UPDATE: MCX GOLD, SILVER, CRUDE OIL, NATURAL GAS, NICKEL & KAPAS KHALI – ALL TARGET TOUCHED

CLICK HERE TO READ OUR LAST COMMODITY NEWSLETTER: https://moneymunch.com/weekly-free-tips-news-of-mcx-commodities-mcx-gold-silver-crude-oil-natural-gas-copper-nickel-kapas/

I was updated gold, silverF, crude oil, natural gas, copper, nickel and kapas khali almost all targets completed in just 2 trading session.

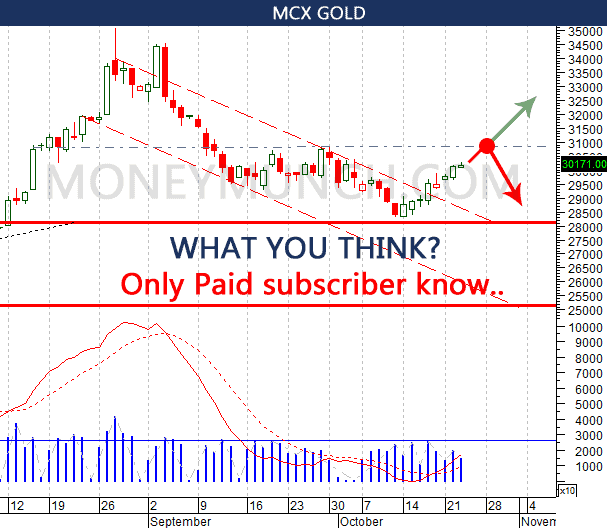

What I said about Gold on last newsletter? (Click here to read it)

“If once it crosses or close continuously above 29790 level then it may touch 29900 – 30000+”

Gold kissed all targets —— know what you think?

I expect, Gold will touch 30204 – 30430 – 30540 level but remember, stop loss & exact level entry is very important.

I was said to my subscribers in password protected zone: “For long term, MCX Silver is looking strong, and it may touch 49000 – 50000+. Intraday traders, just keep your eyes on it ..I will alert you thought SMS.”

Dear subscribers, as I said on last newsletter — Silver touched 49K and second target 50K to few points below thus, book profit on our opening bell.

Dear free users, I hope you remember… about Crude oil

Do you remember na? If NO, then click here and read our newsletter again: https://moneymunch.com/weekly-free-tips-news-of-mcx-commodities-mcx-gold-silver-crude-oil-natural-gas-copper-nickel-kapas/

I said, “MCX Crude oil is 110% downward & very hot! Keep your small eyes on opening bell. Intraday: 6142 – 6110. Hurdle: 6235

Short term: 6080″

Yesterday, crude oil all targets achieved. What else you need friends?

What you think? It will go down continue or stay here?

For to know it, subscribe our service..

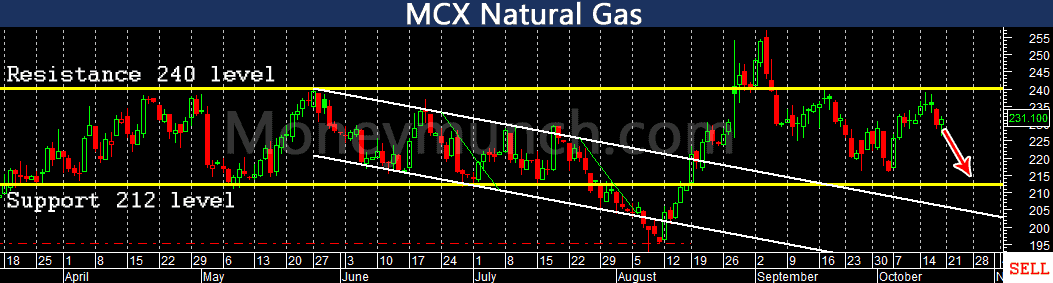

What I said on last commodity newsletter about NATURAL GAS? CLICK HERE TO READ IT

I told you all, “Sell Natural gas if it closes below 228 level. Long term targets: 226 – 224 – 222 – 220 below.”

