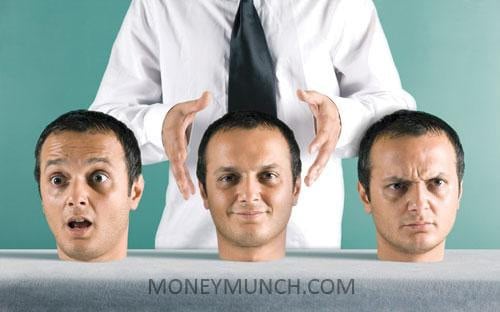

EMOTIONS ARE YOUR WORST ENEMY IN THE STOCK MARKET

Emotion plays an important role in many aspects of life. Most of the decision we take depend on our emotional quotient, either directly or indirectly. It is no different in investing. Though it is impossible to keep emotion out of the equation, it is imperative to keep it under control. In fact, the success rate of our buying/selling decision in stock market depends unswervingly on this factor. There are two extremes, between which decision-making swings like a pendulum. Most of us react to these extremes. We are either too excited to calculate the risk involved in buying a particular stock or too depressed to identify the intrinsic value of a stock when it is down. It is always important to take a balanced and an informed decision. Striking the balance is an art. It needs to be practiced over time. There are scores of channels, magazines and hundreds of analysts who often occupy our mind and ride us through different sectors and stocks. It is this ride which takes us to the extremes.

Emotion plays an important role in many aspects of life. Most of the decision we take depend on our emotional quotient, either directly or indirectly. It is no different in investing. Though it is impossible to keep emotion out of the equation, it is imperative to keep it under control. In fact, the success rate of our buying/selling decision in stock market depends unswervingly on this factor. There are two extremes, between which decision-making swings like a pendulum. Most of us react to these extremes. We are either too excited to calculate the risk involved in buying a particular stock or too depressed to identify the intrinsic value of a stock when it is down. It is always important to take a balanced and an informed decision. Striking the balance is an art. It needs to be practiced over time. There are scores of channels, magazines and hundreds of analysts who often occupy our mind and ride us through different sectors and stocks. It is this ride which takes us to the extremes.

Seldom do we think about who gives them ideas?

How much do they make out of their own recommendations?

What are their intentions?

Following them is very much equivalent to trying your luck at a casino. But then, how does one take a balanced and informed decision. Well, there are several tools & techniques to identify the movement of a stock. There are many ways to protect our investments from a severe fall. Understanding our risk capability, diversifying the portfolio, systematic investment plans and cost averaging are few of many strategies which help us to be in equilibrium at tough times. Above all, this is Technical Analysis. It is an ocean by itself. It is like reading the mind of millions of investors at a particular point in time and hence making an informed decision on buying/selling a stock.

One can learn it, but mastering it requires years of perseverance and experience. We at moneymunch.com have such stalwarts who have over the years guided many people to make informed decisions.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.