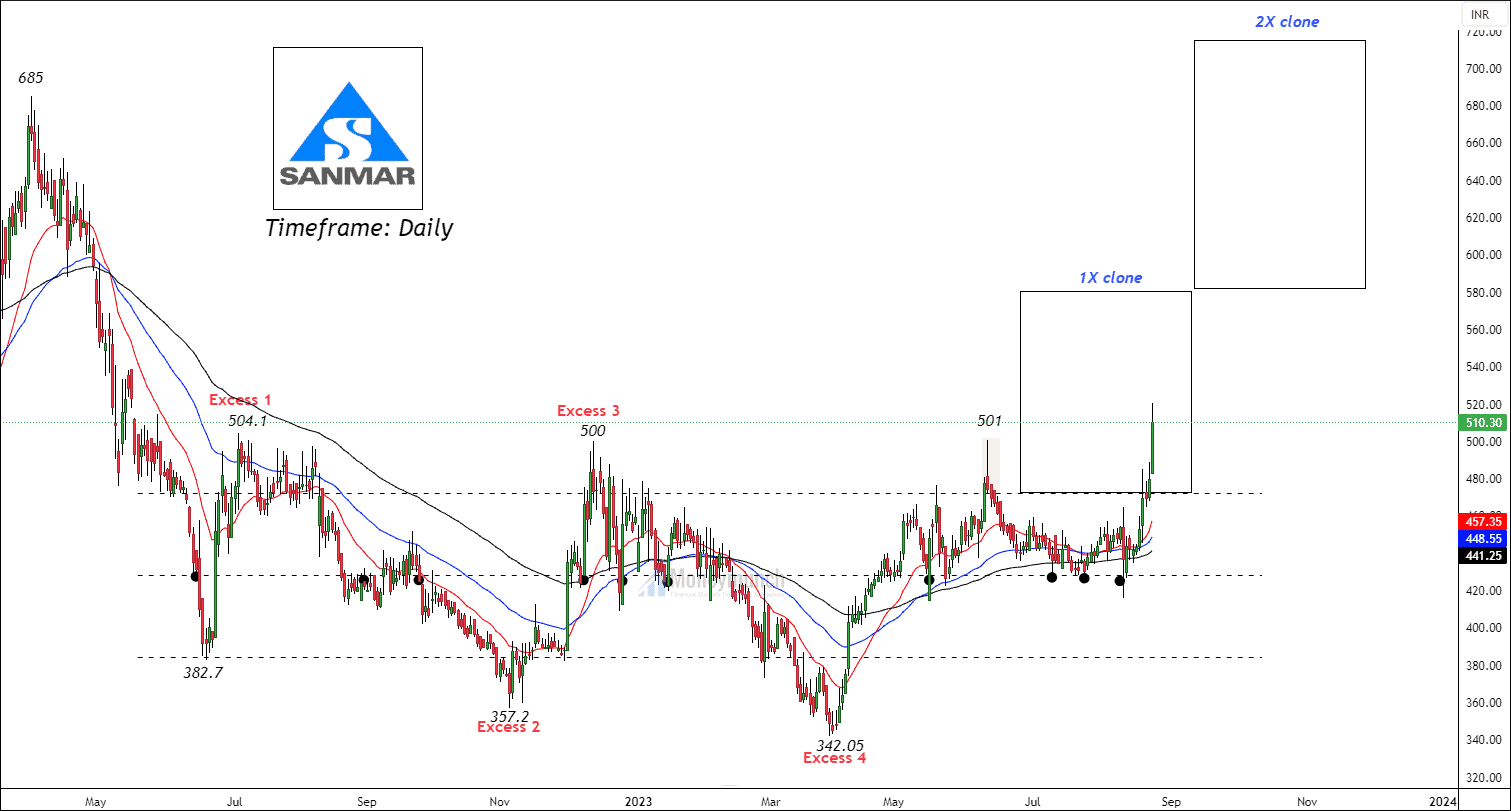

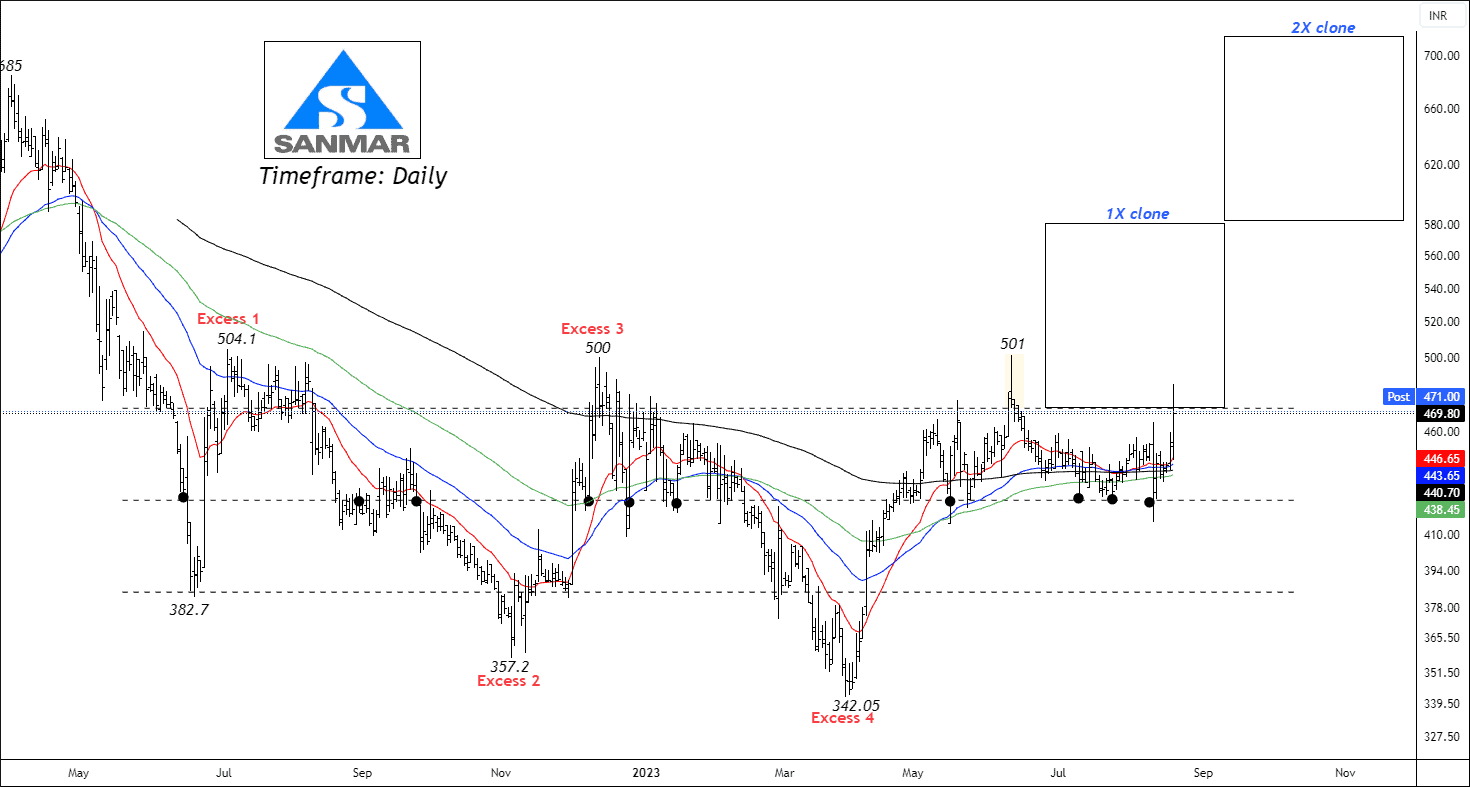

Will NSE CHEMPLASTS Touch The Final Target?

Did you trade NSE CHEMPLASTS Trade setup?

