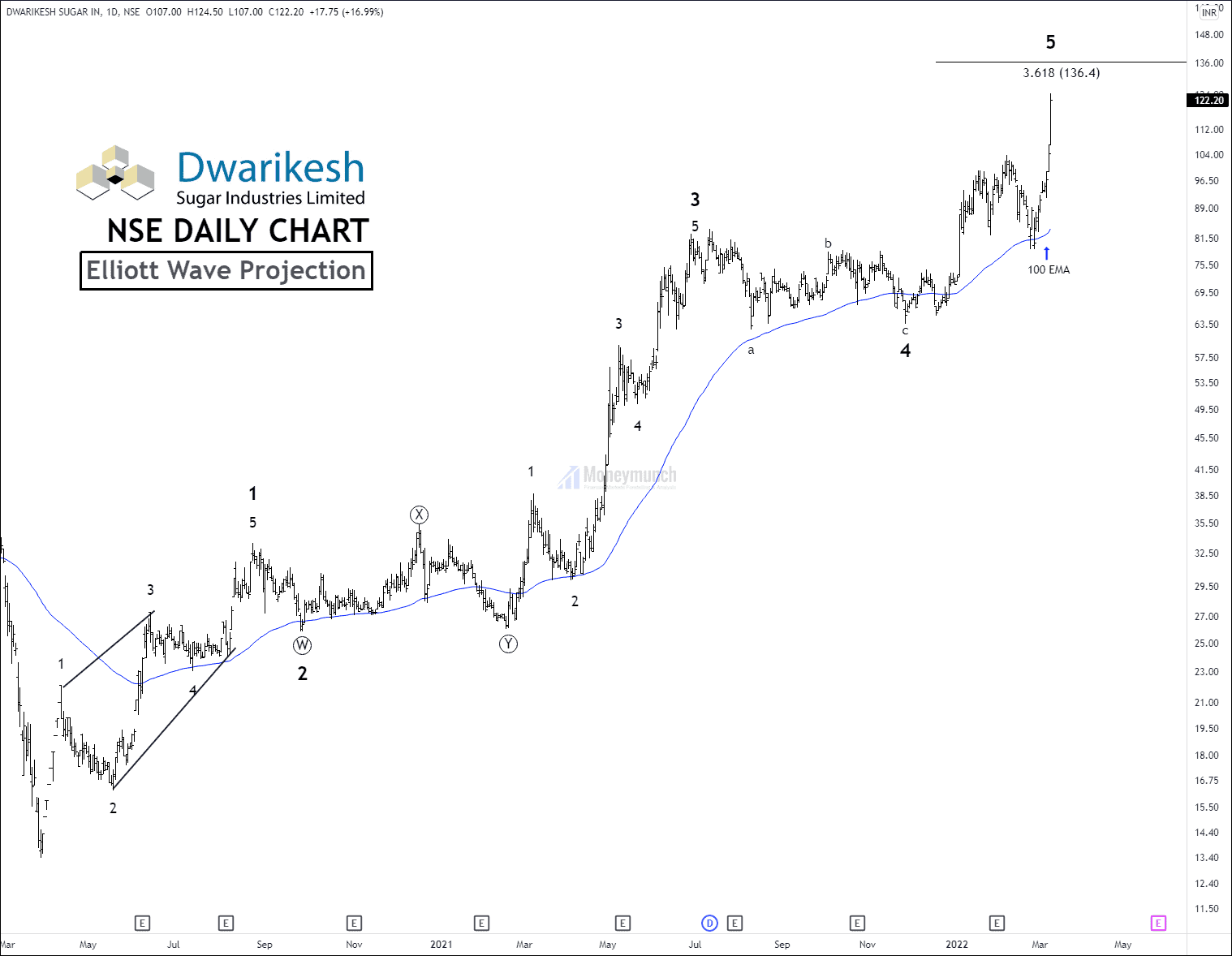

According to Elliott Wave Theory, 5th wave has already traveled for more than 2.618% reverse Fibonacci retracement of wave 4. Now, bullish momentum can push it up to 134 – 136 at 3.618%.

NSE Balramchin & Britannia

Balramchin & Britannia Elliott Wave Projection: Click Here →

Wherein we recommended selling Balramchin & Britannia. Have you done this? Because both stocks have touched all targets.

What else do you want?

