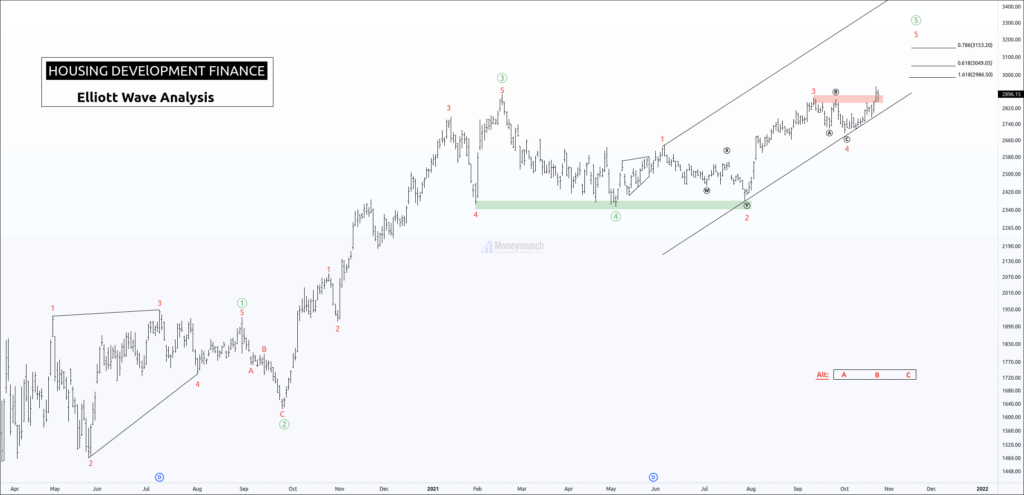

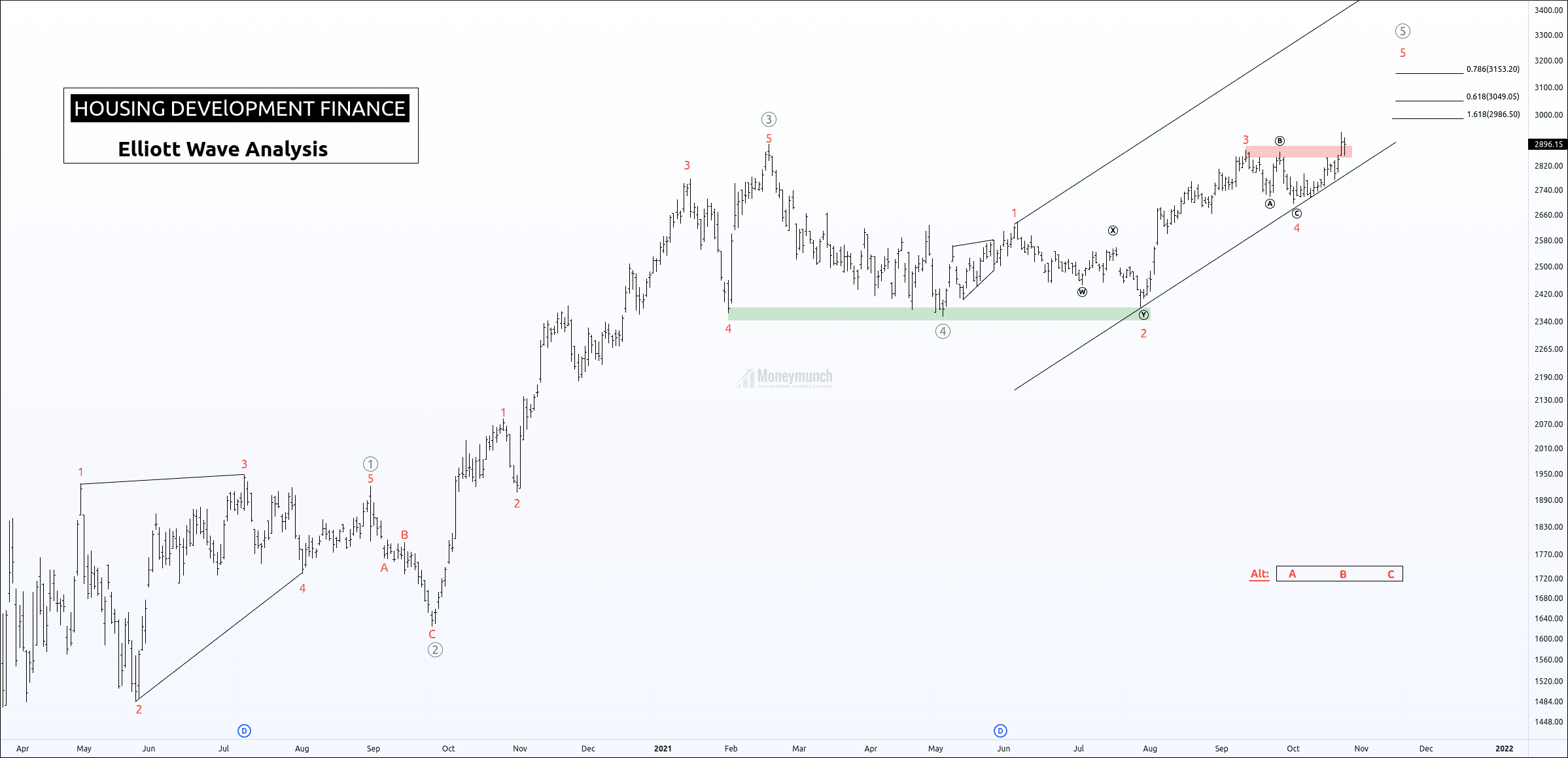

HDFC – 5th Wave Opportunity (Closing Price: 3492.95)

According to Elliott Wave theory, HDFC stock price will keep drilling upward. And we may see Housing Development Fin price at the following levels: 2986 – 3049 – 3153. But intraday traders should worry about the support trendline of the parallel channel because HDFC price may try to retest the support trendline before the trend continuation.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

TCS: This Rise Is A TRAP (Closing Price: 3492.95)

According to the last trading session, TCS prices may hike up to 3560 from here. But this can be a trap for buyers. Technically, we cannot see an upside rally before retesting of 3400 – 3360 – 3320 levels.

Tech Mahindra Trying To Break All-Time High (Closing Price: 1524.10)

Technically, TECHM is trying to make a new all-time high. The day’s candles are making long wicks from the past four trading sessions. And if you look into volume, tech Mahindra stock is trying to throw out the sellers. We may see 1590 – 1636+.

Moreover, if it breakdown the level of 1460, then beware because this level breakout can stop upside rally. And the stock price may fall up to 1430 – 1380.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

No matter how big the crown may get, you with your amazing skills and dedication towards your work will stand out anyways. Great times lie ahead for you, of that we are very sure. Well done.

I read the description alongside looking at the chart. Your prediction might turn out to be a golden opportunity!

Let’s talk about the angle you’ve shown in the charts, I must say I can clearly see the trend you’re trying to show here, clearly see that it’s following the same!

Your way of applying the Gaan theory is worth the appreciation! People must accept that you’re one of the top-notch guides when it comes to market!

You’re a gem for traders like me who are trying to put their foot into the market. As I said in your earlier prediction, keep up the good work. You rock!

Nice Idea.

Thanks for the update.

TCS me enter lene vala tha but apka chart dekhke me opportunity ka wait karraha hu.

Good one!

You consistently bring your all and, I truly appreciate that.