Visit here: NSE CHEMPLASTS – Price Action Analysis

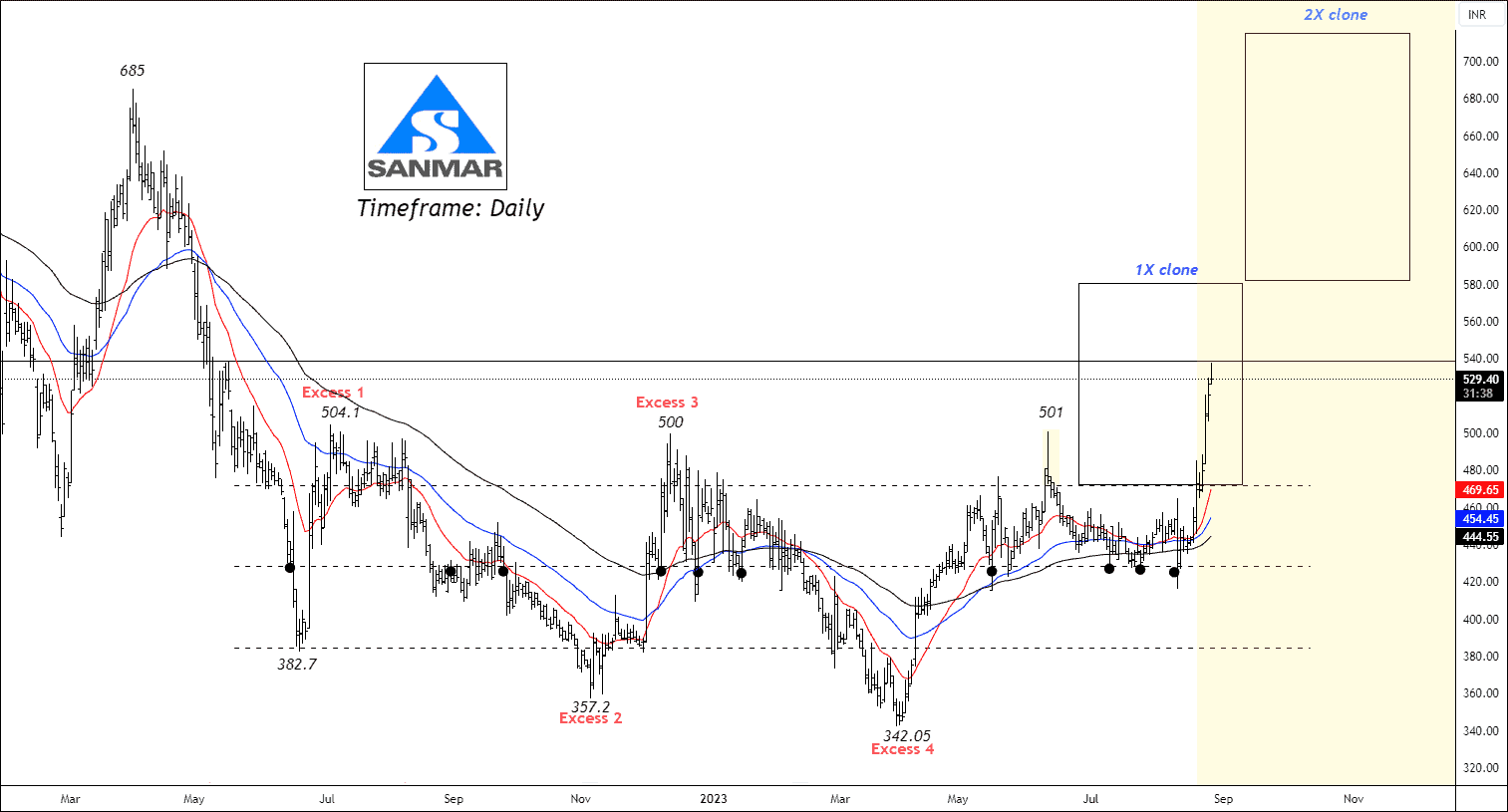

BEFORE

We had written clearly,”If the price breaks out of the upper band, traders can clone the moves for the target within 1X and 2x measurements. Buyers can enter with the following targets: 510 – 535 – 565+.”

