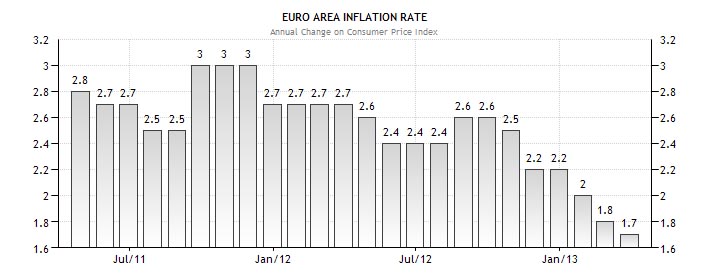

The annual rate of inflation in the euro zone fell further below the European Central Bank’s target level in March, official figures showed Tuesday.

The decline in upward pressures in consumer prices eases one impediment to monetary stimulus from the ECB to support the euro zone’s battered economy in coming months, and in theory makes households better off as inflation erodes less of their disposable income.

But not all countries are benefiting from the decline to the same degree. Inflation remained much higher than the average in Spain and the Netherlands in March, where falls in household incomes in real terms undermine the chances of an economic recovery.

Eurostat, the European Union’s statistics agency, said the annual rate of inflation in the 17 countries that use the euro fell to 1.7% in March from 1.8% in February, confirming an earlier estimate. The figure is the lowest since August 2010 and undercuts the ECB’s target level of a little under 2%.

The figure was in line with a forecast by economists in a Dow Jones Newswires poll last week.

Prices fell for transport fuel, telecommunications and medical services. Electricity prices rose.

The average rate masked big divergences between euro-zone member states.

Annual inflation was significantly higher than the average in the Netherlands, where the rate was 3.2% in March, and in Spain where it was 2.6%. Much lower rates of price growth were registered in Ireland, at 0.6%, and Portugal, at 0.7%. Greek consumer prices fell in year-to-year terms, by 0.2%.