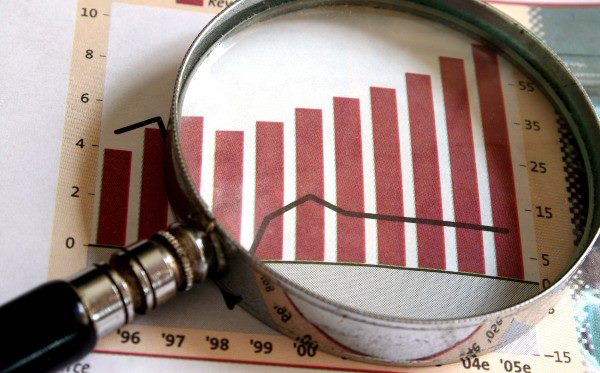

Many people are confused with what is trading and what is investing. Investing and trading are two very different systems of trying to profit in the monetary markets. The biggest difference between them is the length of time you hold onto the assets. An investor is more interested in the long-term appreciation and a trader is more interested in the short-term.

Iinvesting in stock market is like buying an asset and holding it for a long time. Many Investors buy stocks for long run and then sell them off in giant profit. Some big investors such as Warren Buffett have made more money in Long Term Investing. Trading on the other hand, it is like buy stocks for 2-4 Days. In these unstable markets it’s very difficult to make good profits in intraday trading, some traders planned to buy stocks for short term and then sell them off in profits.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Many investors suffer such losses often, hoping that in five or ten years the market will bounce, and they’ll recover their losses and complete an overall increase. Most investors need to remember that investing is not about enduring tempests with your “beloved” company – it’s about making money. Traders are trying to profit on just those short-term price oscillations. The amount of time an active trader holds onto an benefit is very short. If you can catch just two index points on an average day, you can make a relaxed living as a Trader.