Continue reading

Commodity MCX & NCDEX Gold, Silver, Crude oil, Natural gas, Zinc, Jeera

You know, world’s fastest growing market is commodity market and in it crazy movers are Gold and Silver. One more thing you should to know, ‘The major monetary metal in history is silver, not gold’. Remember, your TV is lying to you when it says the ‘demand for Gold and silver’ is decreasing. Anyway, stop struggling and start making money with me.

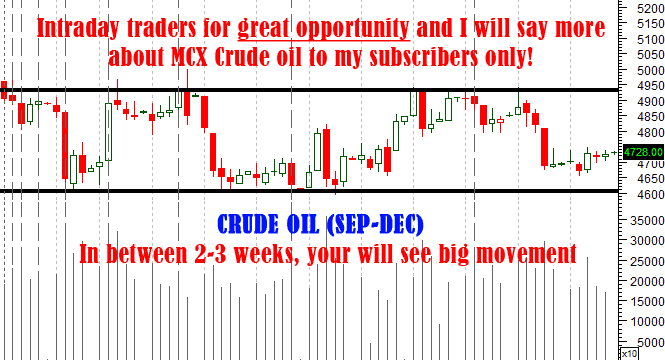

Let me start with Crude oil. First, click here and read our crude oil report now. Okay, now I hope you got it what I want to say you. Go and sell crude oil with targets: 4861-4841-4800. Contract changed that’s why little levels will change. Yes, stop loss and exact levels for subscribers only!

Only subscribers can read the full article. Please log in to read the entire text.

I think, should not say more about MCX Gold after above chart.

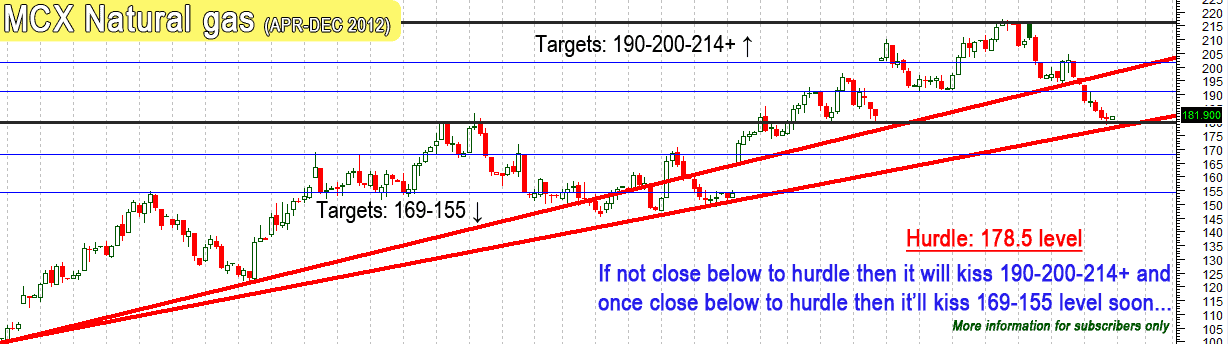

First click here and read our past natural gas report with chart. If MCX Natural gas not close below to hurdle 178.5 then it will kiss 190-200-214+.

On this 21st, Natural gas was kissed our first target!

NCDEX Jeera is very crazy item in Angri commodities. Free readers, I am just your well-wisher and want to say you. Today it’s looking downward. More information about Jeera to subscribers only.

SILVER, ZINC & JEERA REPORT IS BELOW. FOR TO SEE It Log IN NOW AND ONLY SUBSCRIBERS CAN READ IT. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Only subscribers can read the full article. Please log in to read the entire text.

We will update soon Lead and Nickel Chart soon.

Continue reading

New update: MCX Crude oil, Natural gas and NCDEX Dhaniya – CHARTS

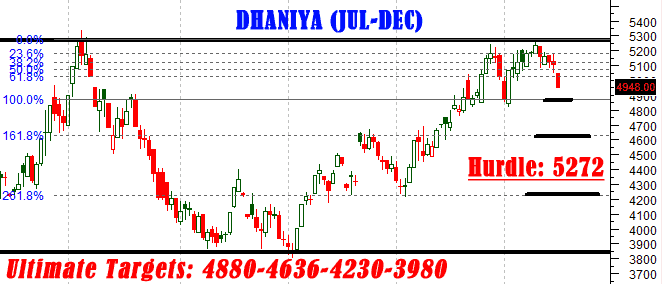

Live update: NCDEX Dhaniya – All targets done!

NCDEX Players, today what I said about Dhaniya at 9:30 AM?

Click here and read it again.

I said, “Buy at opening bell. Targets: 5146-5170”

NCDEX Dhaniya All Targets Kissed, enjoy!

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.Click here to subscribe our service

Continue reading

New update: MCX Copper, aluminum and NDEX Dhaniya

This week, commodities market will make ride upward. Trending higher the last couple weeks and I hate to say it but the direction of the markets is hinging on whether there is a resolution by the end of the year. The bullion sector has come to life in the last couple days. It will be interesting to see if we can get a good move here. Crude oil support level $85 and it could be stuck in the $85-$90 range until a major news events causes a breakout in either direction. Overall market is still looking strong and in future continues… This two week MCX isn’t good for long term trading.

110% Looking very hot!

Once it should be open upside and trade on it like hungry tiger with S/L 443. Targets: 446-446.8-447.2+

Buy aluminum:

targets: 115.6-116

Today we can buy NCDEX Dhaniya for just bit profit and trading purpose. Buying level is opening bell. Targets: 5146-5170

Remember it should be open upward.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Continue reading

UPDATE: MCX Mentha oil, Cardamom and NCDEX Soybean, Castor seed – ALL TARGETS DONE

Yesterday what I said about Cardamom? First click here and read it again

I had written, “If once cardamom closes and cross 917 level above then my ultimate targets: 935-947-959-969”

Yesterday my first targets touched…what else you need huh?

It’s still moving upside and in coming days it’ll hit all targets but more information about Cardamom will be updated shortly.

Let’s talk about Mentha oil. Yesterday I also said about Mentha oil. Click here to read it. I said,”Just keep in mind below menthe oil targets. Intraday: 1279-1291 and Short term: 1300-1311″

IN ONE TRADING SESSION, MENTHA OIL KISSED MY ALL TARGETS!

I hope everyone enjoyed!

NCDEX CASTOR SEED

Castor seed, one of my favorite agri commodity. Yesterday(click here to see it what i had written) I said, “Risky: you can see if it’ll open downside. Targets: 3543-3530-3517”

Yesterday it kissed our first target. I hope everyone enjoyed! You know, it made ride very crazy that’s why I had written Risky. What I am saying, I hope lion heart traders for understandable…

Note: Yesterday I said about soybean also. I say, “If soybean open downward then Sell it.” But soybean opened upward. Yes, it kissed all targets but opened upside that’s why no one traded.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Continue reading

Lock

Lock