This is the first course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 O’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

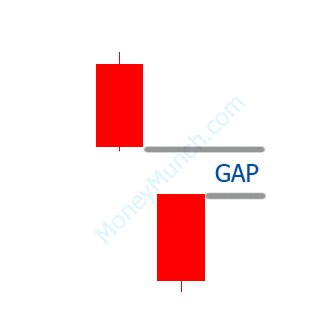

Gap Down Chart Pattern

Effects of Gaps

Gaps generally present important areas of support or resistance. A Gap Down will indicate different instances based in the context in which it was formed. A Gap Down in a downtrend may indicate a previous level of support possess been broken and today forms a resistance amount. A Gap Down in a powerful uptrend may suggest any end to, or maybe a reversal of, the earlier uptrend. Gaps supply an indication of the financial instrument’s SHORT-TERM outlook.

Story

A Gap Down forms when the high for a period (generally a day) is lower than the previous period’s low.

Trading Considerations

Since Gaps express important regions of support or resistance they may be utilized to measure the strength of moves. If a price tag breaks via a Gap it is almost always an alert of the significant price point move.

Criteria which Supports

Three Gap Downs inside a trend suggest a possible end to, or perhaps reversal of, that trend. The 3 Gaps dont have to take place on top of sequential days, however might form many days aside.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

How do we trade a gap up or gap down?

What about the “filling the gap” phenomenon ?

TIME TO TIME, YOU WILL BE GET UPDATE HOW TO USE GAPS TRADING THEORY. JUST READ AND APPLY PAPER OF TRADING STRATEGY.

I HOPE YOU ARE REALLY ENJOYING THIS COURSE.

IT WILL BE A HELPING LADDER FOR TRADERS LIKE US , INSTEAD OF JUMPING HERE ND THERE WITHOUT KNOWLEDGE AND SUFFERING LOSSES WHICH I ALREADY HAD IN THE PAST

THANKS AGAIN FOR THIS KIND HELP GURU JI

Sir,

plz provied this coress in hindi.

RIGHT NOW, NOT POSSIBLE IN HINDI, BUT YOU CAN TRANSLATE THIS COURSE IN GOOGLE TRANSLATOR – LINK http://translate.google.com/#

IF ANY QUERY, THEN ASK ME AGAIN

I would like to study the technical analysis of market trends

THIS IS 60DAYS COURSE OF TECHNICAL ANALYSIS TRAINING.

TIME TO TIME, YOU WILL BE GET ALL UPDATE HOW TO FIND TREND OF STOCK AND INDEX. THIS IS 1ST OF IT.

KEEP PATIENCE, JUST READ AND APPLY PAPER OF TRADING STRATEGY

This information is helpful for trader and investor. How much charge you for this ??? Or is this free ??

YES, I AM SURE FOR “ITS GOLDEN NUTS OF STOCK TRADING MATERIALS. I AM ALSO SURE “YOU WILL EARN MONEY FROM THIS COURSE “TECHNICAL ANALYSIS TRAINING COURSE OF 60DAYS”

Thanks will follow it & try to join you in future ,as we are at present only investor not trader at all but interested to trade

We have heard that some one has develop perfect software indicate when to buy & when to sell do you know them ?

ACTUALLY, THERE ARE LOTS OF APPS. AND SOFTWARE IN MARKET TO TRADE AUTOMATIC BUT THESE TYPE OF SOFTWARE WORKING ON FX TRADING(FOREX TRADING)

NONE OF SOFTWARE ARE WORKS ON NSE/BSE MARKETS. DON’T WAIST TIME ON IT

INFORMATION SUPER

very good it is required and useful

deleep dongre

GOOD

where can i conduct training?

any online training availabel?

how much fee for 60days training?

ITS FREE FOR MY VISITORS(FRIENDS)

THIS IS RS.0 FEES COURSE AND ITS ONLINE UPDATE DAILY 8 O’CLOCK AFTER DINNER.

YOU CAN APPLY YOUR FORCE OF WORK BEHIND AND WIN MONEY INTO STOCK MARKET.

very useful

what is the fees and is there any center in Ahmedbad?

