What had I written about EURUSD @ AUG 19, 2018, 22:05 PM (IST)? Click here.

Our preference

Long positions above 1.12962 with targets 1.15308 – 1.16340 – 1.17498 in extension.

Alternative scenario

Below 1.12962 look for further downside with 1.11180 as targets.

Second target has been achieved, 1.15308 – 1.16340 level.

Is it a time for reversal or last target? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Our preference

Short positions above 69.588 with targets 69.791 – 69.990 – 70.283 – 70.688 in extension.

Alternative scenario

Below 69.588 look for further downside with 69.470 – 69.092 as targets.

Comment

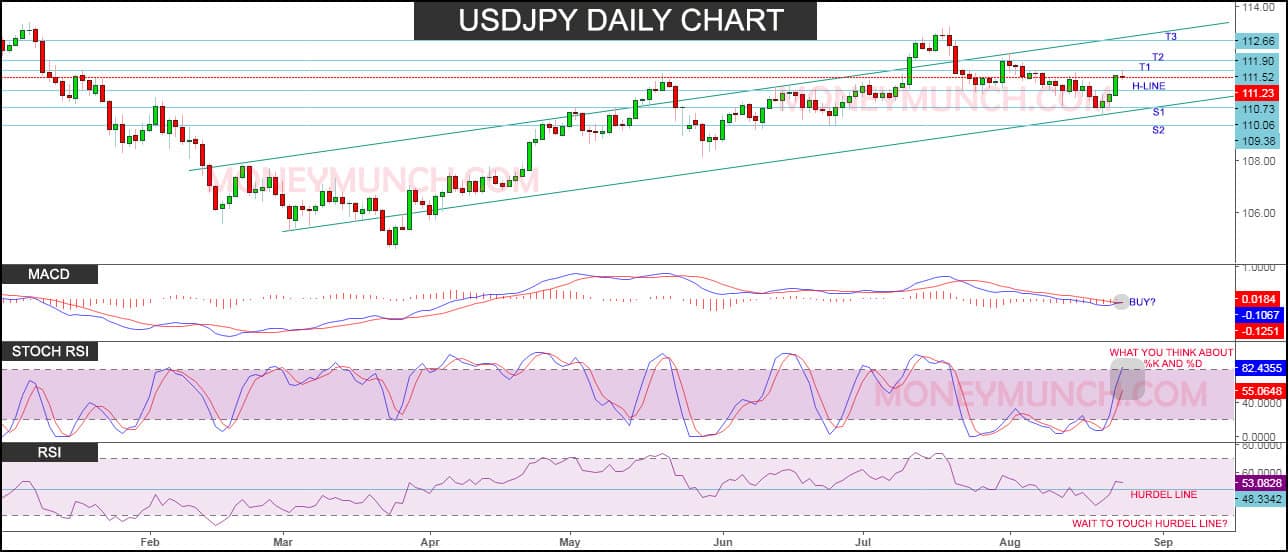

MACD, RSI and STOCH RSI are the clear indication to traders.