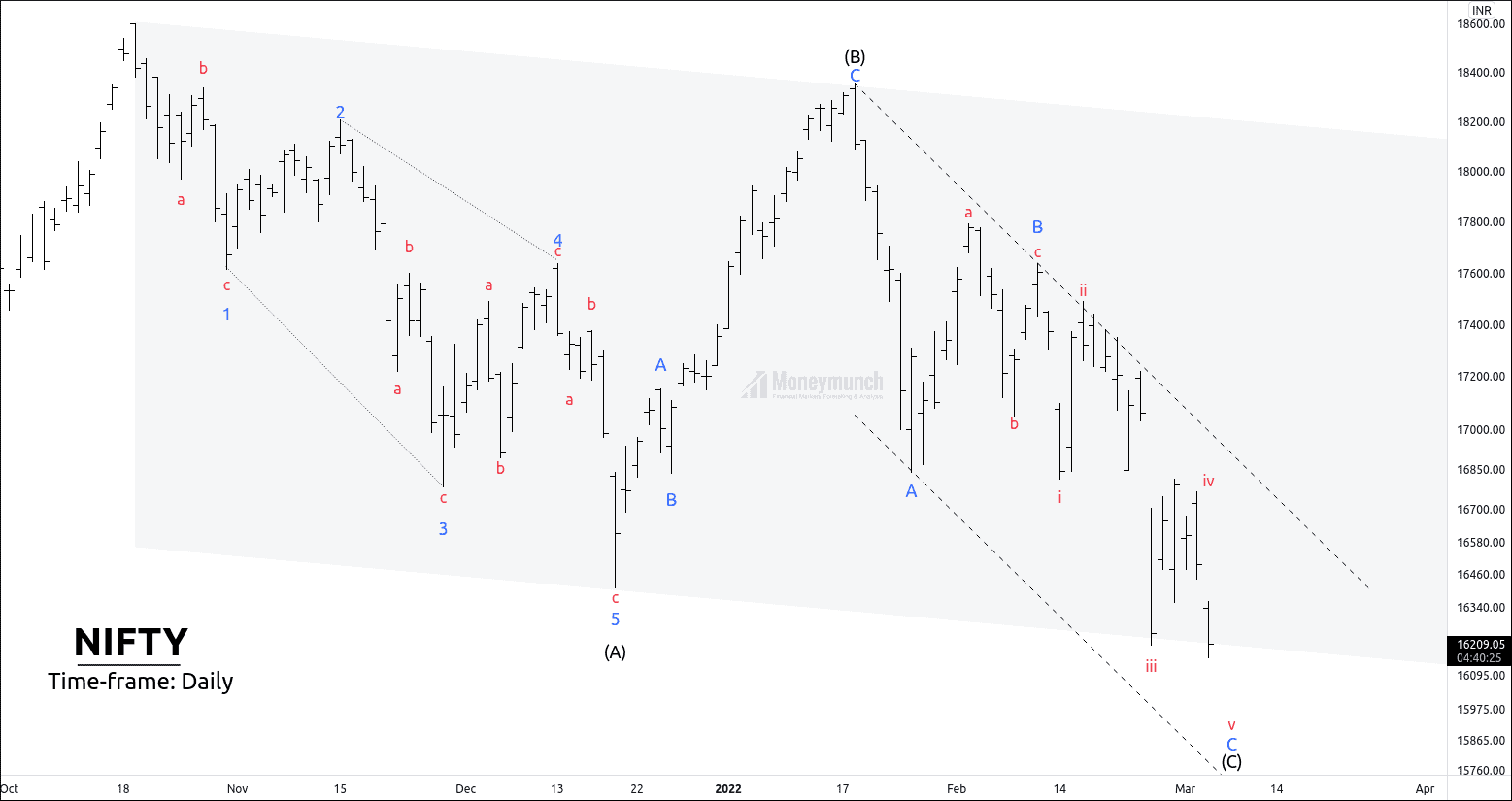

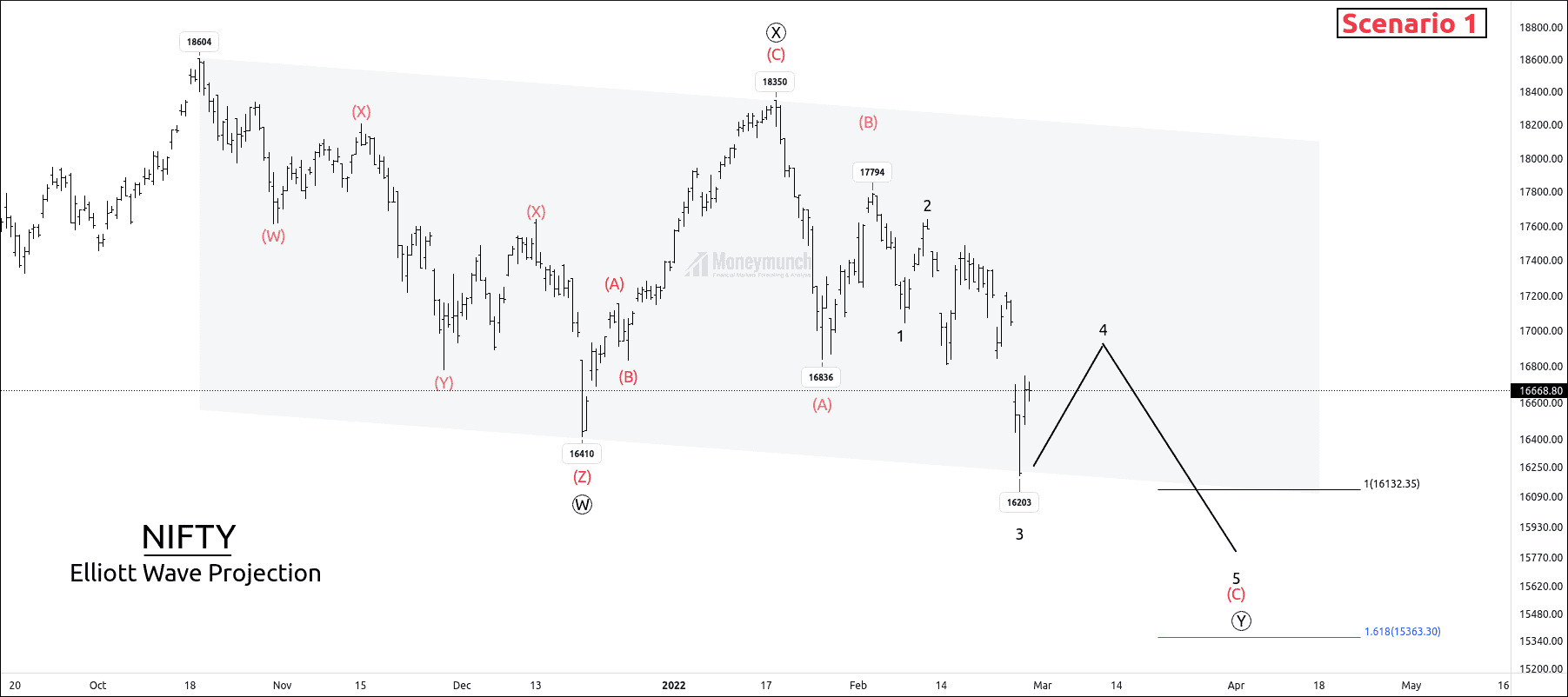

