I clearly Updated on last Thursday in read line : “I will suggest to buy Nifty 5572-5606”

On Friday, the Democrats and Republicans made a joint and civil statement to the press following a brief meeting on the fiscal cliff. It signaled to the markets they are trying to begin this round of talks in a more professional manner, which was not the case in 2011. Therefore, something changed today…it was a step in the right direction. After the rare show of political civility, the tone of the markets improved immediately. The S&P 500 rallied to close 16 points off the session low.

Charts Mixed, But Improved

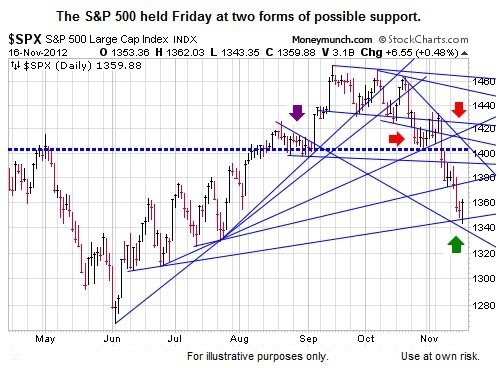

Since warning of slowing stock momentum on September 24, we have seen little to get us interested again in stocks. Friday was better. On the charts, let’s start with the good news; the S&P 500 found buyers at a logical level (see green arrow below).

A Rally…Then A Lower Low?

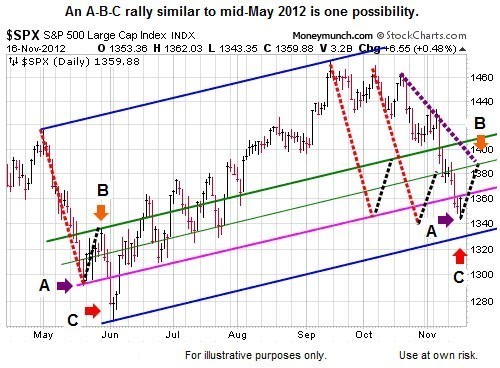

Based on numerous factors, we can envision a countertrend rally back toward the 1388-1448 range on the S&P 500. A similar A-B-C rally took place in May 2012. The rally began at point A, moved to point B, and then made a lower low at point C (see below). Markets often have symmetry and a move toward point B on the right is certainly one possible scenario for the next week or so. Keep in mind, point C would represent a low lower than Friday’s low of 1359. A good next step is to clear resistance near the pink line below, which sits at 1362 on the S&P 500.

Resistance Still Overhead

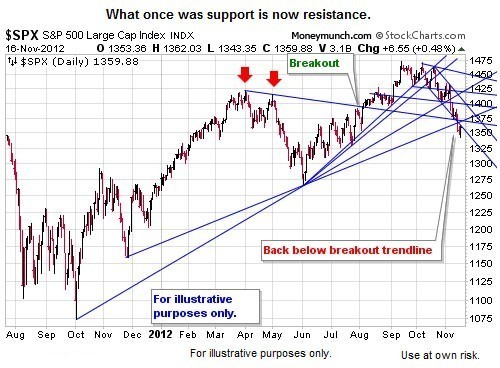

Another scenario is the S&P 500 holding below the downward-sloping trendline from the April and May highs (see red arrows). Stocks broke above the same trendline in August (see breakout below). Now the trendline may act as resistance; it sits near 1370 on the S&P 500.

Not Just Cliff…Europe Still A Problem

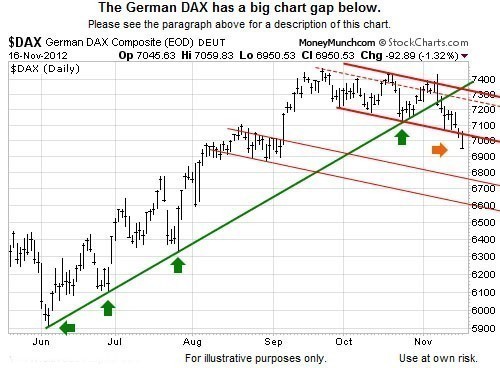

The biggest obstacle to a rally may be Europe. There is talk of another round of “haircuts” for holders of Greek debt, which sides with the “risk-off” camp. The German DAX is clearly in a downtrend and has broken some key support levels (see orange arrow).

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.