Hello Sir,

very good explanation,keep it up the good work,i really appreciate your knowledge in technical analysis.

i know how much pain you have taken to master the these

technics ,but at last you emerged as a guru.

you are really a guru,and may be more than that.

warm regards.

jahan.

dear sir,

looking forward to receive ur tech edu help.

thanks Sir, it will guide to enhance my tech knowledge

thanks in advance

prakash

what is course fee ?

the course is online or offline ?

That’s very nice and it is the natural qualty that enamates from a Guru. Trading is as simple, if it is favoured by luck but it is as difficult if not favoured otherwise, in that case you nedd to know all the tools & techniques to overcome over greed and fear.

Well start Sir.

My congratulations.

Thanks

Sir,

How this Course Material could be saved for future reference?

Day by Day, You will get complete Save and PDF file.

After completed 60days of this course, you will get Separate Menu of “Technical Analysis Training”

thnks gurubhai if possible can u give some example also

EXCELLENT WORK AS GURU.

PL.GIVE LIVE CHARTS AS EXAMPLE SO THAT WE CAN ABLE TO UNDERSTAND THE IMPACTS ALSO.

THANKYOU

dear sir,

very good prectic and this velueble prectic will help for new biginner and tradder ,it guide to my knowlege about market

please any informetion about feeand also this course is online or offline,any book availeble for this prectic.

my heartly congratulation.

thanks

Sir,

Can I copy the material and paste it on other document for reference.

Sure you can Copy and Post anywhere. My AIM is teach proper technics and earn Money in STOCK MARKET

Thanks.Its a noble idea & help people understand the techniqualities of markets and to be sucessful.How do we receive the material course.

Prasad

You will get daily Course after 8 o’clock.

Hello Sir,

Thanks for the info. It definitely helps us.

My question is, after understanding the pattern, where do we get to see these patterns? Means, should I use a software (and daily data feed) or any website where I could see that these patterns are forming on any index or stock? What should I use as reference?

There are lots of software of technical analysis but I suggest to use Metastock : link for metastock – http://www.metastock.com/

Due to this course, you can use Trail version of metastock to download : http://www.metastock.com/

I am not going to post here pirated link for metastock but you will get it if you search it

“Don’t waist money for licence version of metastock”

Now, You need historical data to run this data. FREE Historical data provider link : http://www.getbhavcopy.com/

Guru ji..

Taking example of current scenario (current nifty chart of 4-5 days)… Please explain, that would be a great help.

Thanks,

Ravinder

This is 1st day of this course. I will update life Index and Stock chart with this course. You can also do paper trading over this technical anlaysis

You are really GURU. This is the excellent initiative taken by you, none else could even think for it. You have given this as DIWALI GIFT/GREETINGS-thanks for the same.

I hope after completion of 60 days learning all of us would be able to have own strategy which will only be profitable.

Thanks a lot again.

Guru Atul again as you told these pdf files come in mail or some other sourse

Kindly explain with chart. I want 15 min delay chart , is it aviliable in web site. Kindly give web site address

Guruji,

It would be really helpful if you give some examples along with the articles as it would make learning easy and we will be able to understand it much faster.

Thank you for your learnings.

Best Regards,

Tanvir Singh.

Thanks Guru It will help to improve our trading.

we will definitely make profit

Thanks guruji for new lessons but one qus. about this when down gap is formed someone say surity for fill up this gap, this is true or not and if yes what time to take this fill

Yes, It was True but Not.

This is oldest Technics where you will find this Gap filling analysis. Now a day(New Technical analysis, you should not believe it)

There are lots past Gap. Do you think nifty will come to fill Nifty 200 & Nifty 802 ???

GOOD ONE IT IS A NOBLE IDEA WELL DONE GURUJI

thanks for the invitation can u tell how to join and were to login from daily what would be the procedure

Hi Guru

Want to join and learn. What should i do?

Thanks & Regards

Bhuvan

I am not exaggerating. Your service to investors is highly commendable. I request to brief me about swing trading and turtle trading. I have read books but I want you to explain them briefly with typical Indian stocks as examples. I have given you my mail ID.

NB: I only interested to learn these systems. I may do paper trading to check its accuracy. I will not risk my money without proper guidance.

Thanks for your excellent on-line training. Could you please give explanation with examples? It will be easy to learn the chart reading. Also please let us know how to copy and save this course material.

Thanks

Shinde

Guruji,

How do we know next day trading up or become down .

Stocks are moving like chart or news basic.