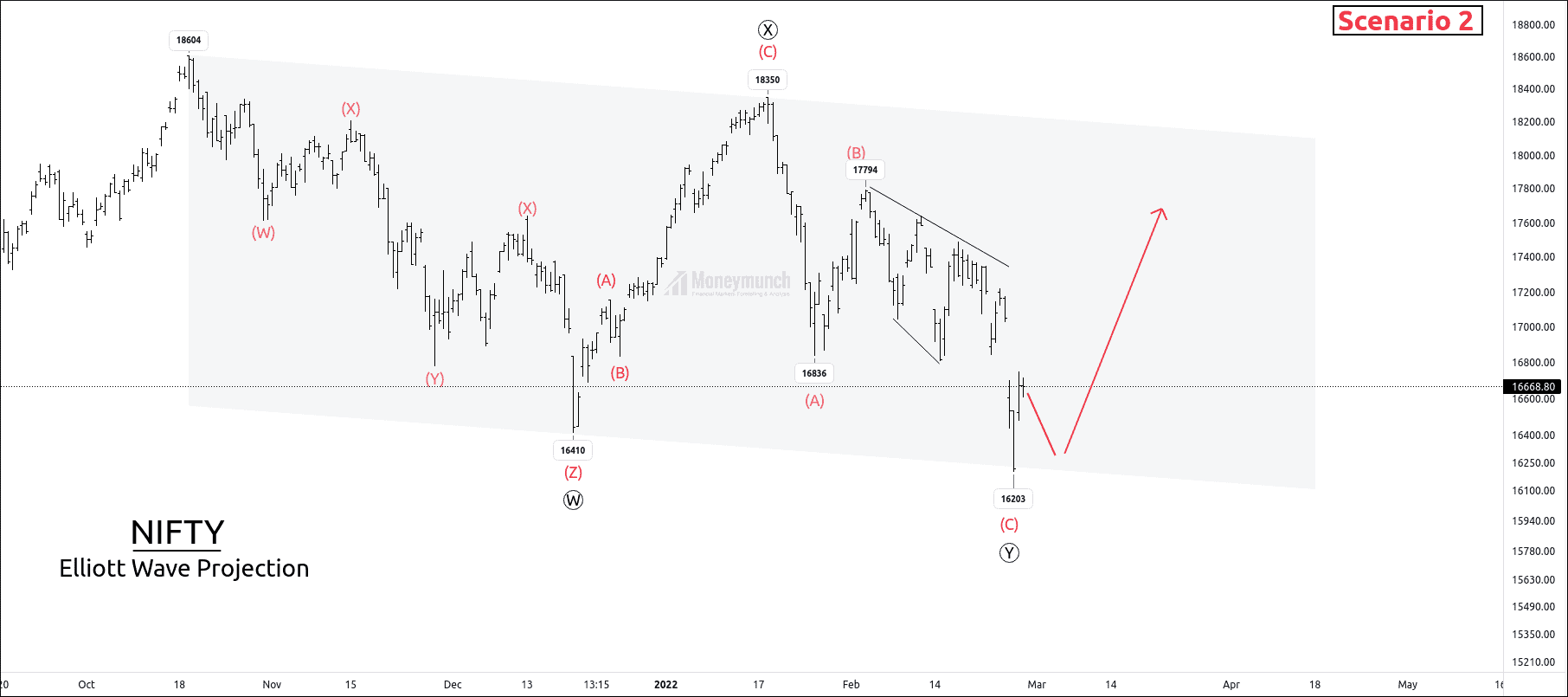

