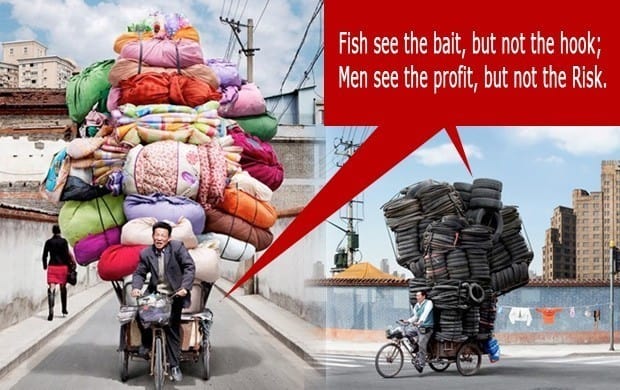

Stock options are not lottery tickets, chips in a casino, or a path to easy street. They are tools for the transference of risk from one person to the other. When trading options you must understand where the risk lies in your specific option play and what the odds are of you winning. The Black-Scholes option pricing model does an excellent job of pricing in known variables of time and volatility into options. Implied volatility does not predict direction of the movement it predicts the amount of movement. The edge lies in three places #1 following the chart and trading in the direction of the trend #2 managing your risk on every trade allowing your wins to be bigger than your losses in the long term, and #3 having the discipline to follow your trading plan. Option trading is no different than any other kind of trading, just more leverage and speed of percentage movement.

- The first question to ask in any option trade is how much of my capital could I lose in the worst case scenario not how much can I make.

- Long options are tools that can be used to create asymmetric trades with a built in downside and unlimited upside.

- Short options should only be sold when the probabilities are deeply in your favor that they will expire worthless, also a small hedge can pay for itself in the long run.

- Understand that in long options you have to overcome the time priced into the premium to be profitable even if you are right on the direction of the move.

- Long weekly deep-in-the-money options can be used like stock with much less out lay of capital.

- The reason that deeper in the money options have so little time and volatility priced in is becasue you are ensuring someones profits in that stock. That is where the risk is:intrinsic value, and that risk is on the buyer.

- When you buy out-of-the-money options understand that you must be right about direction, time period of move, and amount of move to make money. Also understand this is already priced in.

- When trading a high volatility event that price move will be priced into the option, after the event the option price will remove that volatility value and the option value will collapse. You can only make money through those events with options if the increase in intrinsic value increases enough to replace the vega value that comes out.

- Only trade in options with high volume so you do not lose a large amount of money on the bid/ask spread when entering and exiting trades.

- When used correctly options can be tools for managing risk, used incorrectly they can blow up your account. I suggest never risking more than 1% of your trading capital on any one option trade.