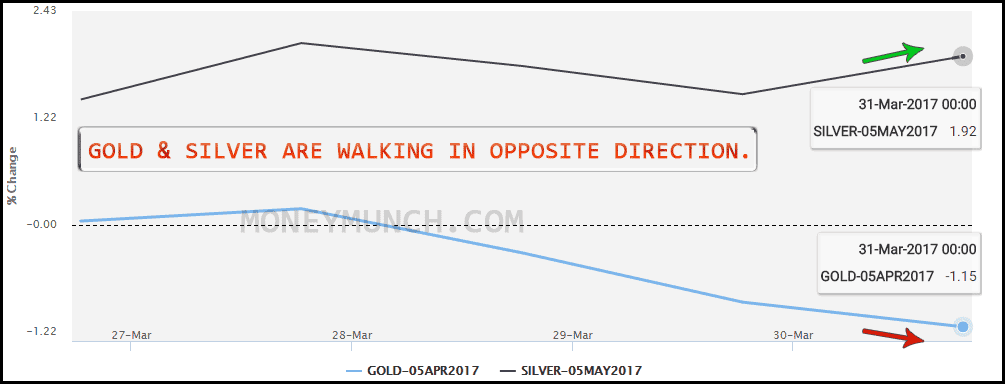

What had I said about Silver? If you forget it then click here and remind now…

What had I said about Silver? If you forget it then click here and remind now…

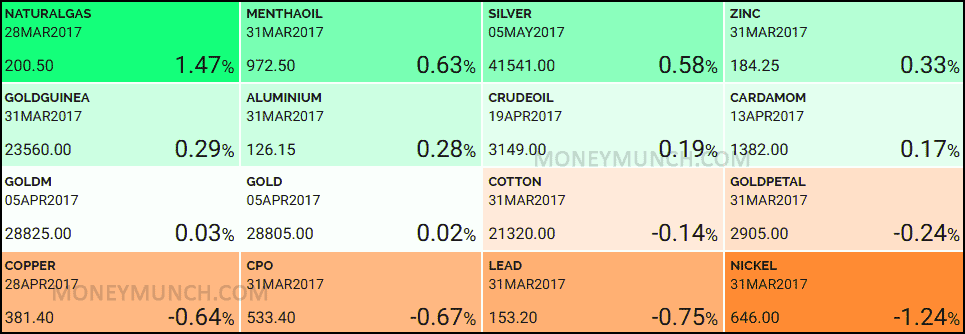

I had said, “If it (silver) will crossover and close below the 41160 level, then you can sell for 40952 – 40760 levels.”

The day before yesterday silver was closed at 41129. Yesterday it started moving down and touched all targets!

I hope, everybody enjoyed FREE tips.

Crude Oil – Will Go more Down?

What had I written about Crude oil? Again, click here and read it now

I had said, “Crude oil will hit 3170 – 3140 levels soon”.

Yesterday crude oil made low 3156. The first target has been achieved and crude oil at 3183 level.

Do you think, it will hit the second target too?