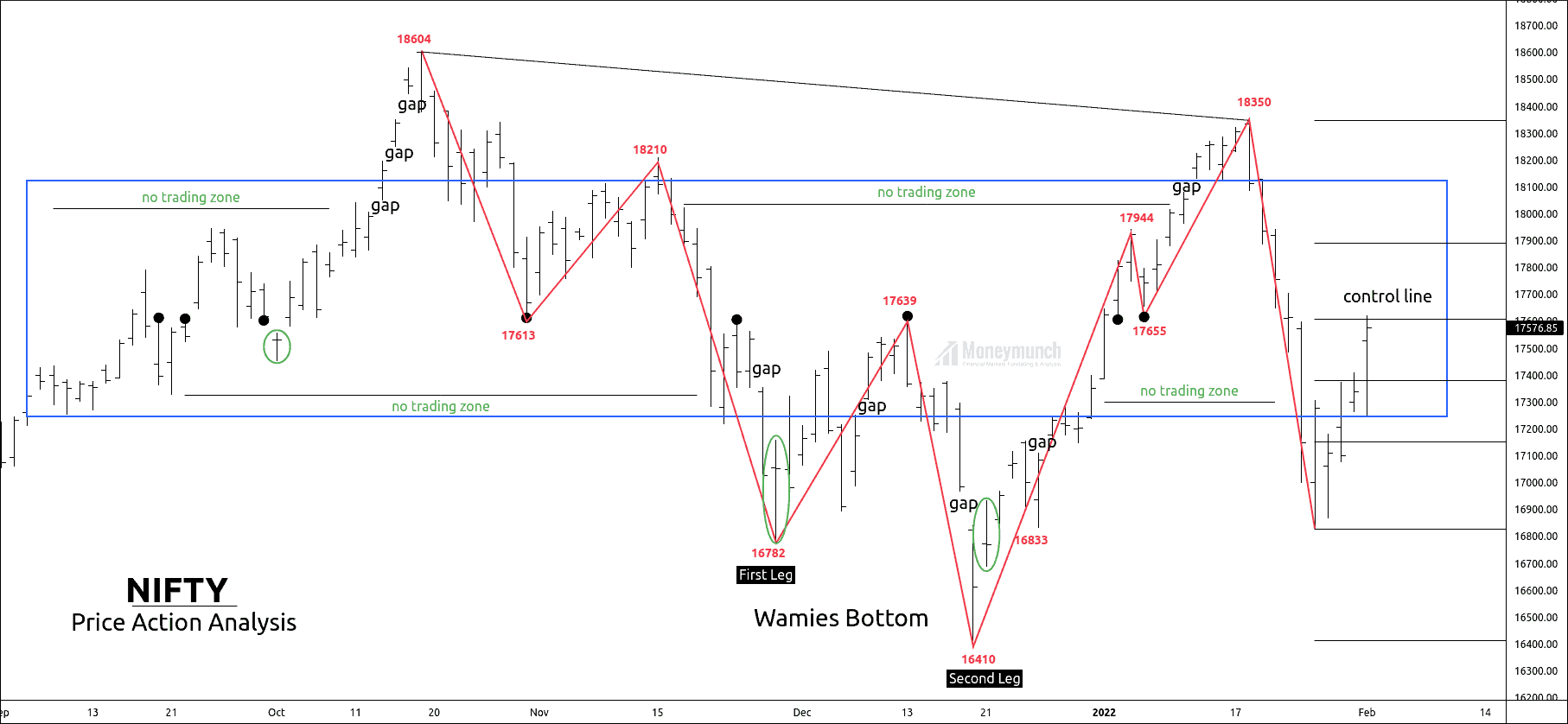

Nifty Is in the Fast Lane, But Where Is It Going?