NATURAL GAS KISSED ALL TARGETS!

I had also written about Nickel

I said, “Who have lion heart? It can play with Nickel. If once open upward then buy buy buy… Targets: 872.5 – 876+.”

ALL TARGETS DONE AT FIRST TRADING SESSION

I was updated about Kapas khali.

I had written: “If MCX Kapas khali [Last close: 1642.5] open upwardly then small traders can jump on it like ants. Targets: 1648-1653”

It touched 1st target on Monday and Second target yesterday. What else you need?

TODAY FREE TIPS FOR FREE USER: SELL CARDAMOM @ OPENING BELL. REMEMBER, OPENING BELL SHOULD BE DOWNWARD. TARGETS: 706 – 702 – 698

Remember, exact time + exact level + stop loss = for subscribers only! To become a subscriber, subscribe to our free newsletter services.

Our service is free for all.

WEEKLY FREE TIPS & NEWS OF MCX COMMODITIES: MCX Gold, Silver, Crude oil, Natural gas, Copper, Nickel & Kapas

U.S. Stock Market S&P 500 Stock index future show new high with solid uptrend plus MCX Gold was jumped above 3% on last week and closed below Rs.133 on Friday. Bullion sector is looking weak for this week and metals are very strong rather than gold & silver. MCX Crude oil and Natural gas will move continue downwardly.

Overall MCX Gold is looking downward for this week and It will kiss 28970 – 28730 – 28400 below plus if opening bell downward then intraday targets 29280 – 29130. If once it cross or close continuously above 29790 level then it may touch 29900 – 30000+

Only subscribers can read the full article. Please log in to read the entire text.

MCX Crude oil is 110% downward & very hot! Keep your small eyes on opening bell. Intraday: 6142 – 6110. Hurdle: 6235

Short term: 6080

Sell Natural gas if it close below 228 level. Long term targets: 226 – 224 – 222 – 220 below.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

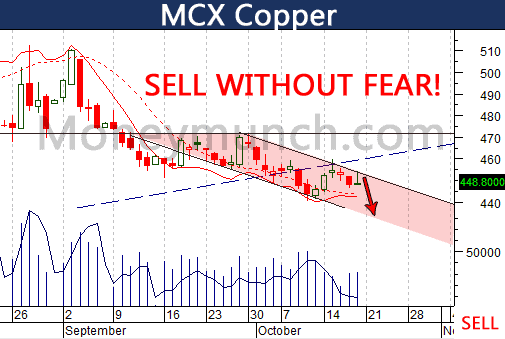

Opening bell should be anywhere! Just sell with targets: 446-444

Long term target: 442.5

Who have lion heart? It can play with Nickel. If once open upward then buy buy buy… Targets: 872.5 – 876+. Remember, if open downward then keep silence..

If MCX Kapas khali [Last close: 1642.5] open upwardly then small traders can jump on it like ants. Targets: 1648-1653

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

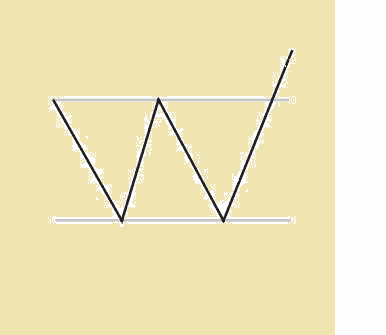

Upside Breakout Chart Pattern Rectangle

This is the 53th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Upside Breakout Chart Pattern

Implication

A Pennant (Bullish) is considered a bullish signal, indicating that the existing uptrend may proceed.

Description

A Pennant (Bullish) observe a steep, or almost straight rise in cost, and consists of two converging trendlines that form a narrow, narrowing flag shape. The Pennant shape usually seems as a horizontal shape, rather than one with a downtrend or uptrend.

