Dow and Nifty Chart

The Dow’s parabolic move higher has continued with gusto throughout November. So what’s next? Well, I think Santa is coming to the party with a Christmas rally that will be the last hurrah for this bull market that began in 2009.

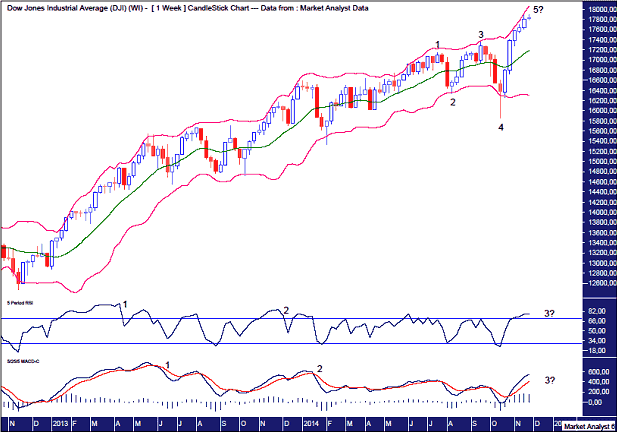

Let’s begin the analysis with the weekly chart.

Dow Weekly Chart

The Bollinger Bands show price clinging to the upper band as expected for a parabolic move higher. This move up still looks to have more price and time left in it.

There has hardly been any pullback of significance in the last month, which is testament to the current strength of the bulls. I thought a minor 23.6% Fibonacci correction may occur, but the bears couldn’t even manage that.

So we have a 5 point broadening top in play as denoted by the numbers 1,2,3,4 and 5. We are now just awaiting the final wave 5 high to form.

This is also a “three strikes, and you’re out” topping pattern, which consists of three consecutive higher highs.

As outlined in the November newsletter, I expect this final high to be much higher than the point 3 high, as that high was only marginally higher than the first high at point 1. That appears to be holding true here.

There also appears the potential for the coming top to be accompanied by a triple bearish divergence in both the Relative Strength Indicator (RSI) and the Moving Average Convergence Divergence (MACD) indicator. This is denoted by the numbers 1, 2 and 3 on the respective lower indicators. This is commonly found at tops and generally leads to a significant decline.

Let’s move on to the NIFTY Chart

As per my personal view, Nifty will fall heavy after big up move.

MORE DETAILS for NIFTY Future will be for Subscribers live by the Yahoo Messenger.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Last Nifty future call by us is to buy 8455 for targets 8610 (Achieved Targets).

NIFTY setup

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.