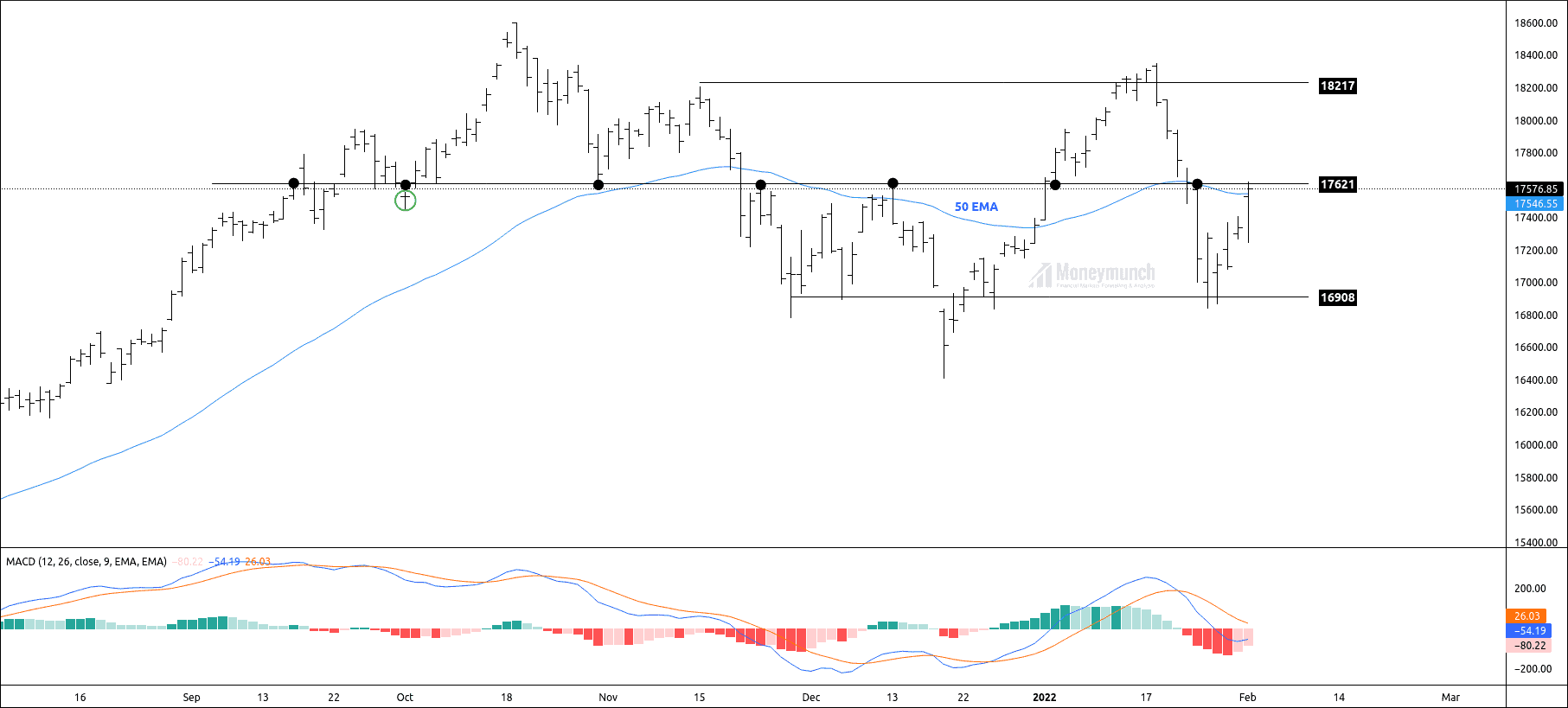

Today, nifty has surged +331.9 rupees. And its overwhelming moves indicate that nifty may decline up to 15880 – 15686 before skyrocketing. But this could happen if it does not stay above the 16540 level. Intraday traders will see 16500 – 16540.

At present, the 16540 is a hurdle (resistance). If Nifty50 breakout this level and close above it, then you must understand that bulls have stepped in.

What happens next if that happens? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock