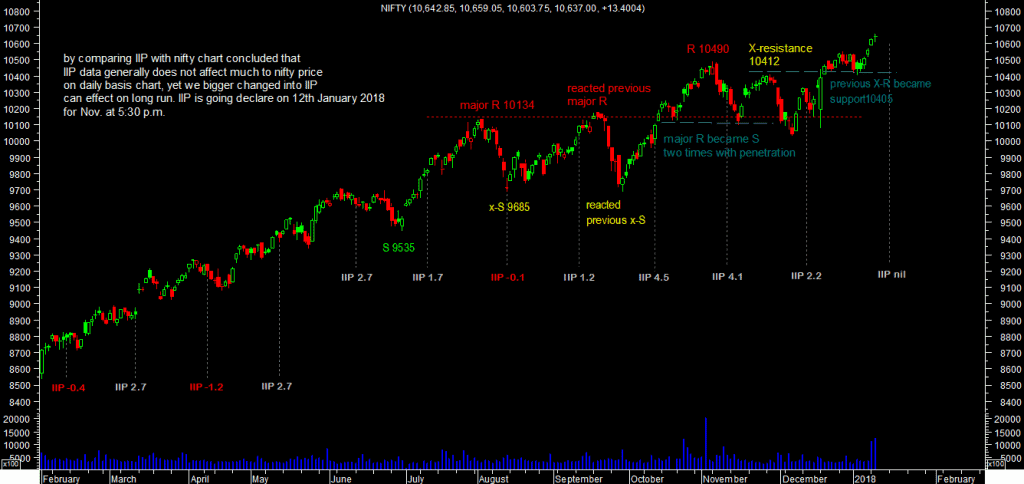

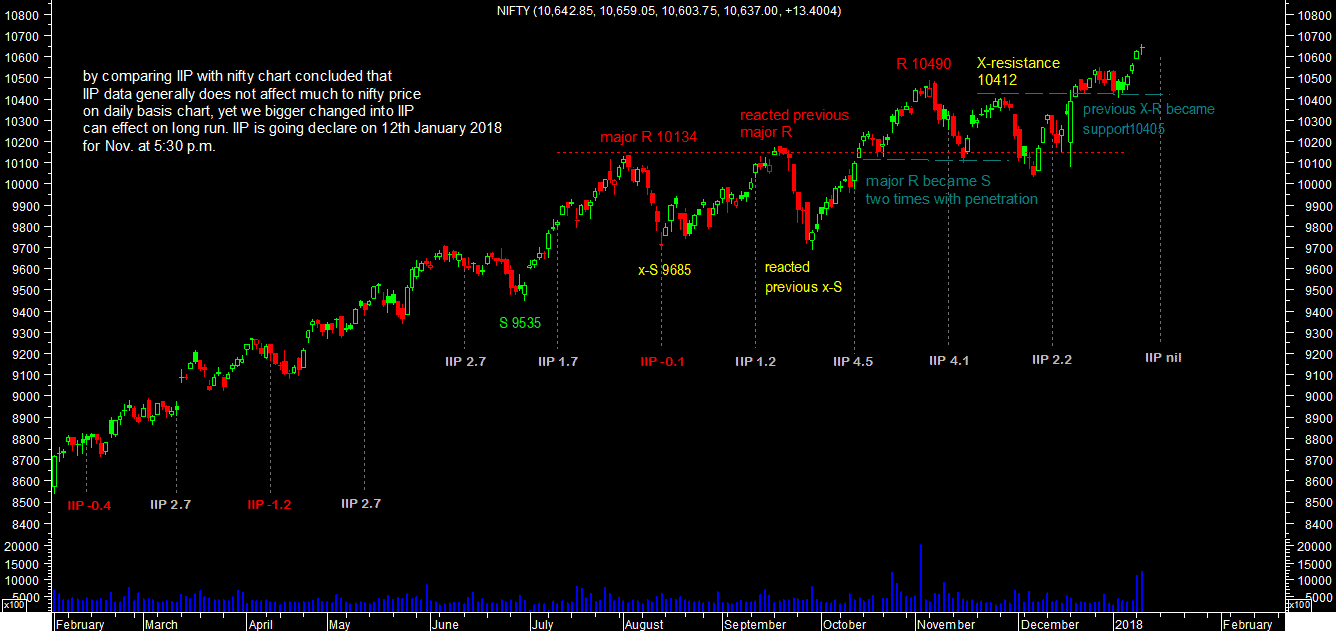

IIP (Index of industrial production) data for November month and CPI data for December month are going to declare on 12th Jan. 2018 at 5:30 PM which are generally minor affect to index nifty for short term period. Therefore, we have created chart of IIP data with nifty future here will useful for traders.

Data for 01/09/2018

|

IIP and CPI data are declare on Friday then result of it will be on Monday. If there’re not good news or unable to support globe atmosphere will lead to fall in market.

IIP data source from.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

If GDP growth will not boost. And small and medium enterprises will not grow.governmet revenue will not increase.so necessary steps to. Boost economy is must for government.

On a consolidated basis, the company expects its revenues for the fiscal year ending 31 March 2018, under IFRS, to grow 5.5%-6.5% in constant currency. The revenues are expected to grow 2.1%-3.1% in rupee terms based on the exchange rates as of 31 December 2017.