Separate from its shape, the Pennant is equivalent in all areas to the Flag. The Pennant is also comparable to the Symmetrical Triangle or Wedge continuation patterns however; the Pennant is typically shorter in duration and flies horizontally.

Trading Considerations

Inbound Trend

The constant trend is an significant characteristic of the construction. A superficial inbound improvement may indicates a length of combination before the amount move recommended by the construction begins. Look for an inbound trend that is extensive than the duration of the structure. A ideal idea of finger is that the inbound trend should be at least 2 times the duration of the construction

Criteria that Supports

Duration of Trading Range

The duration of the investment range for which the breakout occurred can provide an signal of the energy of the breakout. The extended the duration of the investing variety the more significant the breakout.

Narrowness of Investing Range

The “narrowness” of the trading variety can also be utilized to assess the breakout. To determine the narrowness of the investment range comparison the upper boundary with the lower boundary of the investing range. If the spending range has a small difference between the upper and lower boundary then the breakout is considered stronger and more reliable.

Support or Resistance

Look for a location of assistance or resistance around the ideal price. A place of price collection or a effective preserve and resistance Line at or around the desired cost is a effective indicator that the price will move to that place.

Moving Average

Price which conveniently move 50% earlier the 200-day Moving Average certainly support this construction.

Moving Average Trend

Look at the administration of the Moving typical development. For short duration designs use a 50 day Moving Average, for longer patterns use a 200 day Moving Average. The Moving Average should adjustment way within the duration of the construction and should now be proceeding in the way recommended by the construction.

Volume

A intense quantity enhance on the day of the construction confirmation is a intense signal in preserve of the possibilities for this layout. The amount enhance should be substantially above the typical of the quantity for the duration of the construction.

Criteria that Refutes

Duration of the Trading Range

The duration of the investment range for which the breakout occurred can supply an indicant of the stability of the breakout. The shorter the duration of the investment range the less significant the breakout.

Narrowness of the Trading Range

The “narrowness” of the trading range can also be used to evaluate the breakout. To decide the narrowness of the investing variety analyse the higher border with the lower boundary of the trading range. If the investing range has a large distinction amongst the upper and lower boundary (making it wide) then the breakout is regarded less strong and less dependable.

No Volume Spike on Confirmation

The lack of a amount increase on the day of the structure verification is an indicator that this structure may not be dependable. In improvement, if the amount has continued frequent, or was improving, over the length of the structure, then this structure should be regarded less dependable.

Moving Average Trend

Appearance at the location of the Moving Average development. For short length patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average. A Moving Average that is trending in the opposite movement to that suggested by the pattern is an indication that this pattern is less reliable.

Short Inbound Trend

An inbound trend that is significantly shorter than the pattern duration is an indication that this pattern should be considered less reliable.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

SELLER DAY: MCX Crude oil, Lead, Cardamom and Guar seed

Who want hug profit? Go and sell MCX Crude oil… Once it cross 6432 and open downward then sell it with targets: 6403-6391

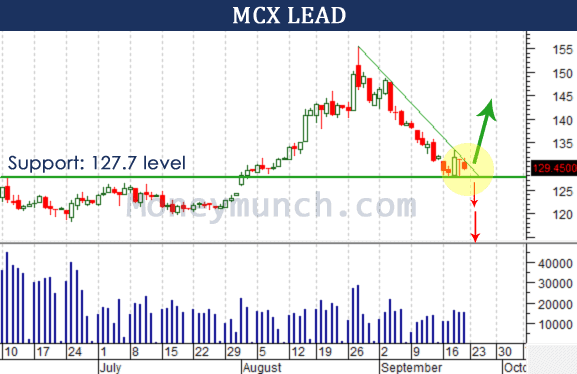

Once it cross 130 level then sell it.. small traders for intraday targets: 129.5-129.3

Don’t forget to keep your eyes on opening bell… if up then leave it!

Sell MCX Cardamom @ opening bell without any worry.

Targets: 702-697 below

Sell MCX Guar seed @ from every corner.. Targets: 5932-5863

Lock

Lock