This is just a brief follow up since tomorrow morning I will be busy and today’s inconclusive price action with another small range body (Spinning Top) does not add anything new to the short-term potential scenarios I have discussed in the weekly technical update.

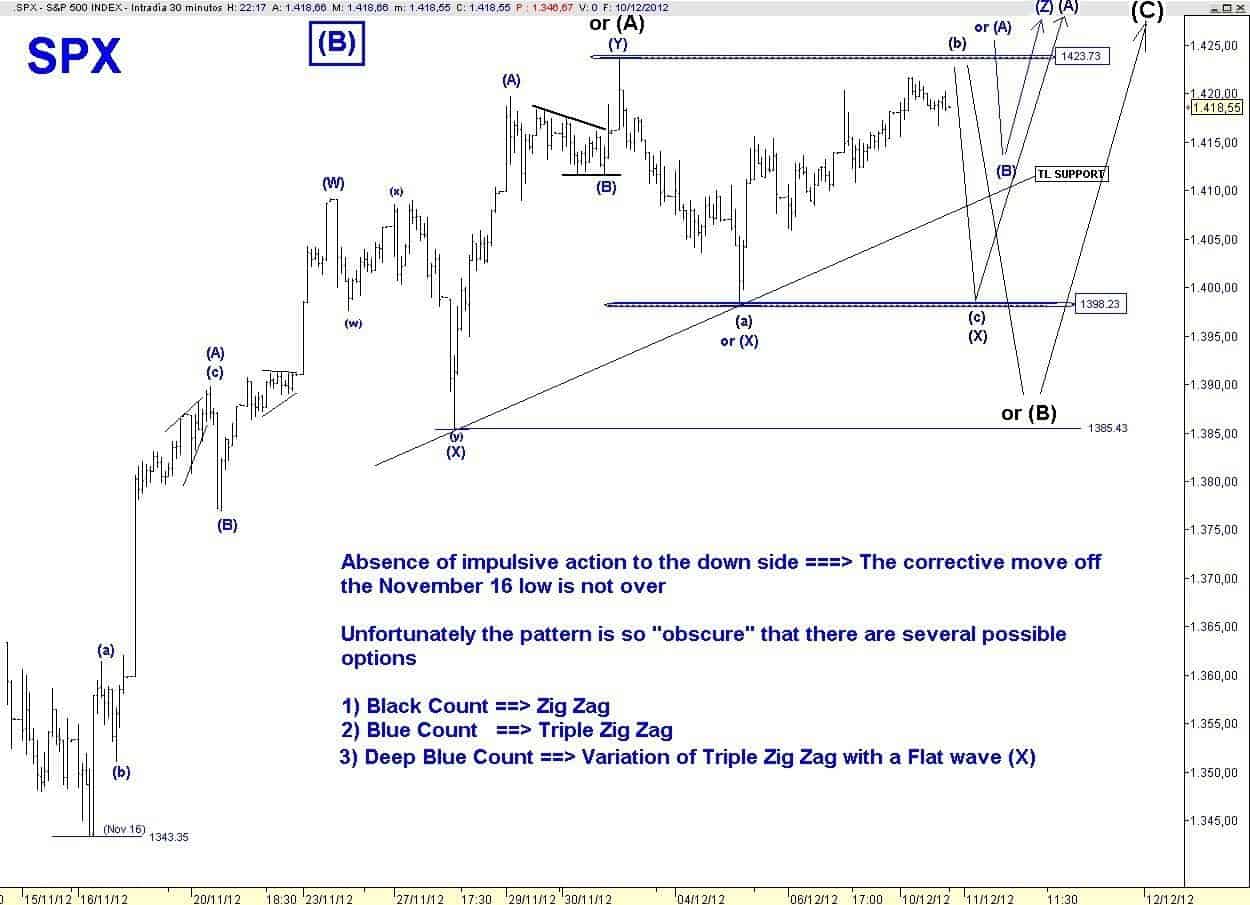

For the immediate time frame price remains range bound between the immediate support at 1398.23 and the immediate resistance at 1423.73.

Theoretically, despite being close to a potential break out the daily Spinning Top is suggesting weakening of upside momentum, but it is unlikely to expect a meaningful pullback ahead of the FOMC.

It seems that the market remains, so far, careless to Risk off news from Europe and a potential, at least, short-term reversal of the EUR, the approaching FOMC meeting may be the reason behind this benevolent attitude.

Therefore, at the moment there is no clear edge within the potential EWP options that I showed this Sunday.

Also, it is strange that at today’s EOD we have VIX up Equity up and bonds up.

Below in the 30 min SPX I show the same ideas:

Additionally, the scenario of a ZigZag with a wave (C) unfolding an Ending Diagonal is still possible as long as 1410.90 is not breached.

If this ED pattern plays out it could have a bearish outcome by ending the assumed wave (B) off the September 14 high since we would most likely have negative divergences in the final wave (V) of the ED.

Conclusion:

Regardless of a potential pullback I maintain a bullish bias (until technical evidence shifts to the bears camp) since the pattern off the November lows is not complete yet.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.