Did you trade NSE BRITANNIA intraday analysis?

Click here: NSE BRITANNIA – Bearish Setup

Continue reading

Continue readingLooking for reliable and free stock tips? Look no further than Moneymunch! We provide intraday and positional trading calls, technical analysis, research reports, and daily or weekly charts to help you make informed trading decisions in the stock market. Subscribe now and stay ahead of the game!

Did you trade NSE BRITANNIA intraday analysis?

Click here: NSE BRITANNIA – Bearish Setup

Continue reading

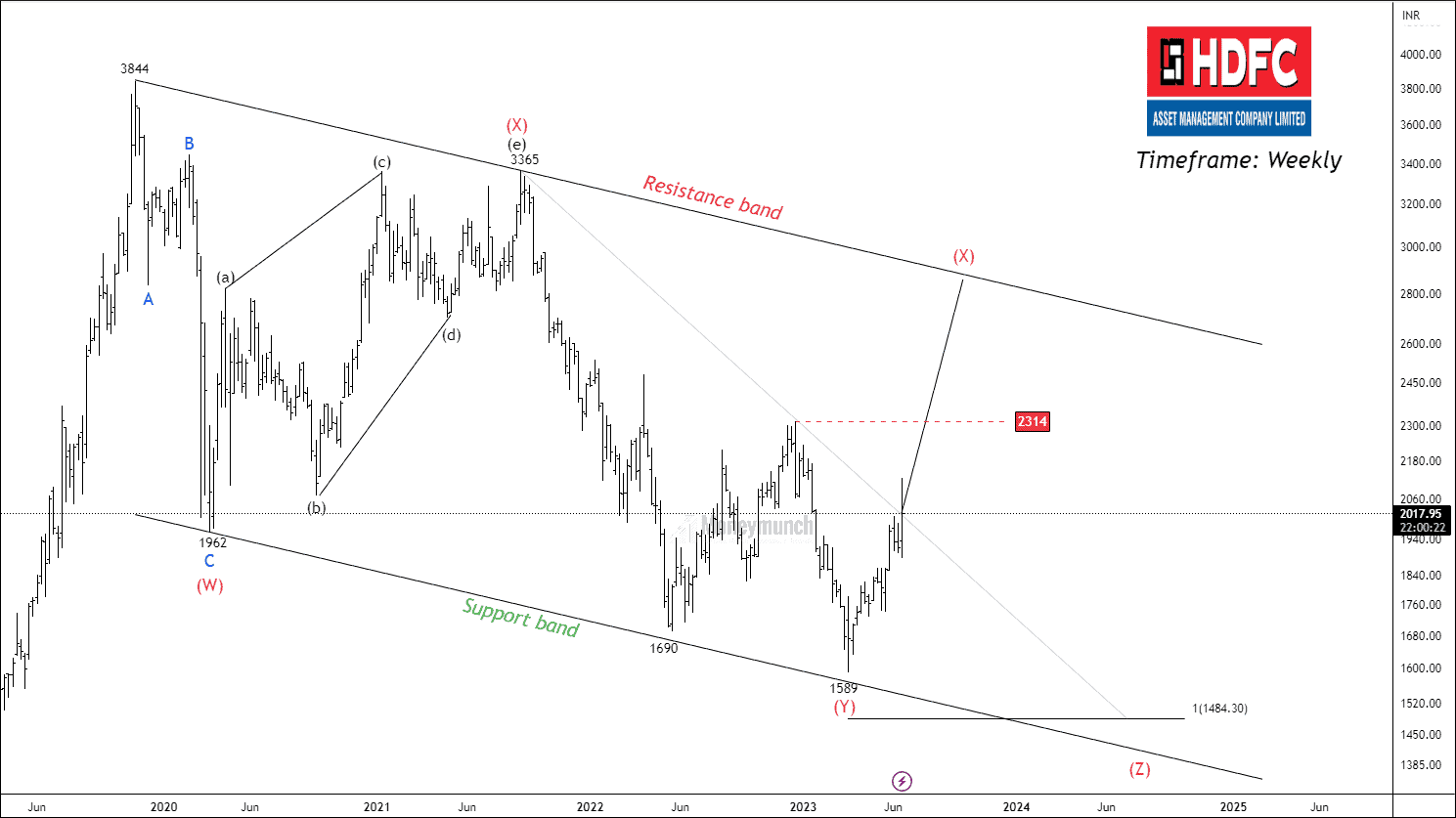

Continue readingDo you remember HDFCAMC Weekly analysis?