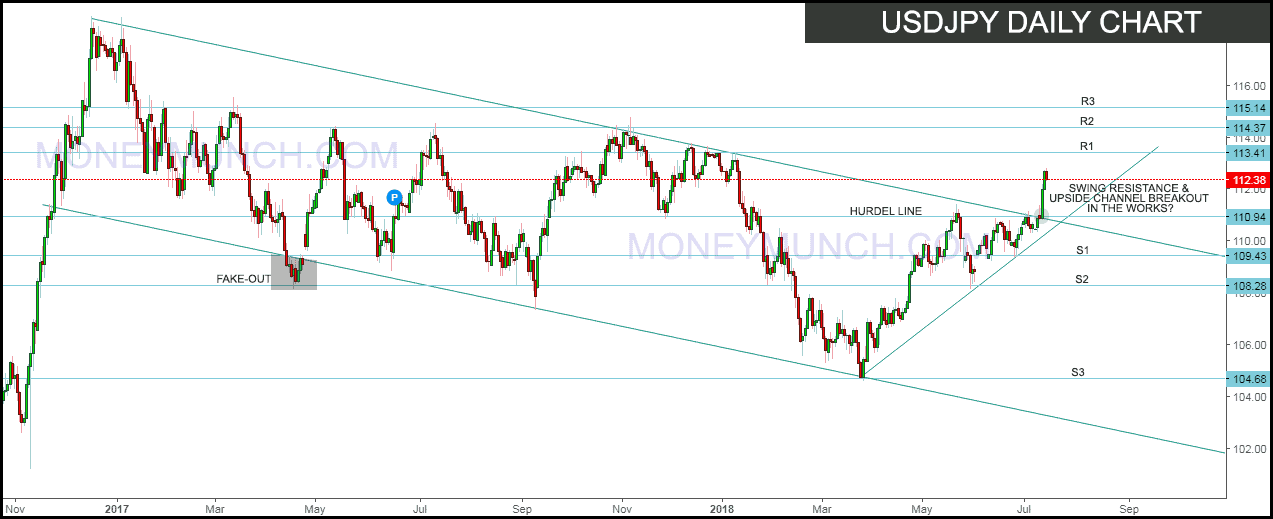

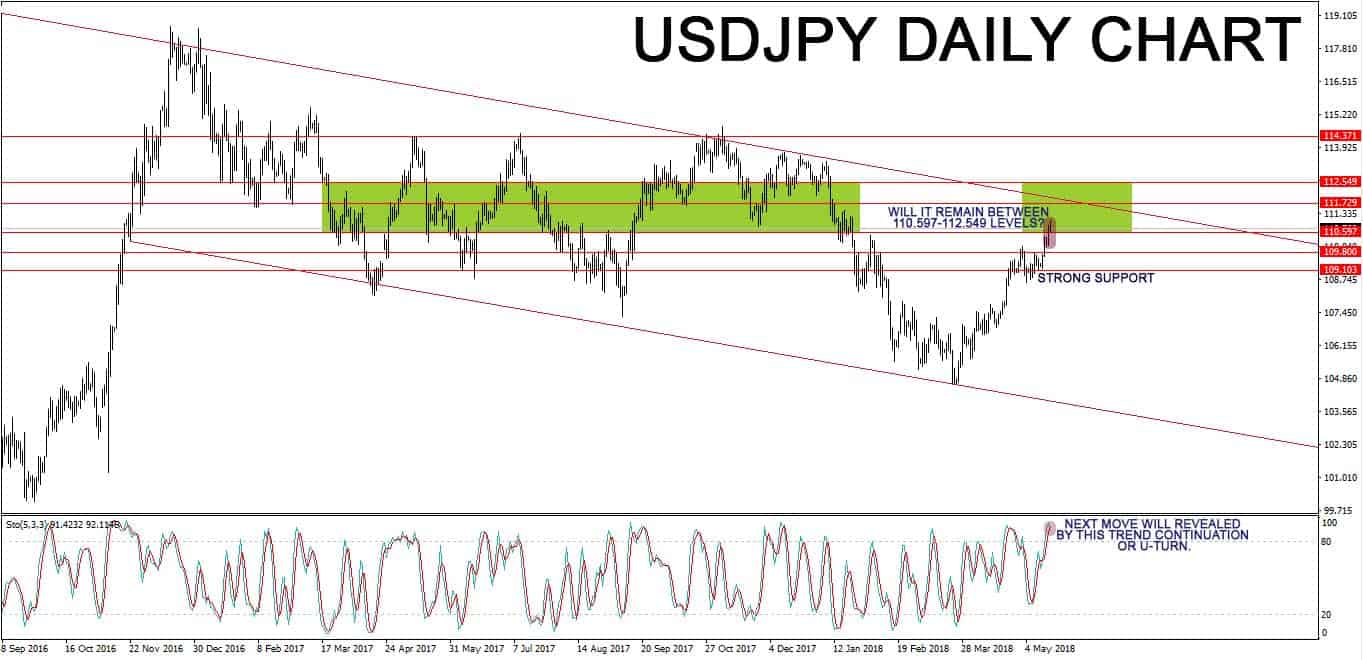

Short positions above 111.23 with targets 111.52 – 111.90 – 112.66 in extension.

Alternative scenario

Below 111.23 look for further downside with 110.73 – 110.06 as targets.

Continue reading

Lock

Lock