This is the 31th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

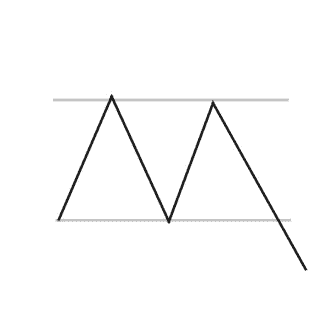

Downside Break Chart Pattern

Implication

A Downside Breakout is regarded a bearish signal, marking a breakout from a trading rate to beginning a new downtrend.

Description

A Downside Breakout happens whenever prices break out from the bottom of a trading range and come down suddenly as a new downtrend forms. It looks that the market is being overloaded with sell instructions. There are generally break inside this activity. This pattern can final for a few days to a few weeks.

Criteria that Supports

Duration of Trading Range

The period of the trading range for that the breakout happened can offer an signal of the energy of the breakout. The longer the timeframe of the trading range the most considerable the breakout.

Narrowness of Trading Range

The “narrowness” of the trading range can also be applied to evaluate the breakout. To determine the narrowness of the trading range contrast the upper bound with the lower bound of the trading rate. If the trading rate has a small difference amongst the upper and lower bound (making it narrow) then the breakout is regarded more powerful and more dependable.

Support and Resistance

Search for a location of support or resistance. A location of price combination or a powerful Support and Resistance Line at or over the target price is a powerful indicator that the price will move to that point.

Moving Average Trend

See at the way of the Moving Average Trend. For small period patterns use a 50 day Moving Average, for extended patterns use a 200 day Moving Average. The Moving Average should modification way during the duration of the pattern and should head in the direction suggested by the pattern.

Volume

A strong volume surge on the day of the pattern ratification is a intense signal in support of the potential for this pattern. The volume surge should be considerably preceding the average of the volume for the period of the pattern. In improvement, the volume during the duration of the pattern must be declining on average.

Criteria that Refutes

Duration of Trading Range

The period of the trading rate for which the breakout happened can supply an signal of the power of the breakout. The reduced the period of the trading range the less important the breakout.

Narrowness of Trading Range

The “narrowness” of the trading range can also be used to gauge the breakout. To decide the narrowness of the trading range evaluate the upper boundary with the lower boundary of the trading range. If the trading range has a large distinction between the upper and lower boundary (making it wide) then the breakout is considered weaker and less dependable.

No Volume Spike on Confirmation

The absence of a volume spike on the day of the pattern verification is an signal that this pattern may not be dependable. In improvement, if the volume has stayed frequent, or was improving, over the duration of the pattern, then this pattern must be regarded less dependable.

Moving Average Trend

Look at the direction of the Moving Average Trend. For short duration patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average. A Moving Average that is trending in the opposite direction to that indicated by the pattern is an indication that this pattern is less reliable.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.