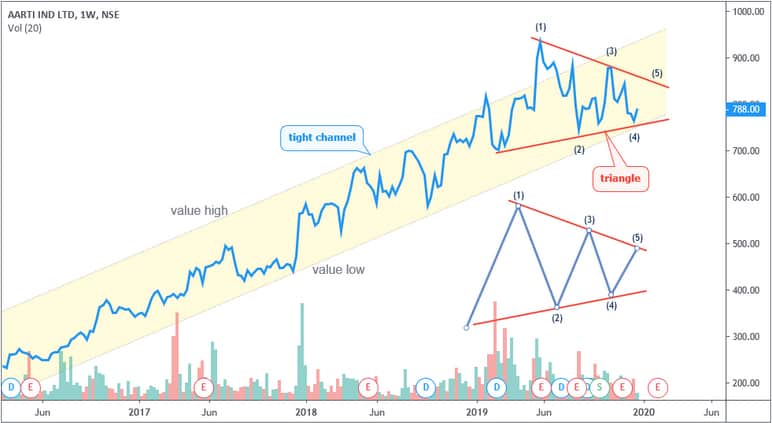

We have seen here two Flag Pattern, One Channel and Triangle on this stock.

- While Flag Pattern found in uptrend and present formed is a triangle at value low of the channel.

- Almost everything is positive on this stock at the value low of the channel. As per triangle, target is 837 nearby. After breaking trinagle, I expect here flag pattern again with the target of 904-923.

Stock is forming triangle pattern on long timeframe.

We are seeing tight channel and the price is trading at the value low(lower line of the channel). This means, investors is ready to enter if volume increase price can make wave (5) as mentioned in the chart.

The primary trend is up on this stock.

Two Trade SETUP is as per below levels…

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock