Trading system:

It is a superstition to think that the one with the most knowledge is the better trader, it is usually the other way around as more knowledge can create confusion. True to the motto “if you want to catch two rabbits, you won’t catch one”. Unfortunately, I have to disappoint anyone who focuses on several trading systems and wants to master all of them perfectly, it will turn out rather badly. You will see several things from several different systems on the chart and in the worst case, they will even clash. You will be confused and will ask yourself which system is the right one. Sometimes you use system A until it no longer runs, then since the system, A no longer runs, you use system B, etc. It is impossible for a system to constantly perform! Focus on a trading system and perfect it!

The probability of catching a rabbit is higher than two at once. In the beginning, you think above all that you need a lot of knowledge (of course you also need it, but the right knowledge plays a decisive role here), you want to experience everything, look at everything, and would like to combine everything, because if the more things you combine the better or not?

In society, people with more knowledge -> are worth more. A boss, for example, gets paid more than an apprentice because the boss has more knowledge and the boss is valued more as a result.

Our brain can absorb limited knowledge, but if you pump up your brain with new knowledge every day, this will not help either, since 99% of the information we absorb every day will be gone by the evening. Only the information the brain can provide to a category or order (meaning metaphorically) remains stored, now you are the one deciding what to keep and what to go. Choose your knowledge wisely, not just the kind of knowledge you have, but also who you get the knowledge from.

In trading, we have to get away from the statement “who knows a lot, can do a lot” and rather ask ourselves whether the new knowledge will help our current system or not. –You do not have to know everything!

External influences

We all know it. You go through the markets, look at a setup, place the order that is triggered shortly afterward, and wait. Now you hear from other traders that they find the setup unattractive and are therefore active in a different one. Doubts arise, did I place the trade wrong? Why do others find the setup unattractive, what should I do now? In such a situation, you are subconsciously influenced, so that in the end you no longer make the decision. It often happens that you either close the current position in a panic and adapt to the other traders, or you also enter another position in another market -> the crucial thing is that we wouldn’t have done it if we hadn’t seen it done by others. The aim is to trade with confidence and not be influenced by other results or other traders in general.

But how do I gain confidence when trading?

Trade, trade, trade! trial and error. Experience makes the trader. You will begin to see certain patterns in the market when you are ready and you will feel more confident every day as you become one with the price movements through continuity and personal growth. Work turned into a passion, an activity that you enjoy doing every day (remember the topic of emotions – joy, and feelings of happiness in combination with the right trading knowledge leads to the rapid growth of the neural network). The better you get, the more confident you become.

What is right for one may be completely wrong for another. We just have to listen to ourselves! Everyone has different experiences and individual difficulties. One is still struggling to set the right take profit, while the other has to develop a more trained eye for the structure – both have been there for the same amount of time, but have different difficulties.

Trading costs:

What do I mean by trading costs?

In short, if you get the wrong knowledge and the wrong approach from the start, you will have to force yourself from seminar to seminar and from course to course until you find the right system for you. The whole thing is of course also associated with costs and the most important thing, whoever does not implement what has been learned in the seminar, will forget all the knowledge after hours, which in turn means that the whole thing was in vain. Find a demonstrably profitable system, get to know it, and don’t give it up after the first 3 months. There is no holy grail, there is no 100% hit rate even in the long term.

Have the right FOCUS, don’t focus on finding the best system with the best hit rate and best CRV. There is only one system and that is what will be focused on and what your experiences will be based on.

Would you rather master 3-5 strategies 50% and still run the risk of mixing things up or focus on 1 system that you master over time like an expert?

The ALDI PRINCIPLE fits in with this: Less is more!

Applied to trading, this means nothing other than that you should pay your full attention to one system and not to several.

- Find the right mentor

- How do I find the right mentor?

The stock market is a dirty business, everyone wants to profit from everyone and unfortunately, there are a lot of black sheep out there, you can fake a lot of things these days, be it your profits or your performance. Demo accounts can look like real money accounts. You can already select out “traders” who advertise with utopian percentages, don’t get me wrong, the whole thing can work, the only question is how long!