AFTER

AFTER

NSE CHEMPLASTS – Trading Insights & Updates

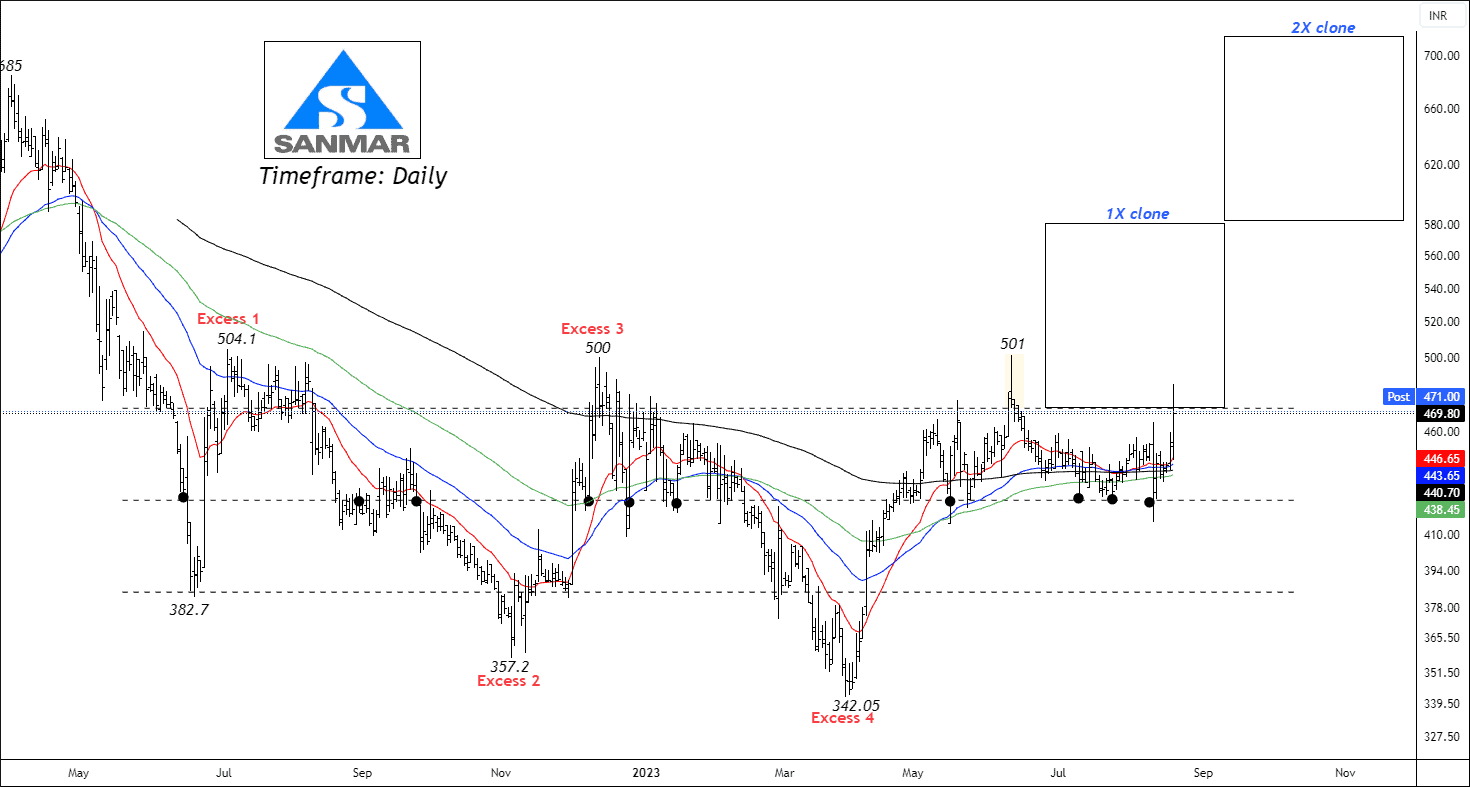

Did you trade NSE CHEMPLASTS Trade setup?

Visit here: NSE CHEMPLASTS – Price Action Analysis

BEFORE

We had written clearly,”If the price breaks out of the upper band, traders can clone the moves for the target within 1X and 2x measurements. Buyers can enter with the following targets: 510 – 535 – 565+.”

Lock

Lock