Click here: HDFCAMC – Correction Will Be Beneficial For the Bulls

BEFORE

BEFORE

We had written clearly, “For traders interested in this opportunity, long above the neckline at 2100, with the following price targets: 2314 – 2588 – 2795+”.

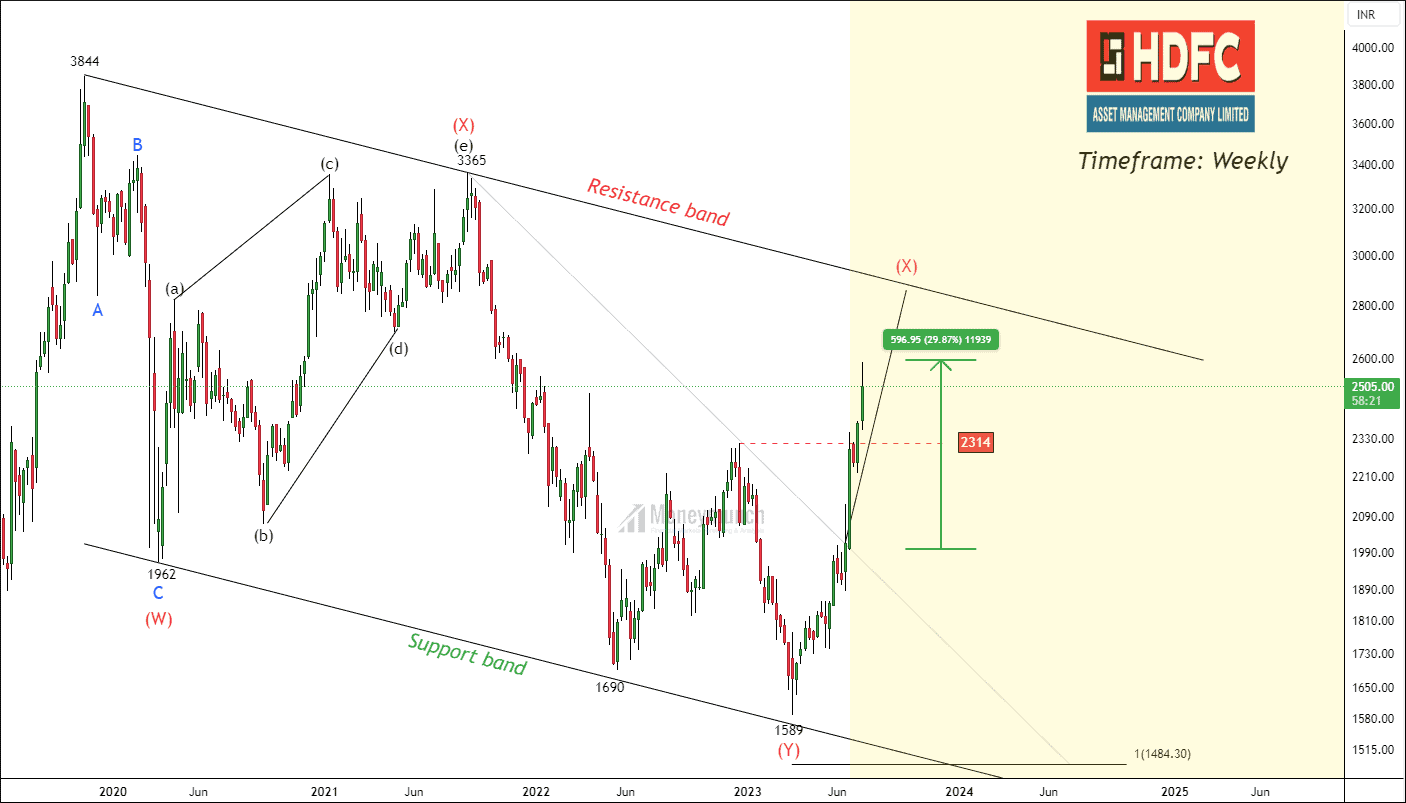

AFTER

[27 June 2023]

[30 June 2023]

[14 July 2023]

[20 July 2023]

HDFCAMC has given a captivating return of more than 29% in 5 weeks. If you have traded this setup, you could have made 590 points or Rs. 59,000 per 100 shares.

Continue reading

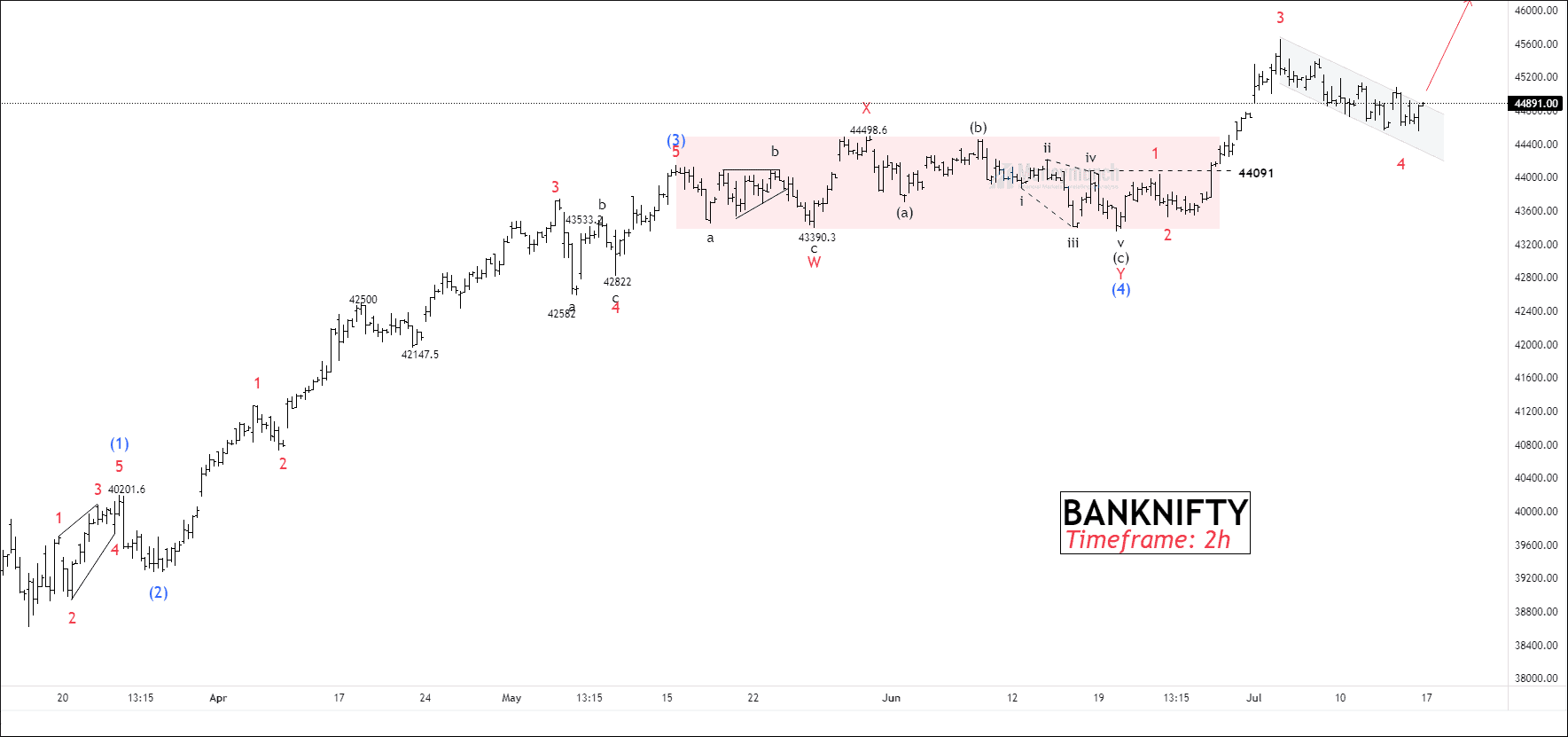

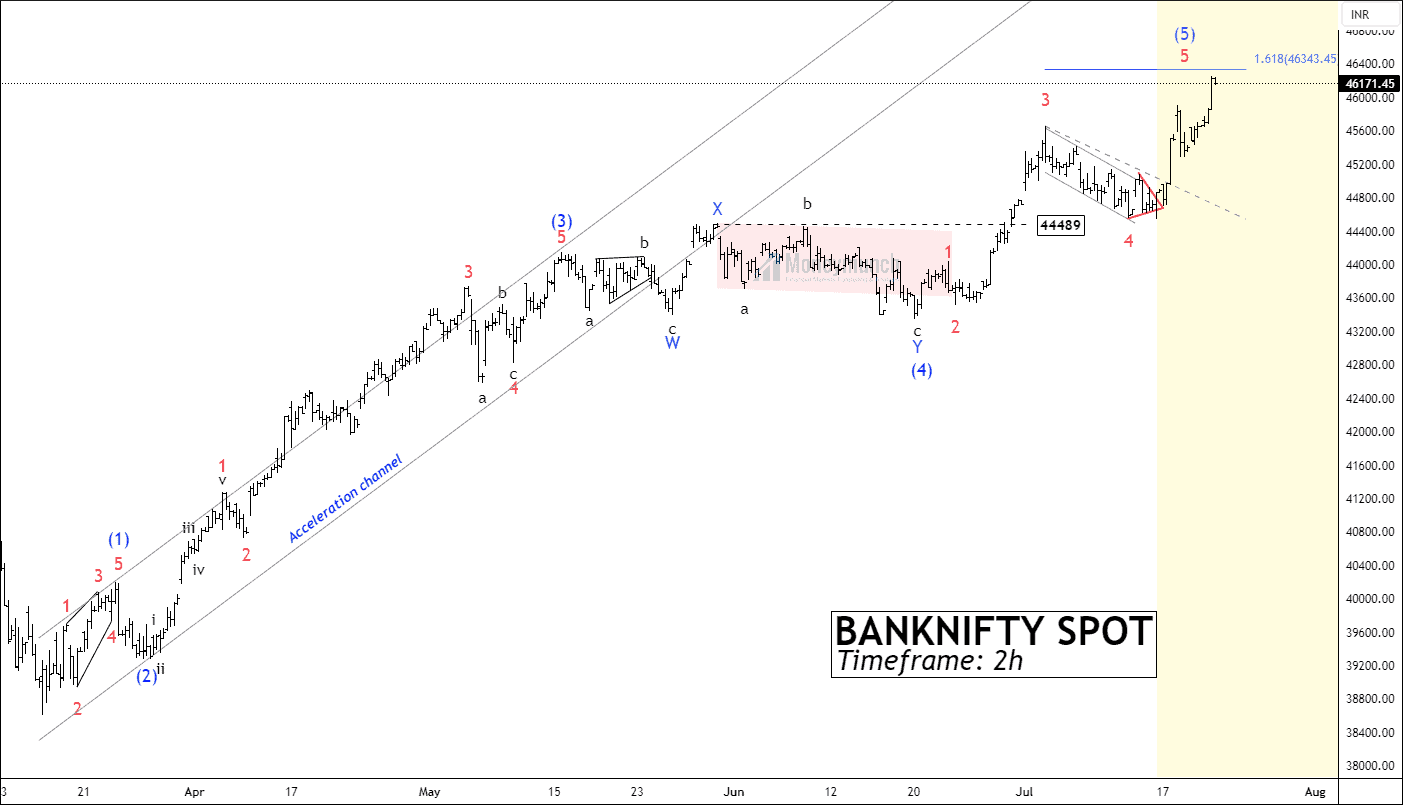

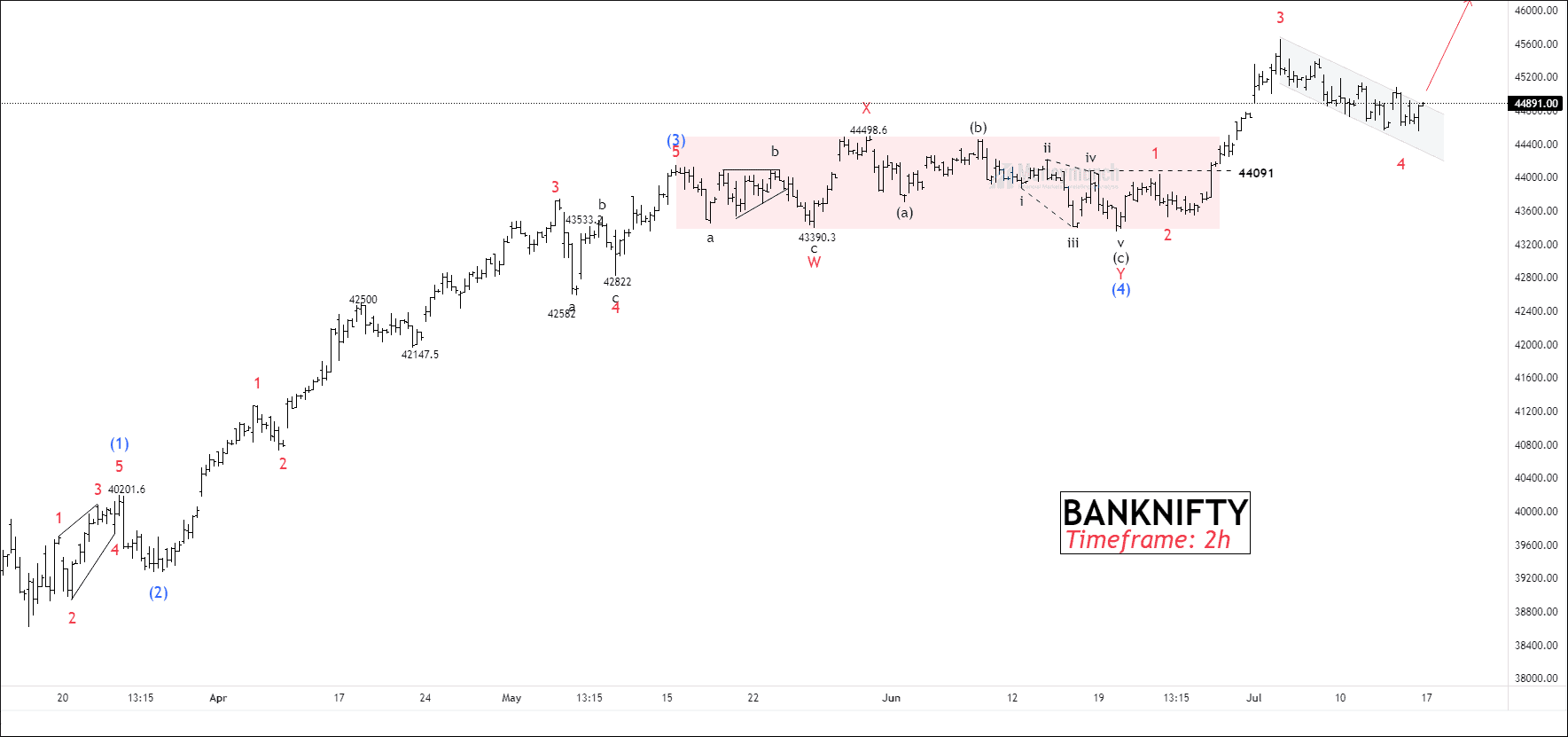

Did you trade Banknifty wave analysis?

Click here: BANKNIFTY SPOT – Bullish Outlook Is Still Valid

BEFORE

BEFORE

We had written in clear words, Traders can use the reverse Fibonacci levels of the previous sub-wave (3) to (4) to set targets after the breakout of the corrective channel. These targets include 45320 – 45655 – 46124+.

AFTER

AFTER

Did you trade Banknifty wave analysis?

Click here: BANKNIFTY SPOT – Bullish Outlook Is Still Valid

BEFORE

BEFORE

We had written in clear words, Traders can use the reverse Fibonacci levels of the previous sub-wave (3) to (4) to set targets after the breakout of the corrective channel. These targets include 45320 – 45655 – 46124+

[17 July 2023]

[18 July 2023]

If you have traded this setup, you could have made more than 950 points in just three trading sessions.

We will update further information for subscribers soon.Continue reading