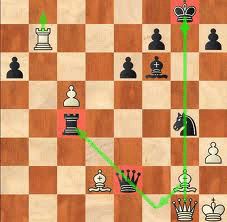

It’s not whether you’re right or wrong that’s important, but How Much Money you Make when you’re right and how much you lose when you’re wrong.”

Don’t miss to read it…!

Most guys had this come to pass in high school. You invite a beautiful girl to go to a dance and she accepts. At the moment you are in trouble! You fear you will compose a fool of yourself dancing and not simply will she never speak to you again, but she will tell all the other girls in the school that you are a klutz (fool). You live out with your tiny sister and your cousin before the date. When you find to the dance, you are determined to make the dancing work. You try hard to be a better dancer than you really are (you are content-oriented). But because you try so hard, you end up stepping all over your partner’s feet. Your life is ruined; you were never meant to be anything but an other-handed klutz. If you could have only relaxed and become a bit more process-oriented, you could have pulled your partner close to you, she could have felt your movements, and you both would have appeared to be dancing with some skill.

The key to dancing well—and profiting in the market—is an ability to relax and simply go with the flow. That is what this book is about – getting with the process, letting go and going with the flow. This material will defuse much of the miseducation of modern technical analysis and demonstrate the way the market really works and how to profit from that knowledge. When Trading Chaos was written several years ago, our goal was to take 80 percent out of a trend move. We wanted to get in on the bottom 10 percent and get out on the top 10 percent of the price movement. In the intervening years, we have sharpened both our research and our strategy. Today, our goal is not to take 80 percent from a trend move but to take 300-500 percent of the trend move. Previously, if there was a 200-point move in a commodity or stock, we were well satisfied with 160 points in our pocket. Now our achievable goal is to bank 600 to 1,000 points on that same move.

Unbelievable?

Read our website articles regular basis and seen the result in your own trading