“I never hesitate to tell a man that I am bullish or bearish. But I do not tell people to buy or sell any particular stock. In a bear market all stocks go down and in a bull market they go up.”

But I’m talking about mistake. You’ve made a mistake. Now what?

Do you know why I’m talking about a mistake?

Anyone who has worked in an office for more than a day has made a mistake. While most people accept that slip-ups are unavoidable, no one likes to be responsible for them. The good news is that mistakes, even big ones, don’t have to leave a permanent mark on your career. In fact, most contribute to organizational and personal learning; they are an essential part of experimentation and a prerequisite for innovation. So don’t worry: if you’ve made a mistake at work, — and, again, who hasn’t? — You can recover gracefully and use the experience to learn and grow.

In regular life, mistake is common, but in Stock Market? There is no chance to make mistake. It’s very risky for your regular life. Don’t compare occurred mistake in stock market to regular life mistake. There is very big different. We can’t say “Man make mistake, we should to forgive it.”

Look forward and base decisions on the future, not the past. Translate a mistake into a valuable moment of leadership. “If you are going to pay the price for making the mistake, you need to get the learning”

Here are a few guiding principles to help you turn your gaffes into gold:

– Fess up and acknowledge your mistake

– Change your ways

– Rely on your support network

– Get back out there

– Not all mistakes are created equal

Principles to Remember:

Do:

• Accept responsibility for your role in the mistake

• Show that you’ve learned and will behave differently going forward

• Demonstrate that you can be trusted with equally important decisions in the future

Don’t:

• Be defensive or blame others

• Make mistakes that violate people’s trust — these are the toughest to recover from

• Stop experimenting or hold back because of a misstep

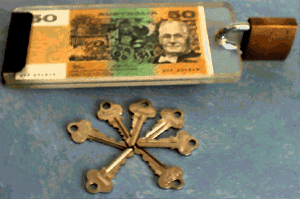

7 Keys to Making Money Consistently

7 Keys to Making Money Consistently