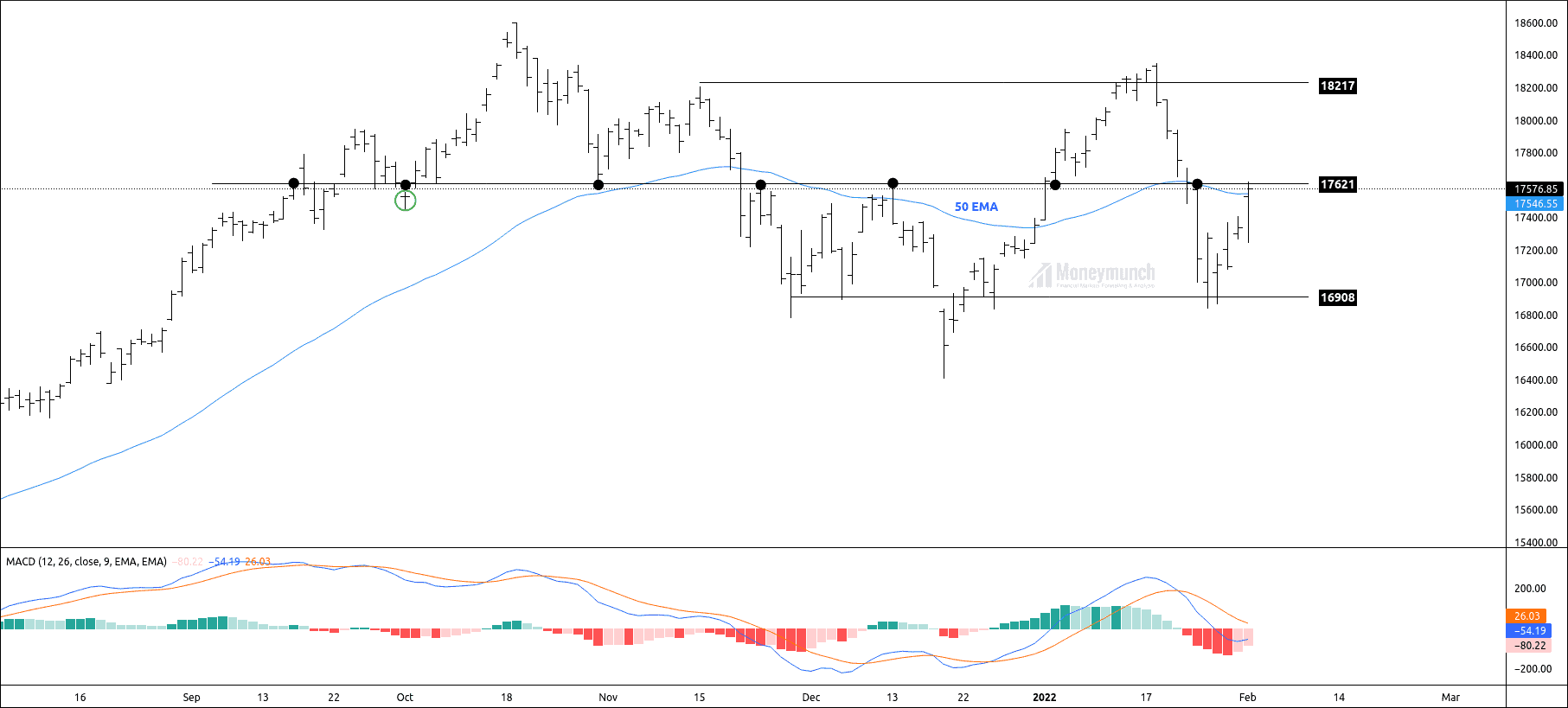

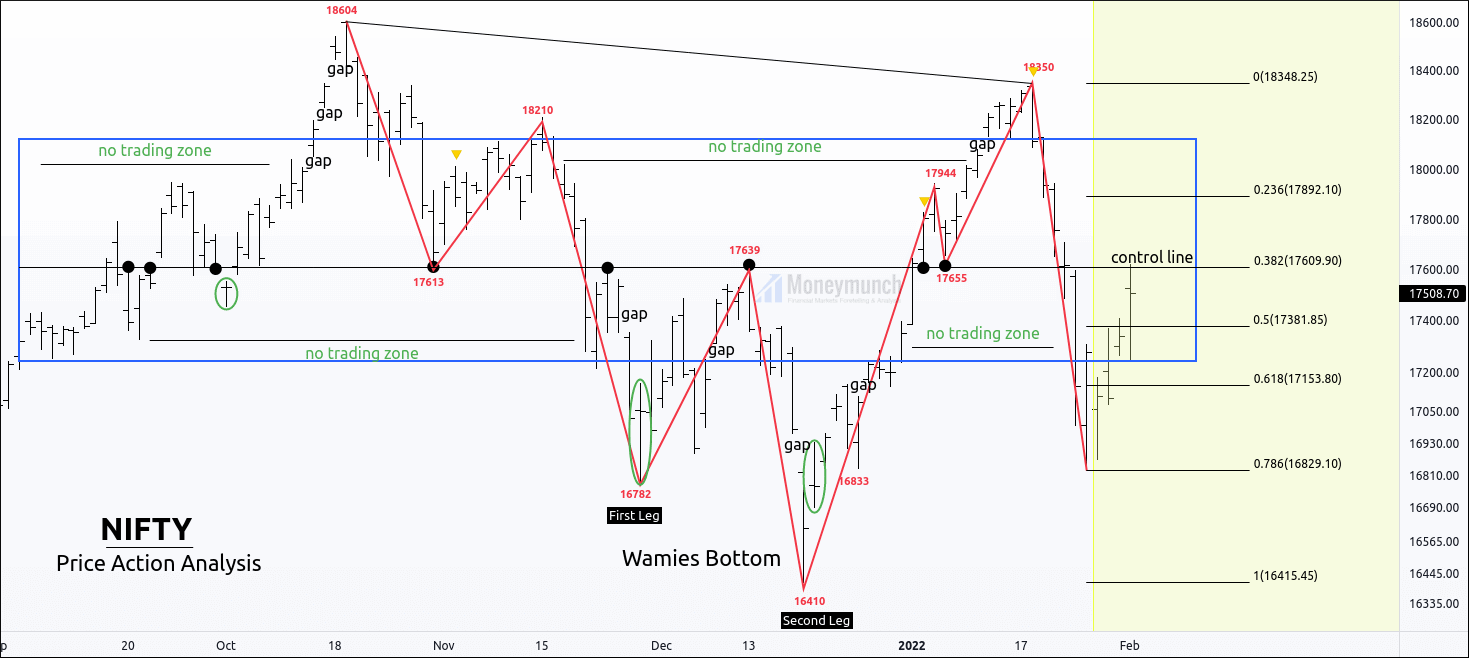

After creating the low of 17836, we have seen a price surge to 17623. Nifty again reached the pivot zone 17621.

If niftysustains above 17621, traders can buy for the following targets 17680-17765-17841+.

Also, a price above 50EMA indicates the presence of bulls in the current juncture.

Please note that the rejection of the pivot zone indicates that the price is not going above.

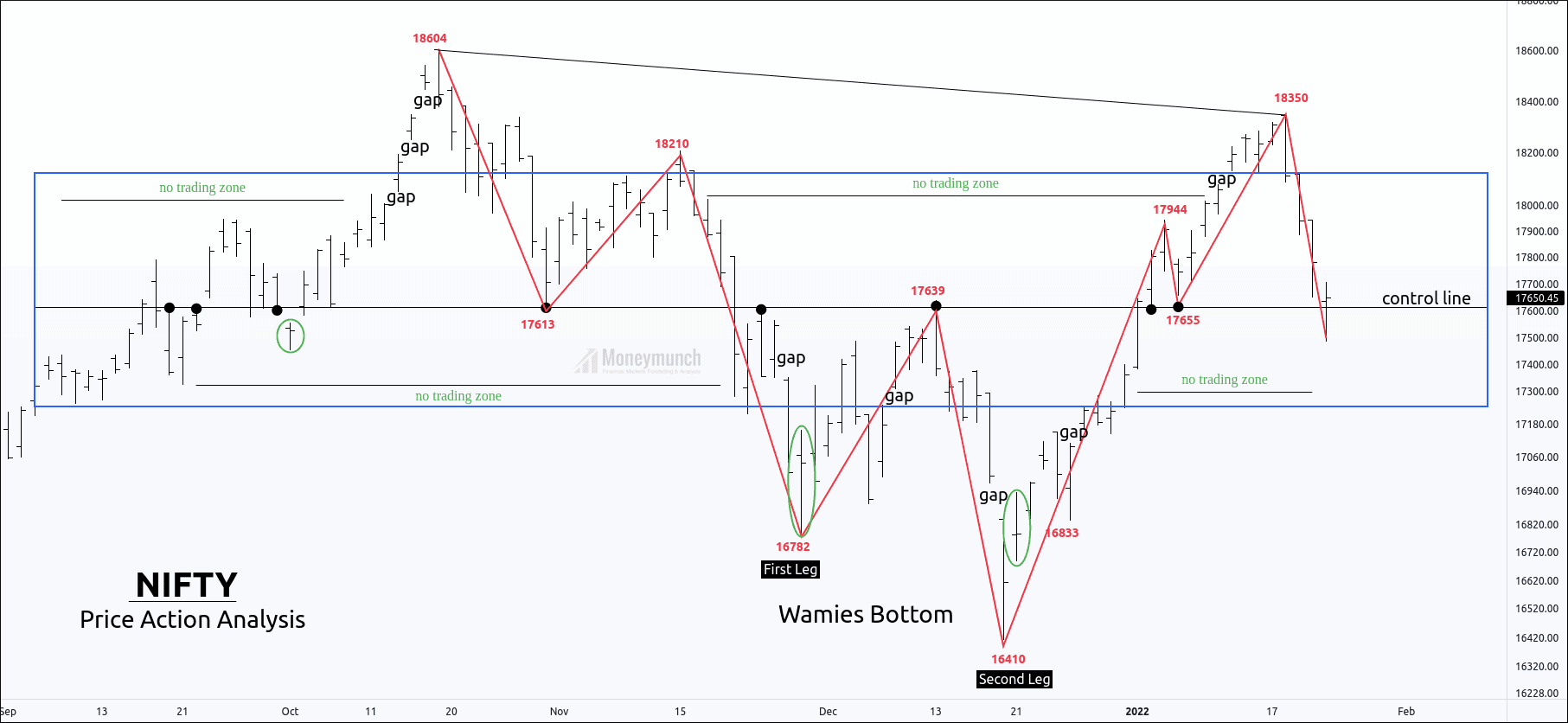

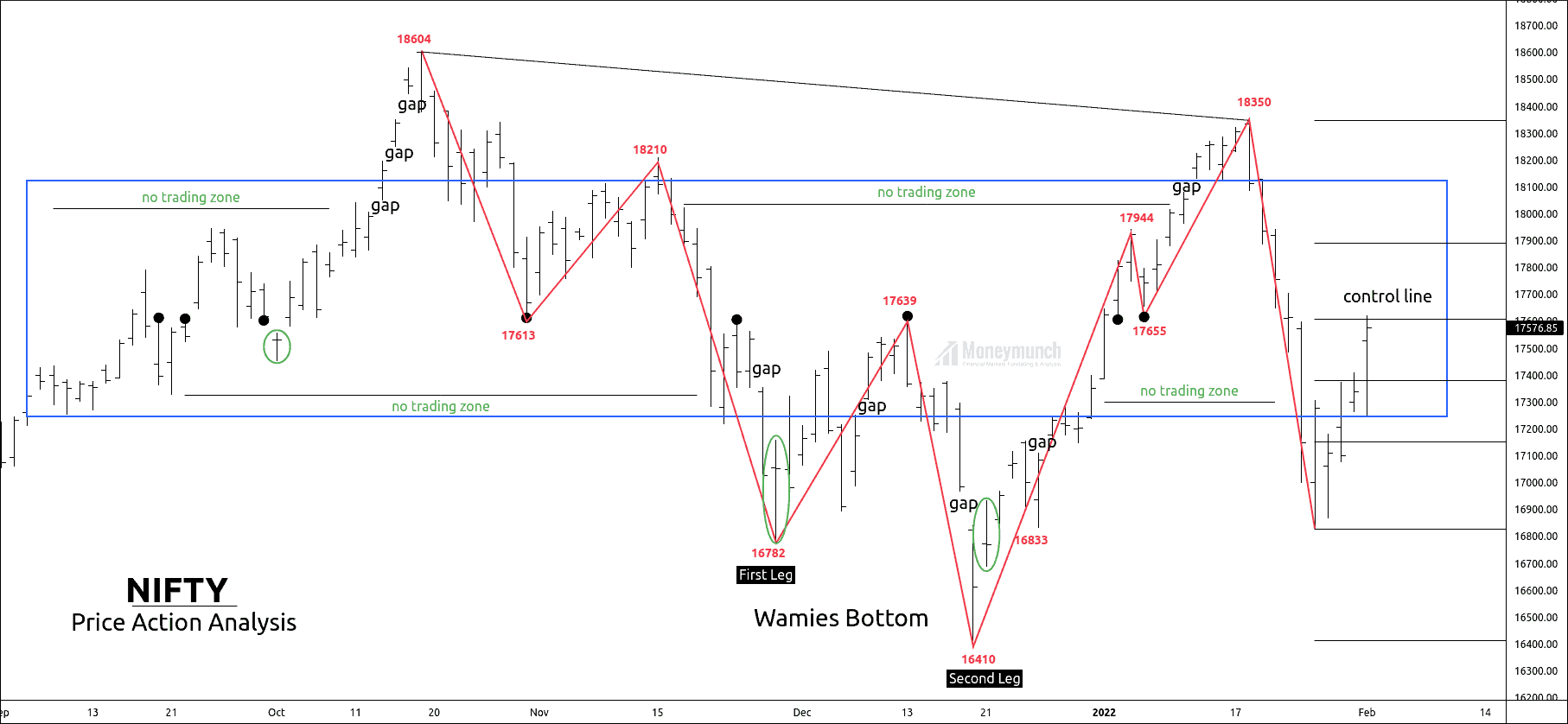

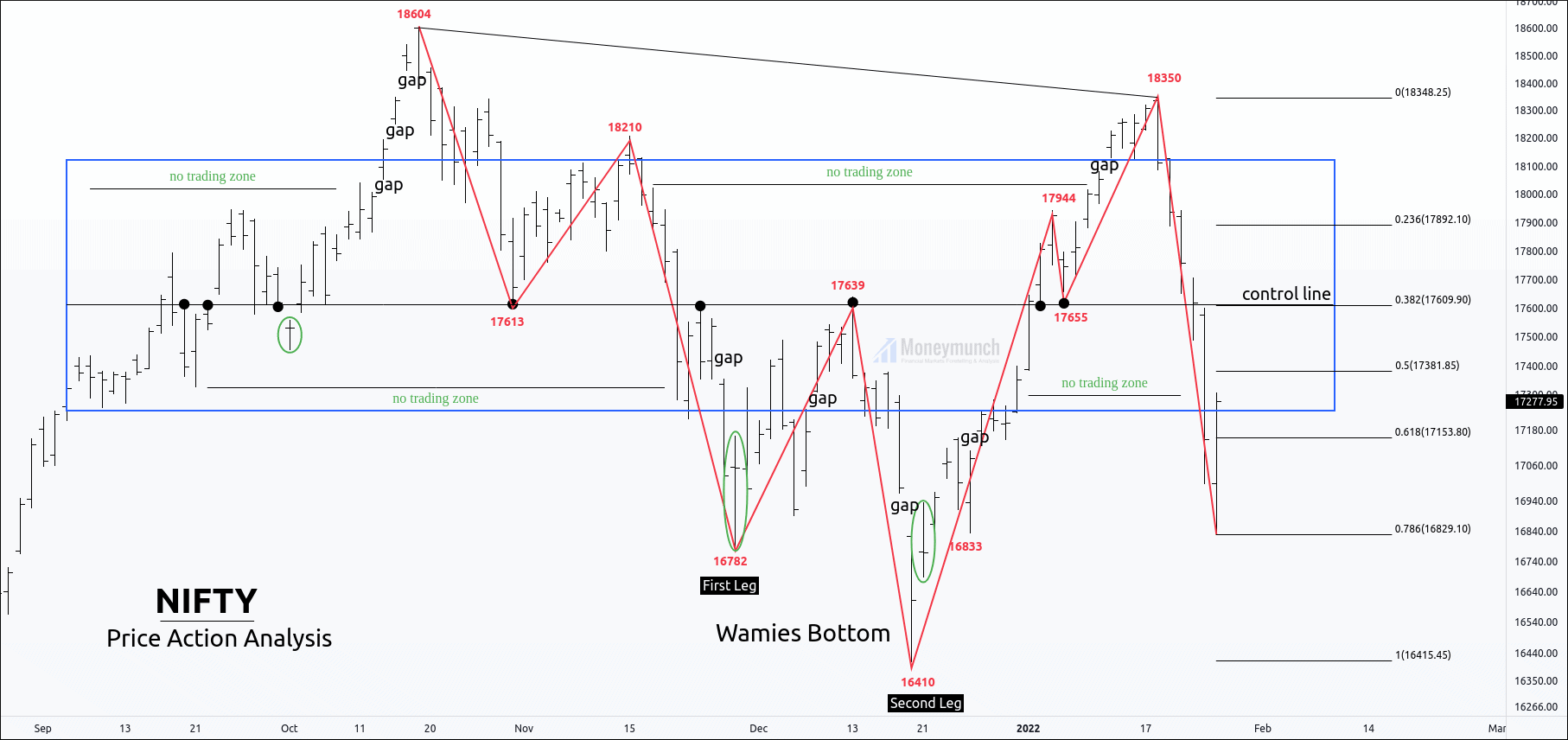

Price had broken out of the value area, and I suggested buying nifty after price entered into the parallel channel.

Price has made excess and entered the equilibrium area, where supply equals demand.

Currently, the price is on the control line. It controls the up and down movements inside it.

Nearly every up or down move in the value area stops at this control price line. It is pivotal support and resistance level inside the value area.

It is called pivotal because of how price oscillates around it.

If the price sustains above the control line, we have a butl bulllish scenario for, 17800+ as I mentioned above. But rejection of the control line will drive the price to 17226.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock