Definition: The science of human experience and behavior.

- Why am I the way I am?

- What moves and controls me?

- Who controls my change, development, in behavior?

- How am I in control of myself?

- To what extent am I influenced by outsiders?

The key statement of psychology: Under what conditions are we brave, cowardly, fearful, happy, etc.

Our everyday life is impregnated with psychology. Psychology uses models from the humanities, social sciences, and natural sciences to understand what makes a person tick, and what is going on inside them, but what they don’t always show to the outside world. Psychology consists of numerous focal points and this shows that there is no area without psychology. Or let’s put it this way: Wherever people are involved, there are always psychological aspects.

Areas of psychology include:

- Behavioral Psychology

- Biological Psychology

- Developmental Psychology

- Health Psychology

- Social Psychology

- Sport Psychology

- Business Psychology

Among all the accusations from society, psychology also has positive sides. Among other things, it helps to process fear, experiences of loss and traumatic experiences, avoiding stress or dealing with it in a healthy way, finding out personal skills and using them in the best possible way and or maintaining social interaction.

Disadvantages are, for example, that the demands on every individual in our society are becoming increasingly complex and difficult. Many people are not able to cope with this external pressure and mental disorders arise as a result of stress and strain.

In business, advertising or the media, the advantages of psychological behavior also have a significant impact and are used to select employees or acquire customers. The topic of psychology is therefore omnipresent in our everyday life and in the professional world.

Experiment based on behavioral psychology:

The point of the experiment is that participants seemed to be sitting around a table, in fact everyone except one person knew beforehand how the whole thing would work. The task for everyone was relatively simple, they had to estimate the length of lines based on the reference line, i.e. which of the comparison lines is exactly as long. They all had to hold up the correct answer at the same time (what the unenlightened person knew is that the rest of the people were intentionally holding up one and the same wrong answer), and then you waited for that person’s reaction.

It’s amazing how she reacted. We as humans think that we are in control of ourselves, but what many do not know is that 95% of decisions are made subconsciously and only 5% consciously. The paradox is that in situations where we have to make a quick decision, we act purely subconsciously, even if we actually believe that it was a conscious decision.

Now how did the ignorant respond? Did he stick to his opinion (which was correct) or did he change it because everyone else had something different and the same?

He rapidly changed his mind and acted emotionally rather than rationally. Since, viewed rationally, he had to check that he was clearly right, but why did he switch off his rational thinking as a reflex? FEAR. The deeper meaning of feelings of fear is to provide safety in danger, safety from a possible threat -> In this sense, the threat is to be the only one to have a different answer and thus risk being called “stupid” or just laughed at by the group , since everyone else has the same answer (in percentage terms, the others have a higher probability that the answer is correct). Being the only one to assert oneself is not for everyone. Fear is an automatic human protective mechanism and works automatically. This protective mechanism, which is controlled by the subconscious, is a reflex that has been active in humans for hundreds of thousands of years and will probably remain deeply anchored in humans for the next few decades.

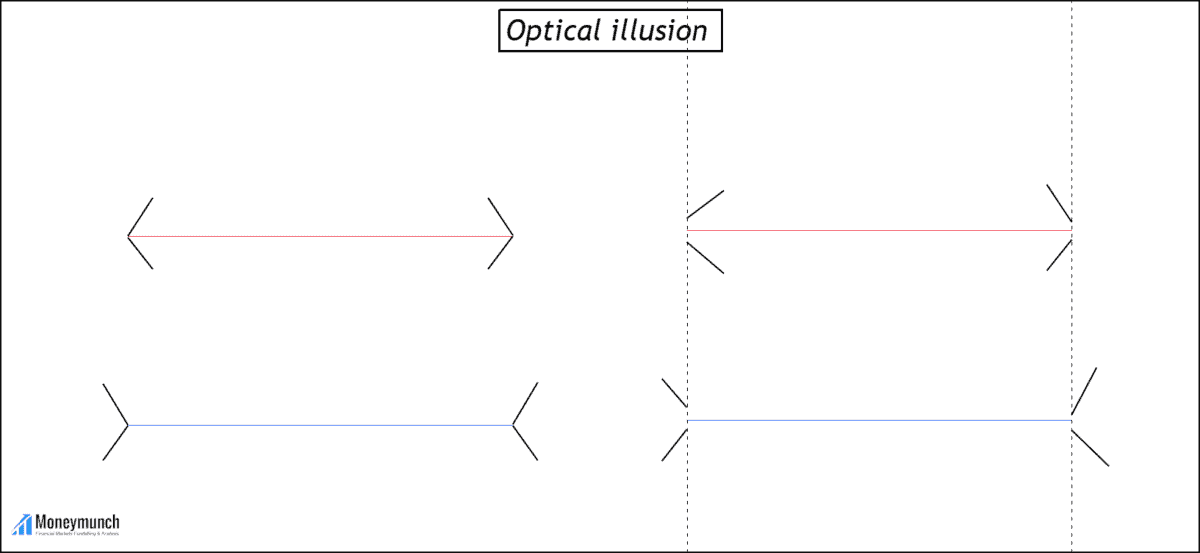

Now we know that we act from our subconscious when making quick decisions, and this can now also be applied to trading. Common trading errors related to this behavior are e.g. Increasing the SL up to no SL (losses last longer than planned), realizing profits as quickly as possible, optical illusions such as consecutive red candles and thus omitting a setup or not trading areas in more volatile market phases, although they are meant to be traded and all for one reason, fear as a protective mechanism in the subconscious.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Great writeup. I totally agree with your point.

Beautifully put!

very informative..great work

Good stuff