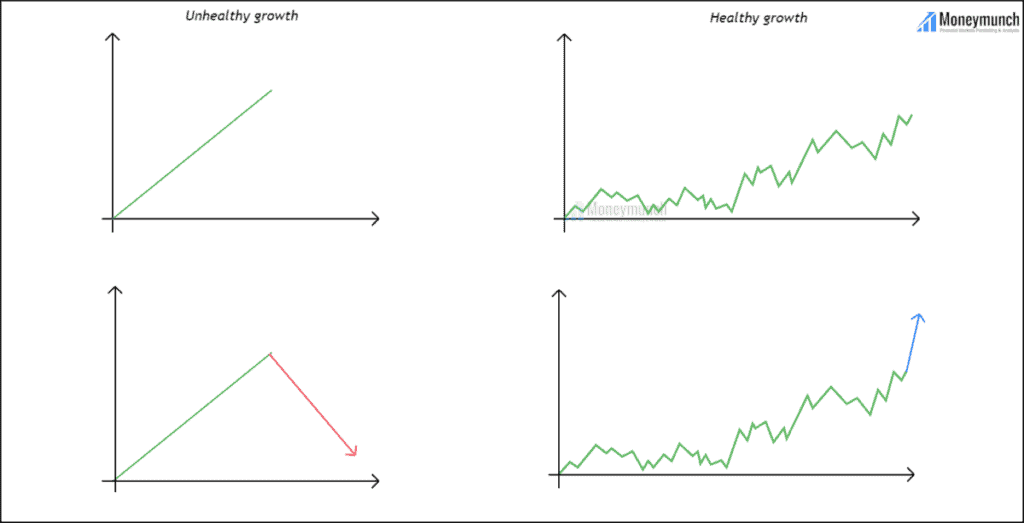

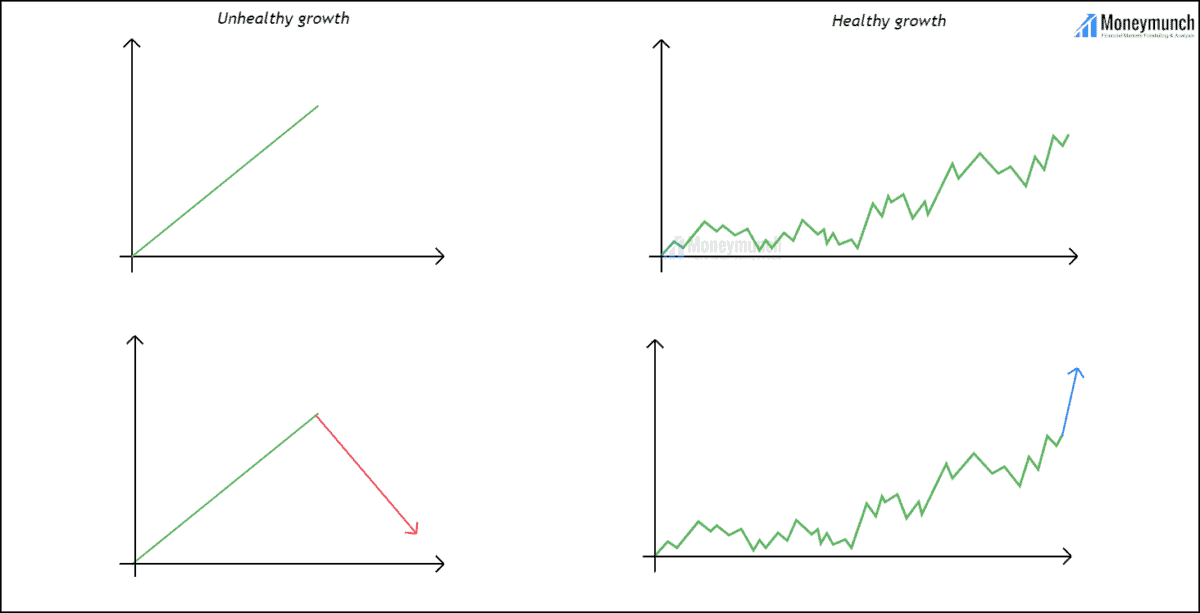

Note: Healthy growth is like a cos/sin curve, with ups and downs. The highs and lows stand for the profit/loss phases. The zero point is the stagnation phase. Every low is a new challenge, you grow with the lows. “Don’t go through it, grow through it. Most fail at the low points. Whoever masters the lows is a match for the trade.

The right mentor will teach you from the start that it’s going to be a long and hard road – but it’ll be worth it if you see it through. He will teach you that it is not about the money at first, because in the beginning, you will lose more money than you will win – which is completely normal. It doesn’t matter to him whether you continue to pay for the course or not, as his primary concern is not about the money but about helping so many people to do what he did. Of course, some good traders offer courses and can also market themselves well – but I don’t think much of that because I know that money always comes first. MMA the mentor should be happy to do it like to pass on the knowledge to his students, money or not.

Of course, money serves as a motivation, but some exaggerate it.

At the end of the day you have to make your own experiences, once you are ready the right mentor will find you.

I was lucky enough to be in the right place at the right time, so I only have one trading mentor from the start and have therefore only traded one system since the beginning of my trading career. However, many hops from mentor to mentor because they cannot cope with the system or simply lack communication with the mentor.

It’s up to you, not the system!

“The system will only work if you work” – Enrique Marin

Some traders change their systems like their underwear. Why is that so?

Giving up your guilt is always easier than being aware of the guilt. Being aware of one’s guilt is always linked to one’s self-reflection and as we all know this is not a popular topic.

When the system is running, you are happy and everything is fine, as soon as the first phases of loss come, you ask yourself whether it is the right system and change it because you have made losses :D. This process is then repeated constantly with new systems – if you’re good, you’ll quickly realize that it’s not the systems’ fault, only you! If not, then you will spend years using systems and then swapping them again.

The huge problem with this is that you don’t give any system a real chance, you just have to understand that every system has its losing phases – see the “healthy growth curve”. You just have to ask yourself how you want to achieve profitability if you’re constantly doing something different and don’t stay true to any system, like in good times and in bad times! The constant change of the system is usually due to a lack of confidence in the profitability of the system and this in turn is linked to the right mentor.

Do you trust your mentor?

Demonstrably profitable system + the right mentor + the right broker + constant further development + continuity + self-reflection = SUCCESS

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.